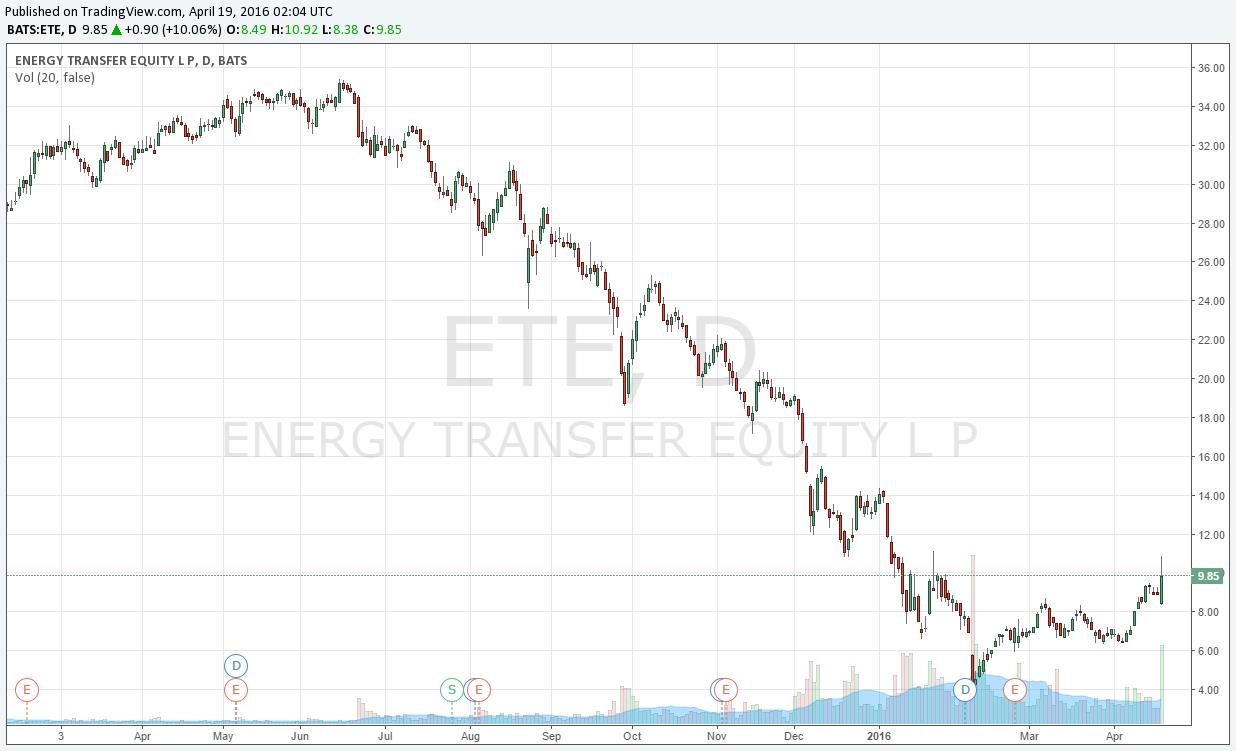

Shown above: Energy Transfer Equity’s recent share price performance.

A lot of investors depend on us for our energy research. We’ve been busy publishing on the website, and we can’t possibly send out all of our research via email, so please come visit. Many are aware of our take in any case: the energy master limited partnership (AMLP, AMZ) isn’t going away tomorrow, but it may not last over the long haul. This is nothing new. We’ve been saying this since the peak in energy MLP share prices, which just so happened to coincide with Energy Transfer Equity’s (ETE) heights in the mid-$30s. Our readers understand that we’re taking the long view with MLPs when we talk about business models and valuation, and frankly, we don’t think energy MLPs are going to make it to be viable instruments in any long-duration dividend growth strategy. We’ve already witnessed so many distribution cuts.

Can energy MLP shares rally during 2016? Yes. In fact, they already have – and we’ve captured the jump implicitly via exposure to the Energy Select Sector SPDR (XLE) and the new position in the Best Ideas Newsletter portfolio in Kinder Morgan (KMI), the latter now a corporate. Though Energy Transfer Equity has nudged up a bit on more news related to trouble with its deal with Williams (WMB), we continue to remind investors that shares of ETE have fallen more than 70% since May/June 2015. Do you remember what coincided with that time period? Well, it was our high-profile warning to members on energy MLPs and Kinder Morgan in particular, of course (you remember – Barron’s picked it up).

