Source: Dragon TV 00:27 / 08:28

Source: Dragon TV 00:35 / 08:28

Source: Dragon TV 01:19 / 08:28

The pictures above are allegedly from a Chinese plant of Shanghai Husi Food, owned by OSI Group, which is based in Aurora, Illinois. This link source will take you directly to the actual news footage from local Dragon TV (it is not translated to English, but the video is of high quality). Shanghai Husi Food is a key local meat supplier in China to KFC, owned by Yum! Brands (YUM), and McDonald’s (MCD)—as well as Starbucks (SBUX), but to a lesser extent. All three US-based restaurants have since halted buying meat products from the company.

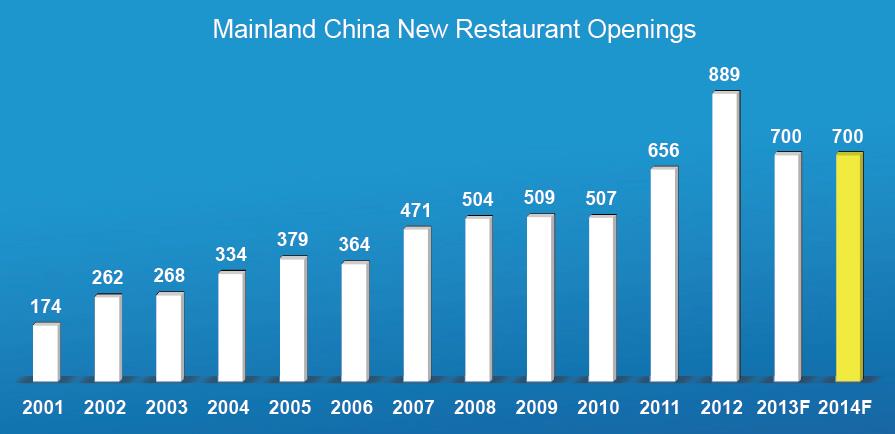

What makes this story worse is that Shanghai Husi Food is reported to have been using and mixing expired meat with fresh meat “for years.” Foreign fast-food companies in China are still viewed as more reliable than local Chinese brands, but the recent report is yet another blow for Yum! Brands and McDonald’s, both of which depend heavily on China for future growth. Yum! Brands, for one, is currently busy revamping its KFC menu and had plans to open at least 700 new KFC restaurants in the country this year alone (there are currently ~4,600 KFC units in China). Management can probably slow down the pace of new openings in the near term in light of this news. Over the long haul, however, KFC could triple its store base, and there’d still only be about 1 KFC unit for every 1 million people in China. Its growth runway in China is long.

Image Source: Yum! Brands

Yum! Brands had seemingly put its poultry supply issues and negative perception behind it when it reported second-quarter results just a few days ago. The company’s worldwide system sales advanced 6% in the quarter, while its worldwide restaurant margin increased 3 percentage points, driving worldwide operating profit 34% higher. Yum! Brands’ China Division system sales had increased 21% thanks to a combination of ~7% unit growth and ~15% same-store sales growth. The China Division’s restaurant margin increased 6.2 percentage points to 16.8% in the quarter, while operating profit nearly tripled. KFC’s same-store sales in China had grown 21% during the period. The China Division accounts for ~35% of Yum! Brands’ total operating profit (it did in 2013).

At McDonald’s, the Asia/Pacific, Middle East and Africa (APMEA) division accounts for ~23% of its sales, and the firm is expanding fast in China. The fast-food giant plans to open 300 new restaurants in China during 2014, up from the 275 it opened in the country last year. McDonald’s most recent monthly same-store sales for May showed declines in the US, but strength in APMEA (up 2.5%). The recent sourcing news will almost certainly hurt an area that had been doing well at the firm. McDonald’s is fighting two battles in the US—one against Starbucks in premium coffee and another in the breakfast arena against the likes of Taco Bell (also owned by Yum! Brands), Dunkin Brands (DNKN) and others—all of this as it struggles to innovate. McDonald’s is expected to report its second-quarter report Tuesday, July 22.

Valuentum’s Take

An investigation into Shanghai Husi Food is ongoing, but we would expect both Yum! Brands and McDonald’s performance in China to suffer at least for the next few months as a result of this public-relations crisis.

McDonald’s blow will be cushioned as it is more diversified in the APMEA region, but third-quarter same-store sales will likely decline as a result of the expected slump in China (we’ll know more when it reports second-quarter performance). Yum! Brands, however, may fare worse. Same-store stores at KFC plunged as much as 36% in April 2013 as a result of the poultry supply issues compounded by concerns over avian influenza. Though we’re not expecting a drop anywhere near as large as that (sales are already beaten down), the fledgling recovery in same-store sales at KFC in China will certainly be stunted. Consumers simply have no interest in putting their health at risk, and damage control (again) appears to be the only viable strategy at this time for both fast food giants.

That said, will consumers still want to eat KFC chicken in China over the long haul? Absolutely 100%. Will consumers still want a McDonald’s Big Mac over the long haul? Certainly. As has been the case before, this again will be just a short-term issue, and we fully expect consumers to come back to the brands. KFC’s long runway of growth in China is still very much intact, and growth in China will remain a priority at McDonald’s.

Though we don’t hold either firm in the Best Ideas portfolio or Dividend Growth portfolio, we think paying close attention to these restaurant bellwethers is vital to staying ahead of trends across the industry. Our only exposure to the restaurant space is in Best Ideas portfolio holding Buffalo Wild Wings (BWLD). Our best dividend growth ideas are included in the Dividend Growth portfolio.

Relative Comparison: KFC versus McDonald’s in China (units)

Image Source: Yum! Brands

Related ETFs: FTSE China 25 Index Fund (FXI)

Other China Equity ETFs: SPDR S&P China (GXC), PowerShares Golden Dragon China (PGJ), Guggenheim China All-Cap (YAO), iShares FTSE China (FCHI), Market Vectors China ETF (PEK), Morgan Stanley China A Share Fu (CAF), ProShares Short FTSE China 25 (YXI), ProShares Ultra FTSE China 25 (XPP), ProShares UltraShort FTSE China 25 (FXP), iShares MSCI China Index (MCHI), Direxion Daily China Bull 3X Shares (YINN), Direxion Daily China Bear 3X Shares (YANG), RBS China Trendpilot ETN (TCHI), Wisdom Tree China Dividend ex-Financials (CHXF), KraneShares CSI China Five Year Plan ETF (KFYP).