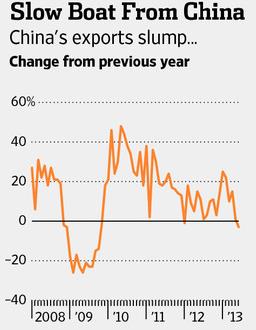

Yet another bearish story came out of China Wednesday morning, this time dealing with negative trade data (shown right). Exports for the month of June dropped 3.1% year-over-year versus a consensus expectation of 4% growth. This compares to anemic 1% growth in May. Imports also fell 0.7% year-over-year compared to a consensus expectation of 8%. Without question, we think it’s safe to say growth slowed in China during May and June. (Image Source: The Wall Street Journal).

Yet another bearish story came out of China Wednesday morning, this time dealing with negative trade data (shown right). Exports for the month of June dropped 3.1% year-over-year versus a consensus expectation of 4% growth. This compares to anemic 1% growth in May. Imports also fell 0.7% year-over-year compared to a consensus expectation of 8%. Without question, we think it’s safe to say growth slowed in China during May and June. (Image Source: The Wall Street Journal).

Though these figures were decidedly bearish regarding the health of economic activity in China, Alcoa (click ticker for report: ) provided bullish commentary on the region just yesterday. In fact, management at Alcoa believes China will drive the lion’s share of global growth in several areas, including automotive, commercial building and construction, and heavy trucks and machinery. Given the barrage of negative news flow we’ve seen out of the country during the past month, Alcoa seems to be a bit too bullish on the country’s near-term economic prospects. With exports and imports dropping, contractionary PMI figures, and a well-articulated position from the Chinese government that it will tolerate lower growth, Alcoa’s outlook appears overly optimistic.

However, we must remember one of the biggest issues from China—data accuracy. For years, some have speculated that China blatantly inflates its GDP numbers, and we’ve seen several Chinese companies forge results in recent years— click here for more info. Though current economic expansion in China clearly appears to be slowing, we leave open the possibility that previously reported growth rates may have been artificially inflated (in other words, the “real” slowdown may not be as bad as it seems from the outside). We also note that the slowdown in exports in China may likely have benefited other export centers in Southeast Asia and Latin America that may have comparatively lower total labor costs. By extension, we acknowledge that a slowdown in exports in the country may hurt China more than it hurts the global economy.

On the employment side, the Chinese government claims there are 107 job openings for every 100 job seekers, suggesting the labor market in the country hasn’t deteriorated much during the year (was 110/100 in Q1). Premier Li Keqiang also indicated that China will avoid any stimulus until unemployment is too high or growth is too slow, so we do not expect massive government spending to ratchet GDP growth up to 8%-9% any time soon (as we had previously indicated).

Valuentum’s Take

When it comes to evaluating China, we like to put the most weight on actual company data that may be more accurate than data issued from the Chinese government. Yet, when the Chinese government reports weak data consistent with private economic reports and negative earnings reports from China-focused companies such as Nike (click ticker for report: ), we start to get a bit more worried.

Chinese growth is a highly-important driver of the global economy, and we will continue to keep a watchful eye to see if additional deceleration in economic growth occurs in the country. In any case, we don’t plan to add any firms with significant dependence on China to the portfolio of our Best Ideas Newsletter at this time.

Related Companies: Vale (VALE), Rio Tinto (RIO), BHP (BHP), Yum! Brands (YUM)

Related ETFs: FTSE China 25 Index Fund (FXI), Australian Dollar Trust (FXA)