By Brian Nelson, CFA

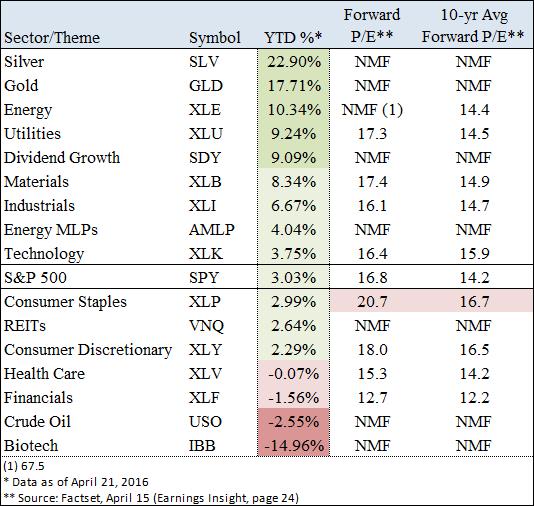

The sector/theme returns have almost been turned on their head as some of the worst performers in the first few weeks of 2016, namely materials (XLB), energy MLPs (AMLP, AMZ), and energy (XLE), have transformed into leaders through the latest data update, April 21. As we outlined in “Alerts: Adding More High-Quality Exposure, (April 2016)” the dividend “track record” growth craze is on, in our view, and yield-rich exposures from utilities (XLU) to the dividend-growth focus itself (SDY) have rallied more than 9% in the year thus far.

The metals gold (GLD) and silver (SLV) have also proved to be good trades out of the gates thus far in 2016, up ~18% and 23%, respectively, though we continue to remind investors of a commodity’s inability to generate tangible intrinsic value in the traditional sense, “Gold Is But a Shiny Yellow Metal, (January 2016)” Commodities can certainly make good trades at times, however. Biotech (IBB) has taken the worst of it in in the first few months of 2016 as a result of a political cycle that continues to threaten drug prices. Can you imagine waking up one day to find out that politicians want Gilead’s (GILD) Harvoni to be $2,000 a single treatment regimen instead of $94,000? The market is coming around to these types of risks, even as Gilead continues to converge to our $130 fair value estimate, something many readers continue to overlook.

Incredibly, S&P 500 companies in the consumer staples sector (XLP) continue to trade at more than 20 times forward earnings, a multiple that is nearly 25% higher than the sector’s own 10-year average, which itself continues to move northward as more recent above-average readings are embedded. Further, in light of the subjectivity of “earnings” potentially included in this calculation, we believe most of the submissions are non-GAAP based when it comes to analyst “consensus” measures, meaning when it comes to reported numbers we could be witnessing a situation where consumer staples equities are actually trading at much higher multiples.

It’s also worth noting that the measure we are pointing to is the forward-looking multiple, meaning that on a trailing basis, the multiple is significantly higher than the 15 times that is most typically used as yardstick for “fair valuation” in back-of-the-envelope analysis. Clearly, investors are flocking to equities with stable, strong business models that have solid dividend track records — in this market, valuation has taken a temporary back seat, but it will rear its ugly head again…eventually. We believe we are well positioned in both newsletter portfolios for when that happens.

We continue to watch a market that remains bubbly, and as incremental undervalued ideas are becoming harder and harder to find, the momentum dynamic of the Valuentum process continues to facilitate a “let-our-winners-run” approach, which has benefited the newsletter portfolios greatly. We’ve recently added exposure to both Berkshire Hathaway (BRK.B) and the SPDR S&P Dividend ETF (SDY) to the newsletter portfolios to capture undervalued, diversified exposure to the Oracle of Omaha’s prowess and to the ballooning theme of dividend growth investing.