Let’s get this out of the way first: we’re not perfect. Though investors can look at our track record over a longer horizon to great satisfaction, as the Best Ideas portfolio (click here) and Dividend Growth portfolio (click here) are doing quite well for long-time members, what about new members that may have joined recently? How would they have fared by following our transaction alert emails? Would they have made money on our ideas?

Before we answer these questions, let’s walk through a few ways members use our services. Many like to replicate the actively-managed portfolios that are housed in the monthly newsletters in their personal accounts in their entirety. Others like to use our transaction alert emails for incremental idea generation, while even others like to overlay the Valuentum Buying Index (VBI) process (click to download the methodology document) with their own views on stocks, ETFs, and even closed-end funds. Many others like the Valuentum Dividend Cushion tool (click here) and/or the fair values and ranges we provide in the 16-page reports. The uses of the Valuentum research are varied and many, and the team is focused on delivering on all fronts.

But while many members know the actively-managed portfolios are doing well (we do our best not to advertise the outperformance too much, but we’re not as well-known as Warren Buffett yet, so we have to) and others have mentioned that they’ve been very impressed with the efficacy of the Valuentum Dividend Cushion over the years, what about the member that’s looking for the next incremental idea…after all, not all members have the funds to replicate the portfolios in their entirety, especially given their strong performance in recent years. How is the new member doing?

Note: We have a few ideas that we’re working on for members that have a more concentrated focus, ones that may be looking for an idea or two as opposed to generating a portfolio.

For illustration, let’s say a new member joined January 1, 2013 (last year). Let’s say that the new member did not replicate the actively-managed portfolios during the year, and instead, followed the long ideas from the transaction alert emails for the Best Ideas portfolio during 2013. How would this member have fared? By the way, if you are not receiving these transaction alert emails, please contact us at info@valuentum.com immediately.

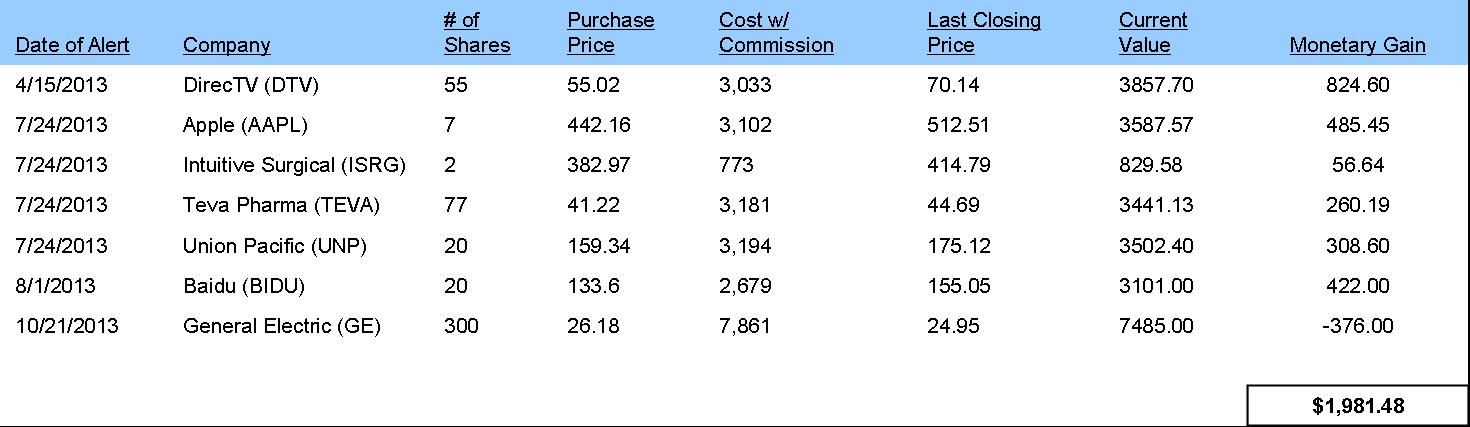

We’ve excluded one of the best transaction alerts we made, which occurred in late 2012 (you can read about Google here) due to the chosen cut-off date (beginning 2013). Below, please find the list of ideas from the transaction alert archive (source) from the period January 1, 2013 to December 31, 2013 (or for all of last year). There were 7 new, incremental long transaction alerts/additions to the portfolio in the year.

