Image Source: Numbers and Finance

As a subscriber to Valuentum’s Dividend Growth Newsletter, you receive email updates if we plan to make any changes to the portfolio before the release of the next edition of our newsletter. If you are not receiving these alerts by email, please contact us.

<< About the Dividend Growth Newsletter

View excerpts from the email transaction alerts previously delivered to subscribers in this article:

December 27, 2024

Summary of the Changes

Honeywell (HON): 3%-4% à 0%

McDonald’s (MCD): 3%-4% à 0%

Meta Platforms (META): 0% à 3%-4%

Booking Holdings (BKNG): 0% à 3%-4%

Alert: Changes to the Newsletter Portfolios

June 27, 2023

JEPI: 0% –> 8%-12%

DIV: 0% –> 8%-12%

MCD: 1%-2% –> 3%-4%

HD: 1%-2% –> 3%-4%

HON: 1%-2% –> 3%-4%

UNH: 1%-2% –> 3%-4%

DKS: 1%-2% –> 3%-4%

March 13, 2023

Johnson & Johnson (JNJ): 8%-12% à 0%

Exxon Mobil (XOM): 5%-7% à 0%

Chevron Corp. (CVX): 3%-4% à 0%

Newmont Mining (NEM): 3%-4% à 0%

Realty Income (O): 3%-4% à 0%

ALERT: We’re ‘Raising Cash’ in the Newsletter Portfolios

November 3, 2022

November 2, 2022

October 4, 2021

Markets Look Vulnerable, Adding “Protection”

June 27, 2021

January 27, 2021

ALERT: Raising Cash in the Newsletter Portfolios

November 27, 2020

Added 5 Dividend Growth Gems to the Newsletter Portfolio!

We added five dividend growth gems to the simulated Dividend Growth Newsletter portfolio. Read this article to find out which gems we added!

October 28, 2020

ALERT: Removing Intel (INTC) from the Newsletter Portfolios

We are removing Intel from both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Intel has been a part of both newsletter portfolios for a long time. The stock was included in the September 2011 edition of the Best Ideas Newsletter with a ~2% weighting in the portfolio at $19.89 per share, and it was included in the inaugural edition of the Dividend Growth Newsletter (January 2012) with a large 7% weighting at $24.25 per share.

August 20, 2020

ALERT: Newsletter Portfolio Changes; Investing Is Simple, Not Easy

BKLN: 4.25%-6.5% à 0%

KMI: 3.25%-4.25% à 0%

LMT: 3.25%-4.5% à 6.25%-8.5%

ORCL: 4.25%-6.5% à 6.25%-8.5%

AAPL: 2.75%-4% à 3.25%-4.5%

MSFT: 2.75%-4% à 6.25%-8.5%

June 12, 2020

*ALERT* Scribbles and More Newsletter Portfolio Changes

We’re putting the proceeds from the removals yesterday, less the new put option “partial hedge,” back into Microsoft (MSFT) and Apple (AAPL), allocating the remaining proceeds equally to both in both newsletter portfolios to go back to “fully invested” (both Microsoft and Apple will now be in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio). Our thoughts on re-adding Apple and Microsoft to the newsletter portfolios are rather simple. Aside from our liking them on a firm-specific basis, if the economy heads south, they’ve shown an ability to hold up better than most. If we see interest rates lower for longer, their dividend growth potential is enormous, which is a big catalyst for income/yield seekers, and if we do see a strong economy and market, they will participate, and perhaps even lead. One can say we should have never removed them, but we now know much more about COVID-19 than we did many months ago.

June 11, 2020

*ALERT* Newsletter Portfolio Changes

We’re making a couple tweaks to the simulated newsletter portfolios today. It has been one of the strongest bull markets we’ve ever seen off the March 23 bottom, and while we continue to be optimistic about some of our favorite ideas, we are now re-positioning the newsletter portfolios after taking advantage of the surge. In the Dividend Growth Newsletter portfolio, we are removing Cracker Barrel (CBRL) and Bank of America (BAC). Cracker Barrel no longer fits the criteria for the Dividend Growth Newsletter portfolio, and we expect the banks to continue to suffer as the economy muddles along and as Fed policy may offer headwinds to net interest margin expansion. In the Best Ideas Newsletter portfolio, we are removing the Vanguard Real Estate ETF (VNQ) and the SPDR S&P Aerospace and Defense ETF (XAR). We think the REITs may continue to face pressure as rents become more difficult to collect in a COVID-19 world, and we think the aerospace industry has largely bounced back to fair value, in many individual cases. We are also adding a 1% put option weighting on the S&P 500 SPDR (SPY) to both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio (August 21 expiration, $295 strike). Much like the protection we have in the High Yield Dividend Newsletter portfolio with the SJB, we think this move is prudent to “hedge” against downside risks.

