The banking industry is based almost entirely on the confidence of intermediaries and counterparties that make up the building blocks of the financial system. An investment in a bank or money center must come with the acknowledgement of the distinct possibility that another financial crisis may occur at an unknown time in the future.

Though we don’t expect one anytime soon, it’s worth noting that there have been three significant banking crises during the past three decades alone: the savings and loan crisis of the late 1980s/early 1990s; the fall of Long-Term Capital Management and the Russian/Asian financial crisis of the late 1990s; and the Great Recession of the last decade that not only toppled Lehman Brothers, Bear Stearns, Washington Mutual, and Wachovia but also caused the seizure of Indy Mac, Fannie Mae and Freddie Mac.

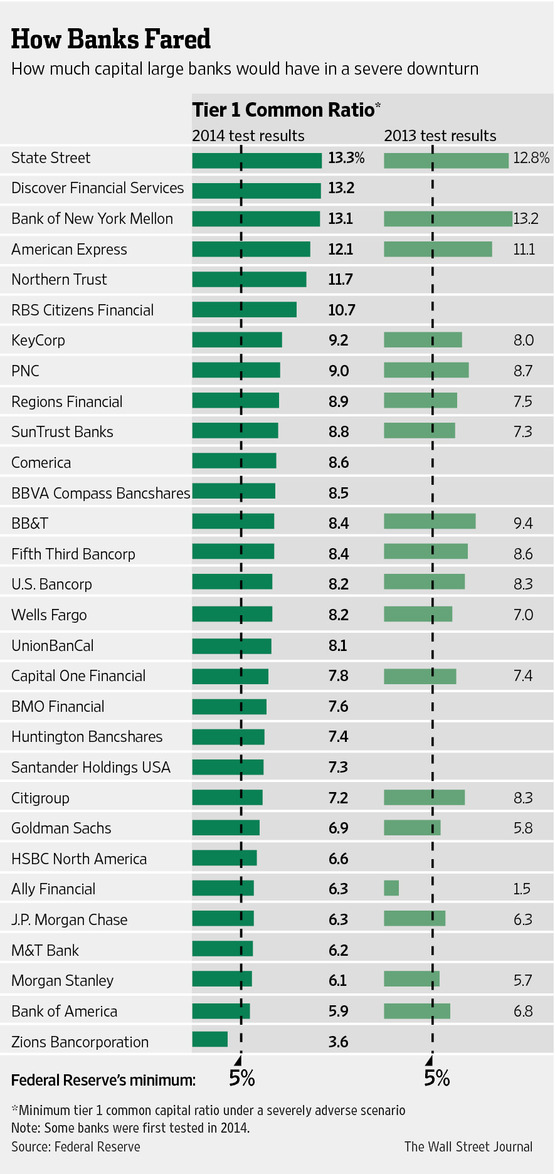

On Friday, we received the Fed’s recent stress test results. For the most part, the banking industry is on sound footing with State Street (STT), Bank of New York Mellon (BK) and Northern Trust (NTRS) showing the strongest capital positions. Discover (DFS) and American Express (AXP) also revealed impressive Tier I Common ratios under adverse conditions. Zions (ZION) and Bank of America (BAC) continue to be among the worst-financed of the largest lenders, though the former was the only to technically fail the stress-test evaluation. Here’s how the capital performance stacked up across the banking sector.

Dodd-Frank Act Stress Test 2014; released March 21, 2014

Image Source: The Wall Street Journal

Valuentum’s Take

We generally prefer diversified bank exposure via exchange traded funds (ETFs) such as the Financial Select Sector SPDR (XLF) and/or the SPDR Bank ETF (KBE). This allows us to capture valuation upside within the banking sector (as the financial system heals from the Great Recession) without exposing us to any firm-specific risk that will always be inherent to the assets contained in any one large bank’s relatively opaque and far-reaching operations. Visa (V) is our favorite credit-card processor in part because it doesn’t take on credit risk like its peers.