The cohort of “too big to fail” banks such as JP Morgan (click ticker for report: ), Bank of America (click ticker for report: ), Goldman Sachs (click ticker for report: ), Wells Fargo (click ticker for report: ) and Citi (click ticker for report: ) recently released self-administered “stress tests” to see if they could withstand turbulent economic conditions. According to the banks, they are all in great shape and can meet minimum capital requirements in the event of adverse economic conditions.

These tests, self-administered, are secondary to the annual March stress test performed by the Federal Reserve. However, these tests have the similar assumptions to mimic how well the banks would hold up if economic conditions returned to the scenario we saw in 2007-2009. Though we like the idea, we aren’t too thrilled with the rigors behind the process.

Problem #1 – The Scenarios Aren’t Adverse Enough

Without question, the Great Recession was the single-greatest economic collapse in the US since the Great Depression of the late 1920’s-1930’s. Armed with years of research, financial models, and greater technology, investors believed that such a scenario like the Great Depression would be inconceivable in this day and age, and that we’d never experience another economic catastrophe quite like it. The Financial Crisis of 2008-2009, however, changed our generation’s way of thinking…forever.

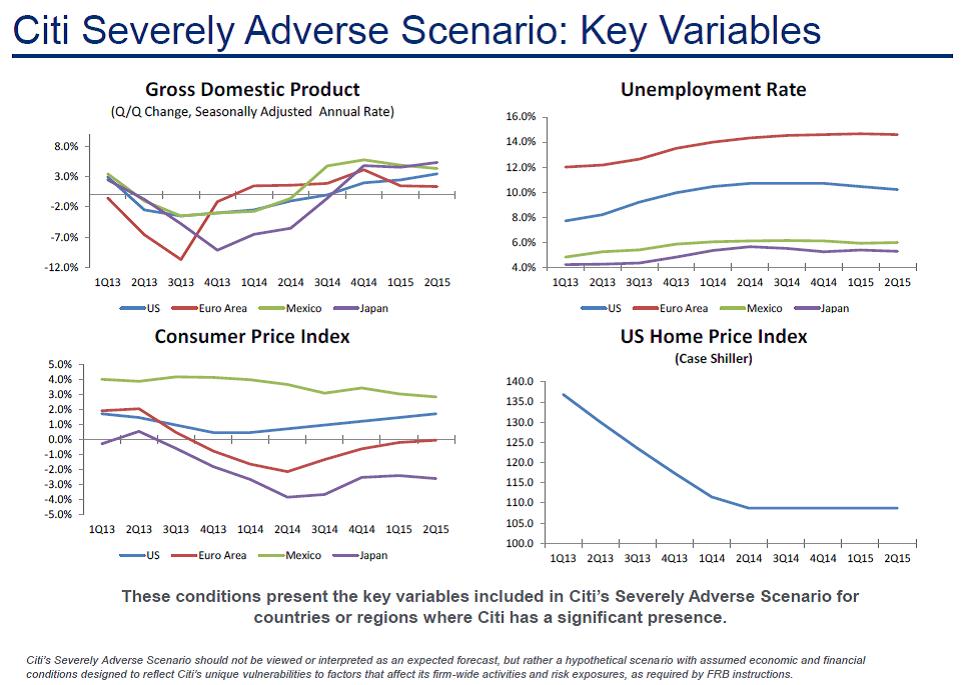

Still, even today, Citi doesn’t account for a scenario in the US where GDP contracts greater than 5% (see slide below). During the Great Recession, for example, GDP fell more than 5% for two sequential quarters – during the fourth quarter of 2008 and the first quarter of 2009. In fact, US GDP fell by more than 8% during the first quarter of 2009. Additionally, Citi’s adverse scenario predicts a fairly short recession, and it doesn’t account for a prolonged economic slump—performance bounces back in a few quarters. The GDP projection runs counter to other variables such as unemployment, which under Citi’s adverse scenario, peaks at 10%, as it did during 2009. This level seems more reasonable, but it may not consider other variables such as under-employment, which also has far-reaching implications on the health of the banking sector.