April 29, 2020

ALERT: Going to “Fully Invested” — The Fed and Treasury Have Your Back

We’re taking the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio to “fully invested,” scaling up our existing positions to reflect that status. We plan to consider put options to hedge against downside risk, if or when the time comes. Moral hazard continues to run rampant, and the Fed and Treasury may have no choice but to continue artificially propping up this market, even buying stocks through certain vehicles, if necessary. Having warned members about the impending “Great Crash of 2020” and identifying savvy opportunities near the bottom, we are now withdrawing our S&P 500 target range as we move now to focus more on individual ideas through this turbulence. We expect to continue to identify opportunities for relative outperformance. 2019 was one of the best years in the Best Ideas Newsletter portfolio yet. In the Exclusive, we just registered our 25th consecutive monthly short idea in a row that has worked out. The markets may go much lower from here before we go higher again, but the Fed and Treasury won’t let this market go down in the longer run, in our view–even as we navigate a Depression-type economic environment in the near term. Stay the course.

March 12, 2020

Closing ‘Crash Protection’ Again, Circuit Breakers Tripped Again, Too >>

On March 11, the Trump administration announced a ban on travel from Europe to the U.S. for 30 days, but containment efforts in this regard may be too little too late. COVID-19 is already in the United States and spreading aggressively. Containment efforts on travel bans into the United States were the right move weeks ago, but perhaps politically difficult to achieve. Director of the National Institute of Allergy and Infectious Diseases Dr. Anthony Fauci noted the following regarding the possible number of eventual deaths from COVID-19 in the United States: “if we are complacent and don’t do really aggressive containment and mitigation, the number could go way up and be involved in the many, many millions.” The World Health Organization expects a global death rate from COVID-19 of about 3.4%. The markets were disappointed in the expected fiscal stimulus response, announced March 11, that focused on proposals regarding deferred tax payments and payroll tax relief, items that will not move the needle in addressing what ails the United States, a novel virus that is highly contagious and far more deadly than the seasonal flu.

March 6, 2020

ALERT: Re-establishing “Crash Protection” >>

Our prior “crash protection” worked out wonderfully, and we think adding back the protection with a portion of the “house’s money,” so to speak, makes sense. In our prior put-option idea, we went out to September 18, 2020 with a $250 strike. This time, we’ll go to June 30, 2020, with the same strike price ($250), a 0.5%-1% weighting in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Please note that most options expire worthless, but such a move offers valuable portfolio protection, in our view.

March 2, 2020

ALERT: Closing Put Option Position >>

I wanted to thank each of you so much for the kind words expressed this week about our service and how once again we were ahead of the herd with respect to “crash protection.” Today, we are now removing that “crash protection,” and closing the put option position in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio for a solid double ($6.50)…

February 24, 2020

ALERT: Adding Market Crash ‘Protection,’ Removing MSFT, BKNG >>

We’re adding out-of-the-money put options to both the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio. We’re removing Microsoft from the Dividend Growth Newsletter portfolio, and we’re removing Booking Holdings from the Best Ideas Newsletter portfolio. We reiterate that, had the Dow Jones Industrial Average already swooned a couple thousand points on news of the COVID-19 outbreak, we might have considered some undervalued stocks with strong momentum potential “buying opportunities.” However, to this point in time, the markets have largely ignored COVID-19, with major US indices still sitting near all-time highs. We could be in for a wild ride in the coming weeks and months, and an outright market crash is not out of question. For those looking for short-idea considerations, please consider the Exclusive publication here. We remain fully-invested in the High Yield Dividend Newsletter portfolio given its yield and income focus.

January 13, 2020

ALERTS: Big Changes to the Portfolios; Goodbye Apple! >>

Dividend Growth Newsletter portfolio

Remove: AAPL (5.5%-7.5%), GM (3.5%-5.5%) = 9%-13%

Add: BAC (2.5%-3.5%), NEM (2.5%-3.5%), RSG (2.5%-3.5%), LMT (2.5%-3.5%) = 10%-14%

August 14, 2019

March 15, 2019

March 6, 2019

Dividend Growth Portfolio Alert: Adding KMI, Removing HAS!

