Why are we talking about Alibaba (BABA)?

First, for investors looking for opportunities outside of the US, Alibaba should certainly be on the list, one that should also include former Best Ideas Newsletter portfolio holding Baidu (BIDU)—two companies that are tied to the secular growth of e-commerce in China. Valuentum covers a broad swath of non-US companies from China, Europe, Australia, Brazil, Canada, and beyond. Our international coverage continues to expand every day.

Second, Alibaba is currently a holding in the Best Ideas Newsletter portfolio. Our team passionately follows ideas we add to the newsletter portfolios and provides updates when warranted. You can read about the tremendous track record of ideas added to the Best Ideas Newsletter portfolio in the following piece: Best Ideas Newsletter Portfolio Audit. We focus on the “story arc” so readers can follow our thesis from idea generation to profit taking. There’s nothing that’s promotional in this business – it either is or it isn’t.

Third, we’re not encouraging you to agree or disagree with our views on Alibaba. The value of research and analysis has nothing to do with whether or not the reader agrees or disagrees with it. Instead, the value of research and analysis rests on whether it informs the reader to make better decisions, and sometimes, hearing the other side of a thesis is as important as finding incremental evidence that adds conviction to an existing view. Know why we talk about the stocks we do, and beware of groupthink.

Finally, as it relates to accomplishing the goals of the Best Ideas Newsletter portfolio, a position in Alibaba within the context of portfolio construction makes a lot of sense. For one, the company adds a significant amount of “beta” to the portfolio in an environment where we’re being very cautious. This may sound a bit counter-intuitive, but the position in Alibaba allows us to replicate increased exposure to broader market movements without having to deploy a significant amount of cash, safeguarding returns in the event the bull market in equities fades in the back half of 2015 and into 2016.

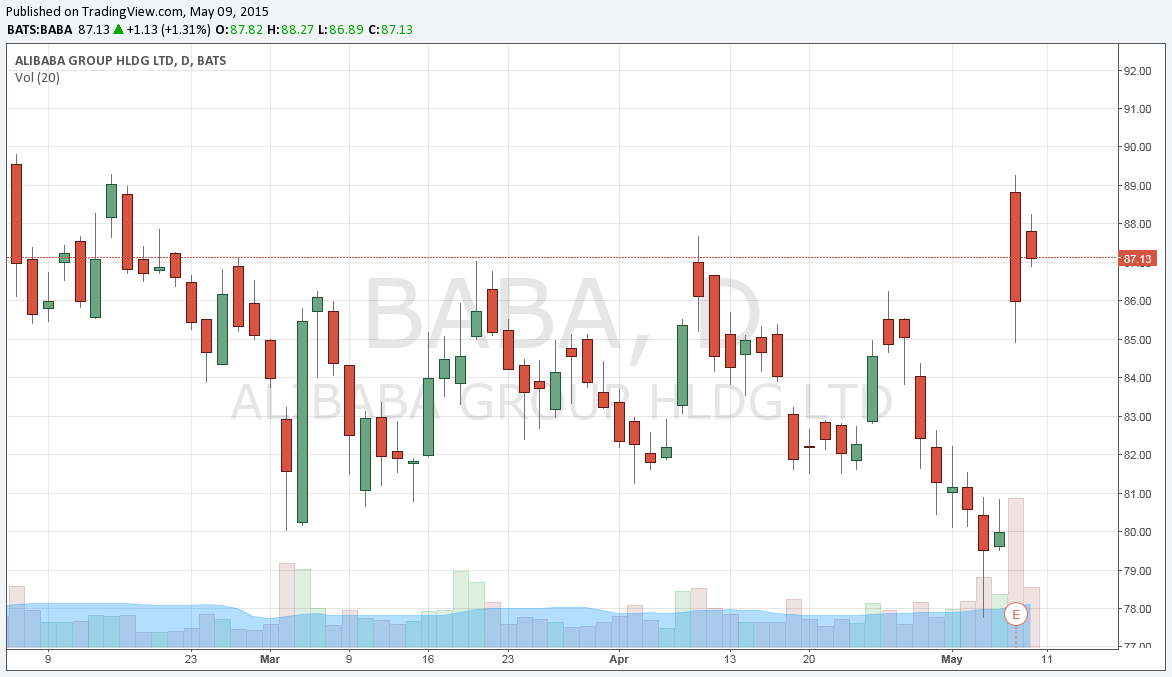

We’d be remiss to say that Alibaba has not been the greatest performer since it peaked at ~$120 per share in early November of last year. But it’s important to note that no stock is the best performer if we measure it from its latest peak (if you think about it, it’s all definitional–the stock has gone down). In two distinct ways, Alibaba looks more attractive today than ever before. The firm’s shares are trading at bargain-basement levels, and its technicals just broke through a downtrend. From our perspective, a quick run to $100 is a high possibility in the next month or so, particularly as the “gap down” is closed.

Most importantly, if you’re not viewing the ideas in the Best Ideas Newsletter portfolio within a portfolio context, you may be missing out on what we’re trying to accomplish: portfolio outperformance. One of the things we hope investors understand is that it is impossible to get everything correct in the market all of the time. For example, in the case of the same idea, an investor with a one-month time horizon may feel disappointment while another with a three-year time horizon may be ecstatic. And this is for the same idea! As we often say, if you are a good investor, your winners will outperform your losers and you will make money. If you are an excellent investor, you’ll still have a lot of losers, but you’ll end up beating the market and make a lot of money doing so.

Image Source: leighklotz

With all of that said, let’s talk about a few of the metrics at Alibaba to continue to grow your familiarity with the company. Revenue for the March quarter leapt 45%, while non-GAAP EBITDA jumped 25%. Non-GAAP free cash flow leapt more than 143% on a year-on-year basis in the quarter. The company’s annual active buyers increased to 350 million at the end of March 2015, an increase of 37% year-on-year. Alibaba recorded an incredible 289 million monthly active users on its mobile e-commerce apps in the month of March alone.

Gross merchandise volume (GMV) across its China retail marketplaces expanded an impressive 40% year-on-year during the March quarter, and it recorded $49 billion in mobile GMV in the period. The firm’s monetization rate (revenue as a % of GMV) was roughly flat at 2.17% during the first quarter, but this was a pleasing development in light of recent pressures. The monetization rate is perhaps the closest-watched metric, and upside surprises in this area could send the stock soaring.

For investors looking for non-US exposure for myriad reasons and/or for a company that dominates a unique niche in the fast-growing Chinese economy, Alibaba is one to consider. The potential possibilities of Alibaba’s business model over the next 10, 20 or 30 years are endless, and it’s hard not to like its dominant e-commerce platform, hefty non-GAAP EBITDA margins and strong free cash flow generation. We value shares of Alibaba north of $130 each. The company is trading in the mid-$80s at present.