The Shanghai Index only fell another 1.3% yesterday.

The US markets are cheering at the open Wednesday on hopes that last month’s July durable goods number is foretelling of what investors can expect after the latest leg down in the Chinese market and the collapse in US equity markets the past few weeks. Though “core” July durable goods orders were better than expected, pre-collapse data is no longer indicative of the true state of the US economy and what lies ahead, in our view. The Chinese government has gone “all-in” to prop up its bubbly market, one that is trading at 60 times reported earnings, but the impact, while arguably successful in preventing Armageddon in China for now, has only stemmed the “inevitable,” natural market decline, which remains ongoing.

On June 12, the Shanghai Composite had a 60%+ gain for 2015, and by the most recent close, the index was down 8% year-to-date, revealing one of the biggest “busts” in stock market history. Annual gross domestic product in China had been approaching $10 trillion, a large number representing about 60% of the size of the US’, and we expect the fall-out in China’s equity market to be near-catastrophic for consumer and business spending in the country, not unlike the impact of many other market crashes on domestic economies throughout history. From smartphone-sales drops to auto-sales declines to reduced consumer discretionary wealth to shattered business confidence, a negative GDP print for the third quarter by China would be an appropriate base case forecast, in our view. We’re anxiously awaiting the published GDP “growth” figure for the country during the period, however.

It is not “new” news that aircraft orders have been strong as evidenced by the backlogs of the airframe makers, Boeing (BA) and Airbus (EADSY), which continue to benefit from increased air travel demand. With unfulfilled deliveries a multiple of the pace of annual production and near-term delivery slots full, it is our emerging view that the urgency of airlines across the globe to place orders at the pace of just a few months ago may be subsiding. It is no secret that aircraft orders represent a sizable portion of total durable goods orders, ex-defense (roughly 20-30%, on average) and that Asia is credited as the largest area of future opportunity. Out of the 38,000+ new airplanes expected to be delivered over the next 20 years, more than 14,000 of them will be ordered from Asia, with China accounting for 6,000 of those alone.

Discretionary air travel demand in China is likely to be crimped by “lost wealth” in the stock market and anti-corruption initiatives are already hurting tourism and leisure revenue, as evidenced by the reduced “takes” in Macau. It’s growing more likely that aircraft orders from the country’s airlines will subside and deliveries may even be delayed from their largest carriers, albeit not cancelled. Point-to-point capacity on international connections in and out of China may also be reduced by some of the largest global carriers, as planes allocated to capture surging Chinese air travel demand are allocated to other routes. Perhaps counter-intuitively, falling prices for crude oil and refined derivatives (jet fuel) may exacerbate slowing order trends, as airlines may opt to postpone fleet renewals as fuel-efficiency becomes less and less of a priority in a world of sub-$40-per-barrel of crude than in one in which the price is approaching $150.

Boeing and Airbus remain extremely healthy with years of commercial production ahead of them, but excitement surrounding pre-market-crash durable goods numbers should be short-lived, in our view.

The EIA noted today that while US commercial crude oil inventories decreased by 5.5 million barrels from the previous week, “at 450.8 million barrels, US crude oil inventories remain near levels not seen for this time of year in at least the last 80 years.” We’ve yet to witness any slowdown in production by OPEC-producing nations, and capital spending cuts by the majors such as Chevron (CVX) and ConocoPhillips (COP) may only cede market share to the cartel. OPEC dependence on oil-related revenue will not subside at any price per barrel, and as the cartel produces more to maintain existing standards-of-living in member countries, oil prices may face ever-more pressure–which in turn, would force OPEC to produce even more oil, and so on. The self-perpetuating cycle may have already been unleashed, in our view.

The oil services sector, which has been pummeled by the collapse in energy resource prices, is seeking consolidation as a means to reduce redundant costs and survive what looks to be a “prolonged period of pain.” Halliburton (HAL) and Baker Hughes (BHI) previously announced that they will tie the knot, and Schlumberger (SLB) just agreed to buy Cameron International (CAM) today. Consolidation in the upstream space may be next, but potential deals may only represent asset carve-out transactions as executive teams are still trying to gain consensus in the board room on the future trajectory of energy resource pricing.

Some executive suites continue to believe $75 to be a base-case for crude oil in 2015, and most internal models may have pricing growth in 2016 and beyond, a far-cry from present-day reality. The implication on project NPVs with such a large disconnect on price is a chasm that still has to be reconciled in the upstream arena for any large transformative transactions, and balance sheets are less-conducive to deal-making than they were even only a few months ago, as operators suspend dividend hikes and buybacks. We expect default rates on overleveraged, spot-rate-dependent upstream entities to soar in coming periods, and under such an environment, we expect the dividends of major bellwethers to be tested, with perhaps Exxon (XOM) the only true safe-haven.

The list of reasons to be fully-exposed to an equity market that has yet to “face the music” is growing shorter, if there is a list at all. The world has yet to witness the extent of the impact of a collapsing stock market on a country nearly two thirds the size of the US, and we expect reverberations in the US markets to have shaken consumer and business confidence, if not immediately then eventually. “Ultra-high-yielders” with overleveraged balance sheets remain at material risk of dividend cuts, as Transocean (RIG) shareholders found out yesterday, and dividend growth investors are only starting to learn in this cycle that chasing unhealthy dividends just for the sake of “high yield” will end badly. Valuations continue to be stretched as the risk to future earnings estimates are material, and the technicals are as unattractive as they’ve been in awhile.

The damage has already been done, and we expect things to get worse before they get better.

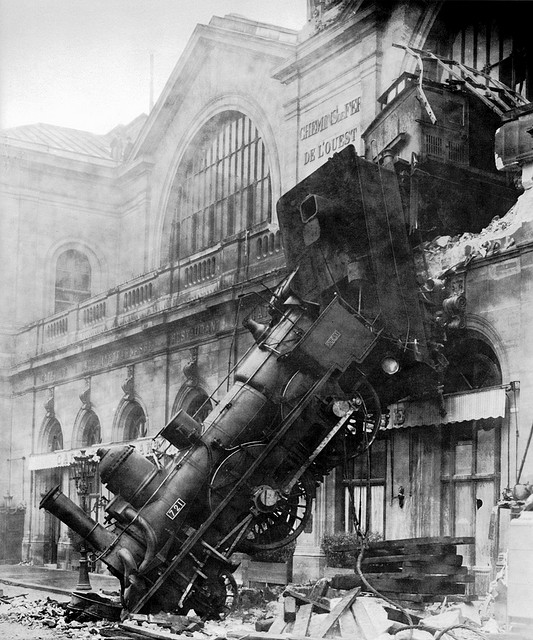

Image Source: Robyn Jay

Related Tickers: SPY