February 14, 2019

December 26, 2018

December 21, 2018

Parting with Altria on News of its Stake in JUUL

November 1, 2018

Adding Xilinx to the Dividend Growth Newsletter Portfolio

April 8, 2018

Digital Realty (DLR) and Oracle (ORCL)…

April 3, 2018

March 16, 2018

Saying Good Bye to Boeing For Now

February 8, 2018

December 26, 2017

Tweaking the Newsletter Portfolios…

August 18, 2017

July 31, 2017

July 19, 2017

June 20, 2017

May 25, 2017

May 17, 2017

May 15, 2017

May 8, 2017

January 26, 2017

Alert: Trading MLPs, Adding Boeing, Adding Hanesbrands

January 6, 2017

December 1, 2016

Medtronic (MDT) trimmed; General Motors (GM) added…

July 15, 2016

June 24, 2016

June 13, 2016

What?!?! Microsoft Acquires LinkedIn; NO!

April 29, 2016

Adding Protection, Gilead Hits Speed Bump

April 20, 2016

Alerts: Adding More High-Quality Exposure

February 17, 2016

We added to the position in Cisco in the Dividend Growth Newsletter portfolio. The email can be accessed here.

February 9, 2016

We removed HCP from the Dividend Growth Newsletter portfolio. The email can be accessed here.

February 1, 2016

We’ve long appreciated the stand-out dividend strength characteristics of Cracker Barrel (CBRL) among the full-service restaurant space, and we see an opportunity to add the company to the Dividend Growth Newsletter portfolio today (see page 5). We’ve outlined our case for Cracker Barrel in the past, “Free Cash Flow Feeds Cracker Barrel’s Dividend Growth,” and while we haven’t quite gotten our price just yet, we’ve inched forward a bit with a small 1.5% position in the Dividend Growth Newsletter portfolio at this time. The company yields a very nice ~3.4%, and its Dividend Cushion is solid for that high of a payout.

One of the areas we’re expecting Cracker Barrel to surprise to the upside is the positive impact from vacationers taking to the roads thanks to plummeting gas prices. Not only are falling prices at the pump a stimulant for road trips, but we think Cracker Barrel may be most to benefit from this trend, given that its restaurants can often be found very close to exits off the interstate or next to lodging and accommodations. The company truly has a differentiated concept, in our view, and it generates as much as 20% of revenue from its retail store business. The cash keeps coming in even as would-be diners wait for a seat. It has an excellent business model, and Cracker Barrel makes it work well. We added 18 shares at $133.50 each.

We’re also taking a stab at the lowest cost exposure to the REIT industry in the form of the Vanguard REIT ETF (VNQ). The Bank of Japan’s decision to pursue negative interest rates has put pressure on government bond yields in the US, with many are now speculating that the Fed will pause with respect to contractionary monetary policy. We’ve been mighty pleased with the addition of Realty Income (O) to the Dividend Growth Newsletter portfolio and even embattled HCP (HCP) has managed to bounce back toward cost. With the energy MLP space (AMLP) in shambles, we think high-yield seekers may be more prone to accepting REIT-related risk in an interest rate environment that no longer looks decidedly upward for the foreseeable future. We added 32 shares of the Vanguard REIT ETF at $77.07 each to capture such a view.

The Vanguard REIT ETF’s top holdings include Simon Property Group (SPG), Public Storage (PSA), Equity Residential (EQR), AvalonBay Communities (AVB), and Welltower (HCN). Annualizing the Vanguard REIT ETF’s latest quarterly distribution of $1.10 per share translates into a nice dividend yield at current prices. Our ETF work on the real estate industry can be found at the following link, and we’ve highlighted the Vanguard offering as one of our favorites:

http://www.valuentum.com/articles/20150319

Methodologically speaking, the US equity markets have punished stocks almost indiscriminately. At times, we may stretch the Valuentum Buying Index criteria (which has started to pick up the market’s weakening technicals) to gain incremental exposure to preferred sectors/industries, as that with respect to the REITs in this instance. We generally remain quite firm with respect to the Dividend Cushion ratio, however. The higher the Dividend Cushion ratio, the more resilient the payout, and negative Dividend Cushion ratios should be cause for concern in a tightening credit market.

November 5, 2015

October 6, 2015

We added shares of the Energy Select Sector SPDR (XLE) at $67.14 per share. The ETF accounts for ~5% of the portfolio’s value.

For more information, please select the following link: http://www.valuentum.com/articles/20151006_1

August 21, 2015

We removed 26 shares of Apple (AAPL) from the Dividend Growth Newsletter portfolio at $108.92 per share for a very large gain–see explanation in email alert here.

August 7, 2015

Energy Transfer Partners was removed from the Dividend Growth Newsletter portfolio at $47.10 per share, comfortably above its cost basis, even after excluding distributions received.