Source: Citi Stress Test

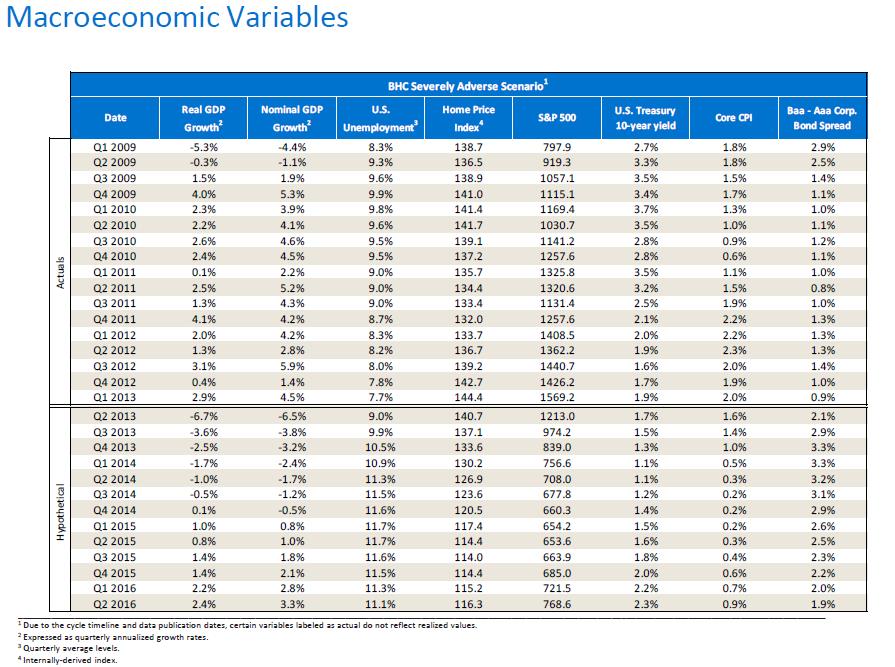

Bank of America predicted more severe assumptions in its adverse case, particularly with respect to the performance of the S&P 500 and unemployment (shown below), but you’ll notice that nominal GDP declines still don’t reach the severity of what actually happened during the first quarter of 2009 (down more than 8%). With the S&P 500 forecast to fall to under 700 in the bank’s adverse case, we doubt GDP will be able to hold up as forecast given the significantly negative wealth effect that would ensue. We also believe the concept of under-employment is not well considered within the bank’s adverse expectations.

Image Source: Bank of America Stress Test

We can’t help but feel that a true stress test should involve more drastic conditions, which brings us to the next issue…

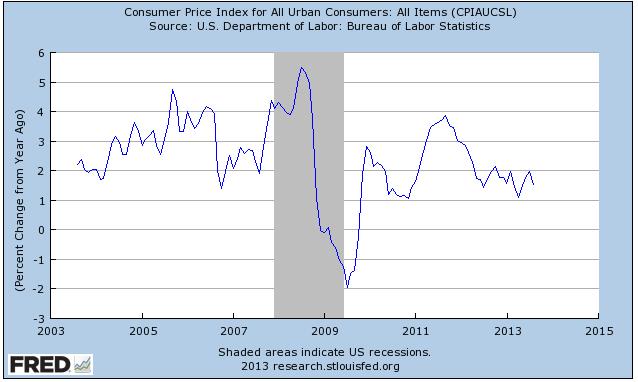

Problem #2 – No Deflation Baked In

Our biggest issue with the degree of severity in the self-administered stress tests was that no scenario, from any bank, considered the potential disastrous impact of deflation (a sustained negative CPI measure). The scenarios do consider declining housing prices via internally-derived home-price indices, but “the approach now used in the CPI, called rental equivalence, measures the value of shelter to owner-occupants as the amount they forgo by not renting out their homes.”

Not expecting a deflationary scenario is particularly egregious, in our view, because falling prices did occur during the Great Recession (shown above, click for data)! Every single bank undergoing self-administered stress tests believes core inflation will remain positive under adverse scenarios, albeit the pace of growth will fall below 1% at some point. Perhaps this rosier scenario regarding inflation is a result of the large increase in the money supply since the Great Recession, but deflation is one factor that could truly wreak havoc on any banks’ health, per below from the Fed:

U.S. banks would likely experience significant earnings pressure with deflation if it resulted in weak loan demand and rising loan losses. In particular, banks with relatively weak capital positions, low profitability or borrowers with a higher risk profile may face significant difficulties if deflation took hold and unexpected loan losses mounted. However, the ability of borrowers to refinance obligations at lower rates could somewhat soften the adverse effect of debt deflation on bank borrowers and the banking industry.

Of particularly worry to us is the potential for a deflationary spiral that may occur in the event of falling prices. In no way, shape, or form is this reflected under the adverse stress-tests. ECR’s definition of a deflationary spiral is best:

…worsening economic prospects lead to asset price declines (mostly real estate and stock prices), while many consumers have borrowed with these assets as collateral. Consequentially, the value of these loans drops, and resulting bank losses mean that banks must reduce lending further to solidify their balance sheets. However, if each bank does this, the result is a worsening economic contraction. Moreover, higher interest rates (caused by higher risk premia) increase the debt burden for both the government and private individuals, and further inhibit economic growth. This is generating a self-sustaining negative spiral for the economy. Investors then demand even higher risk premiums, lower asset prices imply there will be even less borrowing and more deleveraging, slowing growth, and so forth…

Thankfully for the banks (and the economy) Fed Chairman Ben Bernanke and likely successor Janet Yellen have made fighting deflation a priority, so it would take an incredibly large exogenous shock to induce deflation. However, this is the type of adverse event that should be reflected in such stress tests.

Problem #3 – Model Risk

At Valuentum, we love financial models; in fact, we use models daily to arrive at our equity fair value estimates. However, models are only as good as the inputs that drive them. In 2007, banks’ internal financial models didn’t predict the chaos that followed because the models didn’t appropriately consider a realistic range of probable outcomes on certain key inputs.