Remember: the firms included in the actively-managed portfolios are our best ideas at any given time, as we seek to capture the entire VBI cycle (from a high VBI rating to a low VBI rating).

April 15, 2013

On Monday, April 15, we released the April Edition of our Best Ideas Newsletter via email. In the newsletter, we included a transaction alert for DirecTV (DTV). We added 55 shares at $55.02 per share, representing roughly a 2% position of the portfolio.

July 24, 2013

We added to our position in Apple (AAPL). We think the shares are significantly undervalued, and we’re seeing some re-affirming market action following its strong quarterly report. Specifically, we added 7 more shares at $442.16 per share. In aggregate, Apple will be roughly a 6%-7% position in our Best Ideas portfolio.

We replenished a portion of our position in Intuitive Surgical (ISRG) in the portfolio of our Best Ideas Newsletter in anticipation of a price rebound following its disappointing quarterly performance recently. We continue to like the company’s recurring revenue model and view its fair value substantially higher than where shares are trading today. Specifically, we added 2 shares at $382.97 per share. Intuitive Surgical will remain one of the smallest positions in our Best Ideas portfolio after this move.

We started a new position in the portfolio of our Best Ideas Newsletter in Teva Pharma (TEVA). We continue to think the generic pharma space offers significant opportunities for participants, and we like Teva’s global market position (click here for our generic pharma overview). We’re particularly big fans of its ‘first-to-file’ position in the US generics market and think Teva’s shares offer significant valuation upside potential (to the mid-$50s). Specifically, we added 77 shares at $41.22 per share.

We started a new position in Union Pacific (UNP) in the portfolio of our Best Ideas Newsletter. We expect the firm’s operating ratio to be among the best in the railroad industry by the end of this decade, and we like its exposure to growth in Mexico as well as future export expansion on the West Coast. The firm is levered to coal, though we note its mix is more of the Powder River Basin variety, which should continue to take share from Central Appalachian coal in the domestic market. The firm also boasts a strong Valuentum Dividend Cushion score and a decent annual yield. The high end of our fair value range suggests upside above $200 per share. Specifically, we added 20 shares at $159.34 per share.

August 1, 2013

We opened a new position in Chinese Internet search giant Baidu (BIDU). Though we continue to be cautious on the economic environment in China, Baidu will benefit from the ongoing boom in China’s Internet space. The country has the world’s largest Internet user population–and a long way to go to reach penetration levels of developed countries. We think Baidu will remain at the forefront of such secular expansion for many years to come. Specifically, we are purchasing 20 shares at $133.60 each for roughly a 1%-2% position.

October 21, 2013

We were absolutely blown away by General Electric’s (GE) fantastic third-quarter earnings and have added a 5% position in the firm in the portfolio of our Best Ideas Newsletter. We expect valuation upside above $30 per share (at the high end of our fair value range) and think its burgeoning orders in the third quarter and record backlog bode well for future out-performance and increased earnings estimate revisions down the road. Specifically, we added 300 shares of GE at $26.18 per share.

The Results: Members Following the Email Transaction Alerts Have Made About 10 Times Their Subscription Dues in 2013 on Incremental Ideas Alone

Image Source: Valuentum

Though the actively-managed portfolios showed a significant increase through the course of the year, the incremental ideas also did well. According to the tally and after factoring in transaction costs (but excluding dividends), members that only acted on the long ideas in the transaction alert emails generated $1,981 in profit, about 10 times our average revenue per user. We admit, however, that the return still required a bit of capital. We’re currently working on a product where new members can better capture outsize potential without such a large upfront capital investment. We plan to announce our progress in this area soon.

All-in-all, we don’t think the results for incremental ideas in 2013 were bad. We fall short of saying that they were fantastic, however, because we were a bit cautious in putting new capital to work through the course of the year, given market valuations. We still think this was the correct long-term move, and we trust that this prudence will be well-rewarded in 2014 (see our outlook for the year here). We know that new members are still getting used to us and the process, and we encourage you to use our services in such a way that fits your tolerances and preferences. We are always available for your questions.