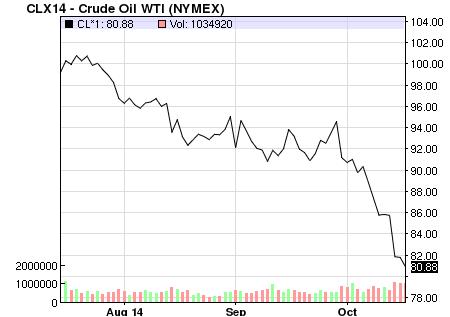

The slide in WTI crude oil prices (USO, OIL) during the past three months has simply been remarkable. No energy company has been spared from the indiscriminate selling, and we point to Chevron (CVX) and Energy Transfer Partners (ETP) as our only direct exposure to the energy sector (XLE), with both being positions in the Dividend Growth portfolio. Kinder Morgan (KMI) remains high up on the watch list.

Image Source: Nasdaq

We like Chevron as our favorite dividend growth pick among the majors because of its defenses against the inevitable volatility and cyclicality of crude oil prices. It’s not that we dislike Exxon (XOM) or ConocoPhillips (COP), but it is that Chevron’s balance sheet is the healthiest; it has the lowest net debt position. High degrees of cyclical end market pricing (e.g. oil) and high degrees of leverage (e.g. net debt) are never a good combination in any industry, no matter the skill of management. Energy Transfer Partners is one of the best-run MLPs, and the only one we’re sticking our neck out on in this tumultuous energy environment. It yields ~6.8%.

European economies are in disarray. European Central Bank President Mario Draghi’s words (see here) were telling of the conditions the region is facing. Equities in France, Italy, and Greece have tumbled significantly in recent months, and Germany is not faring well either. Draghi continues to call for policy reform, but varying interests across national boundaries may make this obstacle too difficult to overcome anytime soon. Greece appears to be in a whole lot of trouble again. Renewed tensions in Russia-Ukraine, and threats of natural gas sanctions on Europe by Putin could make matters even worse. If Europe heads into recession (again), it will inevitably bring the US and much of Asia with it. The US is no longer an isolated economy, and while US jobs data continues to be encouraging, we think hiring will slow as uncertainty in the business climate increases. Not all is well in the global economy.

France (EWQ)

Italy (EWI)

Greece (GREK)

Germany (EWG)

Third-quarter earnings haven’t been great either. Netflix (NFLX) bombed, eBay’s (EBAY) results came in a bit light, Walmart (WMT) cut its outlook for next year, and warnings among chip stocks, Microchip (MCHP), and telecom equipment providers, Juniper (JNPR), cannot be forgotten. Dividend growth gem Dover (DOV) cut its earnings outlook for 2014, Baker Hughes (BHI) missed estimates, and Mattel (MAT) continues to struggle. In many cases, however, we think Mattel’s pain is Hasbro’s (HAS) gain. The recent deal with Disney (DIS) was telling. Even if these may be one-off cases, there’s quite a few of them so early in earnings season.

The Ebola crisis continues. We don’t think the second nurse to be infected with Ebola will be the last to be diagnosed on US soil. It is becoming increasingly likely that the CDC may not know all that there is to know about how the virus is transmitted. As of now, touching an infected person’s body or any contaminated objects is all that is needed to spread the virus. President Obama noted that he had hugged and kissed a number of female nurses at the Texas hospital, and while not reported as such, even he may need to be monitored for Ebola symptoms now. We’ve also learned that the second nurse infected was contagious before boarding a plane with 100+ people and that the plane flew five more flights after the nurse’s. We think the likelihood of the virus spreading is high.

Though we’re certainly not panicking, an understanding of the implications of the Ebola scare with respect to the airlines, lodging and leisure industries cannot be ignored, even if you are of the opinion that such fear is transitory and over-reported. Ebola may not be as deadly as other more commonly known conditions (e.g. influenza, etc.), but the likelihood of survival is much lower, and because of that, the fear of the virus is much higher. It doesn’t take much fear to truly stifle the demand for air travel and products/services of ancillary industries. A transitory item can thus become a fundamental one.

All-in, our team is proud that we were able to get members ahead of the recent slide in US equity prices, and the Best Ideas portfolio just notched its second-highest outperformance gap since inception. You’ve been watching and paying attention this whole time, and we thank you.