Specifically, there’s a very real likelihood that financial models are missing crucial risks and are built upon faulty inputs/assumptions (e.g. the strength of AAA-rated sub-prime mortgages). In other cases, inputs/assumptions in the model could simply be missing (think the severity and duration of GDP declines, the lack of consideration for under-employment, or the big omission with respect to the potential for deflation in these recent stress-test results).

Problem #4 – Regulations May Fail

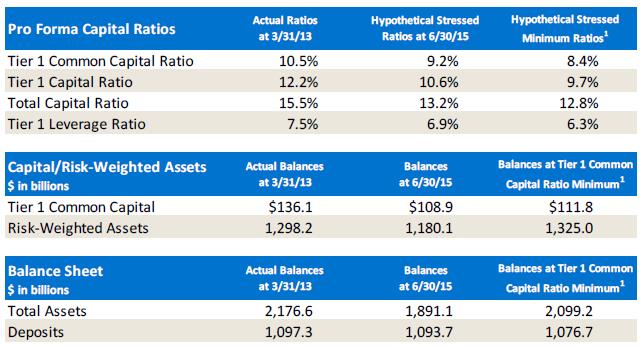

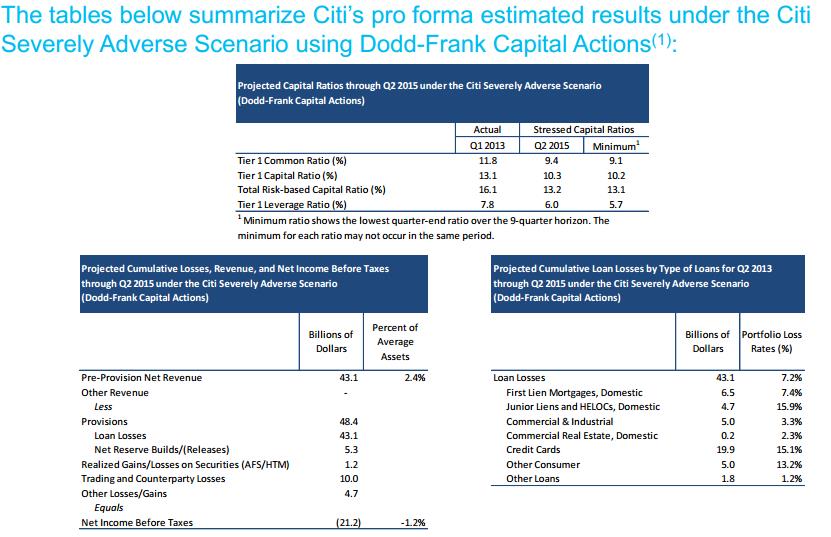

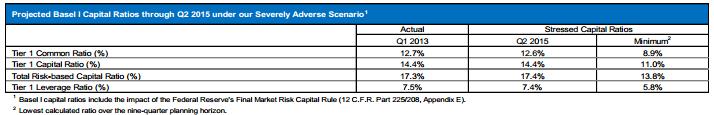

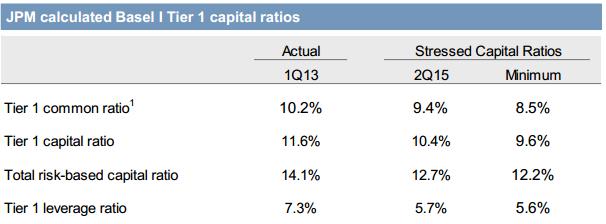

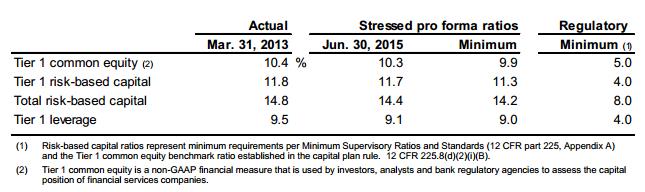

Trusting an entity to test itself is always a risky proposition predicated on the party’s honesty and integrity. It is also human nature to flock to moderately difficult tasks that can still be completed, leaving more difficult (yet more realistic tasks) un-pursued. Let’s take a peek at the results of the adverse scenarios of key banking participants:

With the exception of Goldman Sachs which passed easily, every other bank passed the stress test by a relatively narrow margin. Given that the banks used similar variable assumptions about inflation, unemployment, and GDP growth, the banking sector may simply be using assumptions that are “just negative enough” to make the scenario look adverse in order to meet capital thresholds.

Valuentum’s Take

We believe investing in banks is a difficult proposition—particularly for the dividend growth investor. The banking system is inherently fragile and crisis prone, and even with new regulations in place, we do not believe the US financial system is immune from crisis.

Stress tests are viewed as a way to de-risk the financial system, but we fear the adverse conditions aren’t adverse enough. With every bank passing a self-administered stress test, regulators and investors alike may be lulled into a false sense of security, making a potential financial catastrophe even worse.

Investing in financials is a risky bet, but we feel comfortable holding shares of diverse financial ETFs such as the Financial Select SPDR ETF (click ticker for report: ) and the SPDR S&P Banks ETF (KBE) in the portfolio of our Best Ideas Newsletter.