Our members were warned about energy MLPs 70% ago – but what about those that didn’t find us until recently. We care very much about them, too — we wish they would have found us sooner! We measure our performance on the move of ETE from ~$35 to $10 per share, not on its recent dead-cat bounce from $6 to $10…or even short-covering to $15, but even that may not matter to new members that may not have been aware of our call many moons ago. The mountain of debt on ETE’s books means that we’d need a degree of precision unattainable to say whether shares are attractive at $6 or $10. At $35 per share, however, they were absurdly overvalued. We catch these big outliers all the time in our repeatable process. Dead cat bounces are mostly luck, in our view.

We think it is also important to issue a brief reminder that, for some time, we’ve been neutral on the energy MLP space — the latest reports on the group can be found here. They are fresh with reported 2015 data, and updated future forecasts, and interestingly Boardwalk Pipeline (BWP) registers one of the highest ratings on the Valuentum Buying Index. Several of the equities trade at discounts to their intrinsic value estimates, but we’re not all that fond of the group. We maintain our view that energy MLPs are mostly externally-financed pass-throughs that are hoping for the market to return to an artificial pricing paradigm on their distributions, even as we say their businesses are solid. In light of ever-lower global interest rates, a reversion to the “good times” for energy MLPs can happen, just like any bubble can be formed. Remember, the market is not always rational, and another debt-infused stock bubble in energy MLPs can re-inflate if market participants facilitate such “hot air.” Many investors aren’t buying into energy MLPs because they are doing extensive enterprise free cash flow valuations – their research may not go further than the yield – which is in part a return of capital.

Pipelines – Oil & Gas: BPL, BWP, DPM, ENB, EPD, ETP, EVEP, HEP, KMI, MMP, NS, PAA, SE, SEP, WES

Continuing with the after-hours news flow, we wanted to remind investors of the Financial Analysis 500 piece we put together on IBM (IBM) some time ago, talking about how Big Blue is now the poster child for poor earnings quality, “Financial Analysis 501: How to Assess Earnings Quality.” In that piece, we explained how IBM’s performance was enhanced due in part to a a number of artificial EPS enhancers ranging from a low tax rate to share buybacks to cost-cutting maneuvers. The article mirrors a case that one might see in the Harvard Business Review. Not much has changed. IBM is still targeting full-year operating (non-GAAP) EPS expectations of at least $13.50. Remember when its target was $20 just a few years ago? The company’s fundamental trajectory is way off the mark, and results, released April 18, continue to be bolstered by unusual tax items, the latest a $1 billion refund of previously paid non-US taxes. We know Mr. Buffett likes IBM, but he bought it for all the wrong reasons. A large number of IBM’s previous share buybacks have destroyed shareholder capital. Revenue, gross margin, operating income and net income all fell during the reporting period. IBM’s date with disaster has been delayed, not canceled.

We ran a number of articles a couple months ago about our concerns about Netflix’s (NFLX) valuation and business model, highlighting the difficulty it would have growing into the existing price the market had been placing on the enterprise. Shares ran up along with the market since then, but recent results, released April 18, started to reveal some big cracks in the story. The company’s US streaming business continues to benefit from hit content, but an eventual miss in this category will inevitably derail momentum there – as subscribers aren’t locked into long-term contracts and can move in and out each month. This is a huge problem for businesses. It remains apparent to us that the company’s international streaming business will never be as profitable as its US business either, even if such a statement remains masked by heavy investment (segment contribution margins continue to disappoint).

The biggest news at Netflix, in our view, is that international streaming net adds will slow from last year’s mark in the second quarter. We don’t think that there is any acceptable excuse for the slowing pace of international growth, and while Netflix is pointing to its Australian/New Zealand operations as the reason, if Netflix is to grow into its valuation, the pace of growth should not be slowing for any reason. From our perspective, long-duration forecasts of the business need to be ratcheted down, and the Street may come to realize this in the coming years. Negative free cash flow of $261 million underscored the poor business performance in the quarter, and the company continues to spend more and more on original films as its existing collection gets tired. The digital streaming company plans to add to its $2.4 billion long-term debt load later this year or in early 2017, and we believe its single B credit status is appropriate as only an immediate equity raise at current prices would change such a view.

Competition is heating up at time when Neflix is most vulnerable, too. We think the news that Amazon (AMZN) is now targeting Netflix directly with a standalone Prime Video option is a big deal. The price for Prime Video — $8.99/month — is a full dollar less than Netflix’s recently-raised price on its most popular plan. We’ll be waiting for consumer discretionary income in the US to being to slow before taking any action in Netflix’s shares in the Best Ideas Newsletter portfolio (a put option idea). Shares of Netflix are indicated down about 8% in after-hours trading, and it will be interesting to watch them during the session tomorrow. Hope everyone is well! Please don’t forget to reach out with any questions.