July 1, 2015

We removed half of the position in Hasbro (HAS) for a ~140% gain (110 shares at $75.50 each).

June 11, 2015

We removed our entire position in Kinder Morgan (KMI) from the Dividend Growth portfolio at $40 per share. The note outlining 5 reasons why can be found here.

April 1, 2015

We added a 3% position in the Energy Select Sector SPDR Fund (XLE) in the Dividend Growth portfolio to replace the recently-removed position in Chevron (CVX). The 20-page ETF report on the XLE and its peers can be downloaded here (pdf). In the report, we outline our thoughts on the outlook for crude oil and natural gas prices and explain why the XLE tops our list of energy sector ETF ideas.

As it relates to Chevron, we very much like the oil and gas giant, but we think the XLE will still position us to capture a potential recovery in crude oil prices but without exposing us to the individual capital budget decisions of any one major oil and gas operator. The top-10 constituents of the XLE are outlined in the energy sector ETF report. Specifically, we added 62 shares of the XLE to the Dividend Growth portfolio at $77.75 each.

Importantly, from our perspective, the position makes the most sense for energy exposure only in the context of a balanced and diversified dividend growth portfolio, not as a standalone idea.

March 16, 2015

We removed the entire position of Chevron from the Dividend Growth portfolio, which is housed in the monthly Dividend Growth Newsletter, at $102.36 per share.

January 27, 2015

We removed from the Dividend Growth portfolio 154 shares of Microsoft at $42.34 each. We’re most concerned that a 4% dividend yield, a level where significant fundamental support rests in Microsoft’s shares, isn’t until $31 per share. Though there is material technical support in the $40 per-share range, general market weakness could threaten those levels.

November 14, 2014

We added Cisco (CSCO) to both the Best Ideas portfolio and Dividend Growth portfolio. We’re adding 100 shares to each portfolio at $26.15 each. More >>

October 22, 2014

We established 157 shares of KMI at $38.72. More >>

October 10, 2014

Closing Put Option Contracts >>

September 30, 2014

We sold our full positions in Phillips 66 (PSX), the spin-off from ConocoPhillips (COP), and Emerson Electric (EMR). Phillips 66 has been one of the best performers of the Dividend Growth portfolio, and it has raised its dividend on a number of occasions since the spin-off. Emerson Electric has also been a solid performer. Phillips 66: $81.43 per share; Emerson Electric: $63.02 per share.

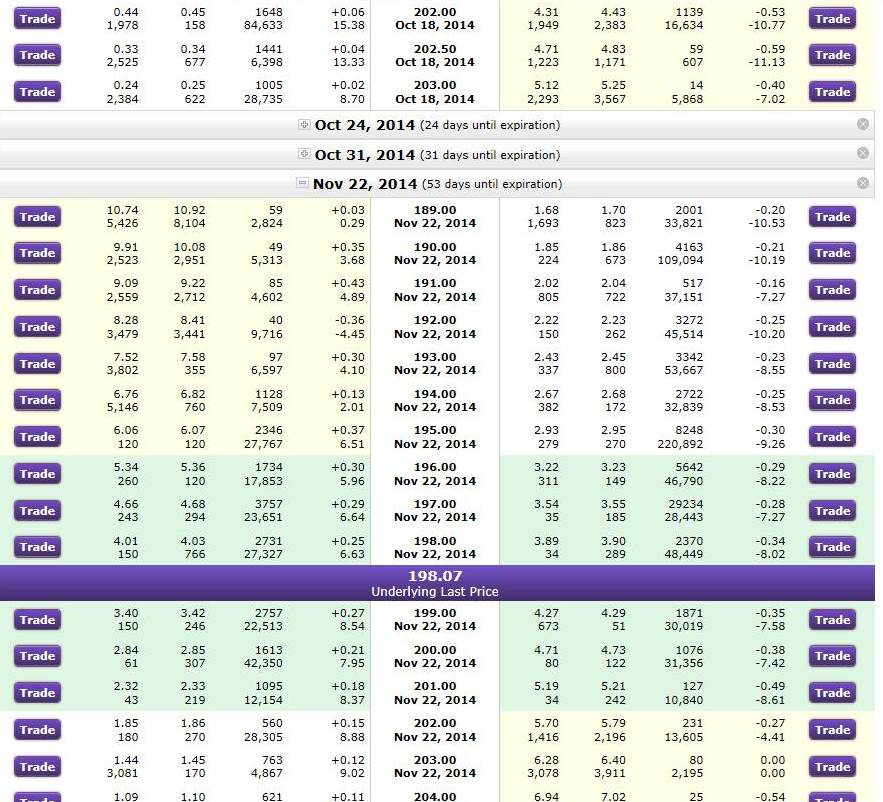

We added protection in the form of 5 put option contracts on the S&P 500 (SPY), with Nov 22 expiration at 195.00 strike ($295 each). The options positions are hedges to the portfolio, and may or may not be of interest to you. They can expire worthless.

