Image Source: Jonny Williams

There are three things you have to know about Altria (MO).

First, the company has tremendous pricing strength, which works wonders on driving increased profitability and free cash flow across its core business lines. Second, the company has a lucrative ~27% economic stake in SABMiller (SBMRY), which offers the firm financial flexibility like no other tobacco stock. And third, the entity pays a dividend that makes some REITs and MLPs envious. Altria is one of our favorite corporate dividend growth stocks, and this won’t change anytime soon.

The tobacco giant said April 23 that first-quarter adjusted diluted earnings per share leapt more than 10%, to $0.63. Affirming its 2015 full-year adjusted diluted earnings per share guidance in the range of $2.75-$2.80, representing a growth rate of 7%-9%, means that we’ll probably see dividend growth of a similar pace for the year. The firm targets paying out 80% of adjusted diluted earnings per share as dividends in any given year. From the Marlboro brand in the smokeable segment to Copenhagen and Skoal in smokeless to Nu Mark (MarkTen) in the e-vapor arena, Altria has the bases covered.

As has become the case as of late, Altria’s crown jewel investment in SABMiller muddied quarterly reported results. In the calendar first quarter, for example, the company logged a $134 million loss from earnings from its equity investment in SABMiller, slightly lower than the $225 million loss posted in the prior-year quarter (but confusing at first glance nonetheless). Altria noted that SABMiller’s results were negatively affected by special items and unfavorable currency impacts, but the accounting treatment for this entity is hardly fair or informative to the investor.

If we back out the GAAP loss related to SABMiller on the firm’s income statement in the quarter, Altria’s core performance would actually look better, despite this valuable equity stake ironically hurting reported results. Further, more appropriately adjusting the company’s ‘Investment in SABMiller’ of $5.85 billion on its balance sheet at the end of the quarter to $23.6 billion, or Altria’s current value of its prevailing stake in SABMiller, reveals one of the strongest balance sheets in all of the consumer staples sector (SABMiller’s market cap is 56.9 billion GBP, or $87.5 billion at the time of this writing). GAAP accounting is not as helpful in estimating value in many unique cases, Altria being one.

Source: Altria

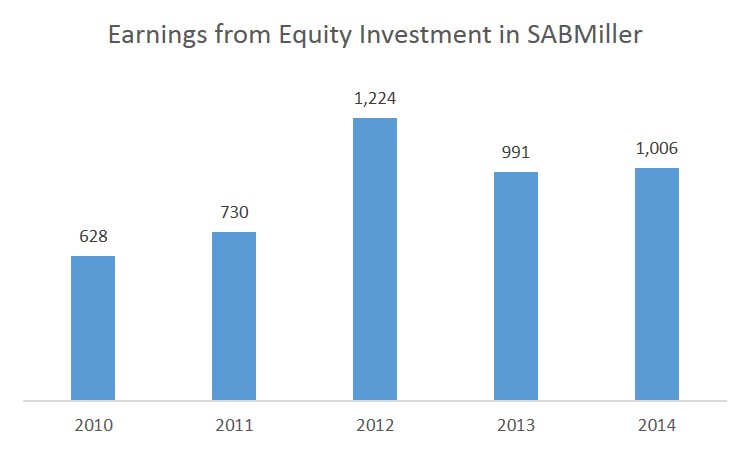

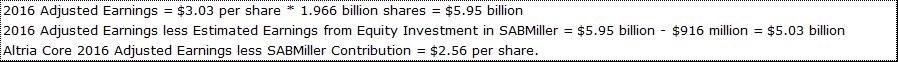

Now follow our back-of-the-envelope math: Altria is trading at a ~$100 billion market cap at the time of this writing. Backing out the market value of its SABMiller stake of ~$23.6 billion leaves the core Altria valued at $76.4 billion. Dividing the core value by shares outstanding (1.966 billion), one arrives at a price for the core Altria at ~$38.90. Dividing this core price by expectations for the firm to earn ~$2.56 per share in adjusted earnings in 2016 (see table below, which backs out SABMiller contributions to earnings), one gets to a forward price-to-earnings ratio of ~15 times.

Note: Forecasted SABMiller earnings approximate average historical contributions.

At $51 per share (our fair value estimate), it’s hard to argue that the company is not fairly priced at the traditionally-accepted “fairly valued” multiple of ~15 times adjusted earnings. But when the average consumer staples entity is trading north of 17 times on a forward basis (see ETF analysis ), relatively speaking, the market continues to be too punitive on Altria’s portfolio of assets, especially when considering its dividend yield, which stands north of 4% at the time of this writing. In this light, it’s hard to kick to the curb a 4%-yielder, 10% EPS-grower, and moaty entity with substantial brand strength and product pricing power. Right?

That said, knowing when to sell a big winner is one of the most important parts of investing. Here’s our view: If Altria continues to move higher to the mid-$50s (as it did earlier this year), we may look to take just a little bit of our position in shares off the table (perhaps sell one third to one half of our position in both newsletter portfolios). Our perspective, which is assuredly different than yours, where the company is one of the largest positions in both the Best Ideas portfolio and Dividend Growth portfolio, we simply wouldn’t be able to stomach a move to the lower $40s, so even a move below $48 could prompt some profit taking on our part. Nobody ever went broke taking profits, to our knowledge.

Most importantly, kudos to those that have made a bundle on this stock, in both capital appreciation and dividend payments.