September 19, 2014

We opened a 2% position Coach (COH). Though this idea is not without material risks, we think the firm’s 4% dividend yield will act as nice pricing support. We think downside is rather limited. You can watch Brian Nelson’s clip on CNBC here >> Transaction: 80 shares at $37.55 each.

We opened a 2% position in HCP (HCP). The firm is the first healthcare REIT selected to the S&P 500 and the only REIT included in the S&P 500 Dividend Aristocrats Index. View HCP’s landing page here. Shares yield 5%+. Omega (OHI) remains on the watch list. Transaction: 75 shares at $40.11 each.

September 2, 2014

The convoluted structure of the Kinder Morgan umbrella will now change, as KMI—4.7% annual yield—announced August 10 it will purchase all of its subsidiaries KMP—6.8% annual yield, KMR—7.2% annual yield, and EPB—7.6% annual yield. The combined entity is expected to receive investment-grade marks from the credit agencies, and to please the dividend growth crowd, the “new” KMI expects 10% annual growth in the dividend from 2015-2020. The deal amounts to ~$70 billion in total transaction value and is expected to close by year end. We think the transaction is a smart one and speaks loudly about the limitations and risks of the MLP structure. As a result of the lost income stream associated with the buyout, KMP has been removed from the income-oriented Dividend Growth portfolio (KMP, KMR and EPB will cease trading once the deal closes before year-end). KMP was removed from the portfolio: 65 shares at $95.62 (the previous Friday’s close).

October 21, 2013

We added a 5% position in General Electric (GE) in the Dividend Growth portfolio. Specifically, we added 240 shares at a price of $26.18 per share.

July 24, 2013

We opened a new position in Apple (APPL) in the portfolio of the Dividend Growth Newsletter. We think the iPhone-maker has some big dividend increases ahead of it in the coming years (the company boasts an excellent Dividend Cushion score). Its current annual dividend yield of nearly 3% is nothing to sneeze at, and we think shares offer a bargain at current levels. We’re also reiterating our opinion that the iPhone is far from dead — read our most recent take here. Specifically, we added 11 shares to our Dividend Growth portfolio at $442.16 per share for a 4%-5% position.

We started a new position in the ‘Monthly Dividend Company‘, Realty Income (O), in the portfolio of our Dividend Growth Newsletter. We’re expecting ongoing increases to the dividend in coming periods, and its shares have recently fallen to a relatively attractive entry point. In fact, the company just raised its dividend late last month. We opened a position of 60 shares at roughly $44.35, or about a 2%-3% position. The shares may still fall a bit in coming periods, and in that case, we’ll be looking to add to this initial position at potentially lower prices (but only on technical stability/improvement).

May 23, 2013

We sold our full positions in ConocoPhillips (COP), Republic Services (RSG), and Superior Industries (SUP).

ConocoPhillips’ cash-flow position has become more and more onerous in recent quarters (click here), and the company now posts poor scores for both dividend safety and dividend growth. We think it’s a good time for us to head to the exit, as shares are now trading at the high end of our fair value estimate range (further, it registers but a 3 on our Valuentum Buying Index). We plan to sell our full position at $62.81 per share (an excellent gain since our cost basis includes our full position in Phillips 66 (PSX), which has been a huge winner for us).

We’ve been patient with garbage-hauler Republic Services, and it has paid off greatly. Though the firm has had a variety of fundamental hiccups in the past number of months, not over-reacting to potential poor cash-flow news has allowed us to turn this investment into a big winner. We think being tactical in our trades–not rushing to sell when a fundamental driver turns sour–has been a large driver of the strong performance of our portfolio. Republic is now trading above our estimate of its intrinsic value, and its Valuentum Dividend Cushion score is not as strong as it once was (when we first added it to the portfolio). We plan to sell our full position at $34.81 per share.

Superior hasn’t been as strong a performer for us as we would have liked, though we are still up nicely above our cost basis. However, the firm’s decision to accelerate 2013 dividend payments into 2012 has left us at odds. We like its valuation upside potential, but we think there are better income opportunities out there. We plan to sell our full position at $17.67 per share.

For previous trades, please view the inaugural edition of our Dividend Growth Newsletter here.