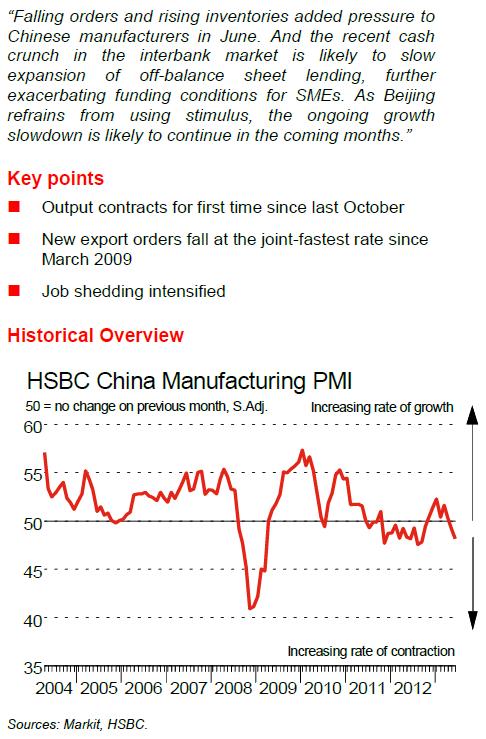

Earlier this week, the HSBC China Manufacturing PMI was released for the month of June, coming in at 48.2—marginally below the flash PMI of 48.3 we saw earlier in the month (and signaling further contraction).

Image Source: Markit, HSBC

It seems as though the economic decline in China is worsening, with HSBC noting that job-cutting intensified during the month, registering the most job losses since the Great Recession in 2009. We continue to see several structural issues with the nation, including potential excesses in the “shadow banking system” and increasing labor costs that could make the country a relatively less attractive market for global manufacturers. The cost of Chinese real estate remains in nosebleed territory, perhaps foreshadowing signs (or symptons) of the large credit bubble. The price-to-wage ratio, shown below, reveals that housing prices in Beijing are more than 3 times more expensive than those in New York, considering consumer earnings power (disposable incomes). In Shenzhen and Shanghai, housing prices are more than twice those in New York, by the same measure.

Image Source: Sober Look, Credit Suisse

Nike (click ticker for report: ) perhaps provided one of the more recent data points on the health of the Chinese consumer. Late last week, the firm reported weak results in China for its fourth quarter, and its future order growth in the country also looked poor. We think the average Chinese consumer is starting to hurt a bit, and companies with significant exposure to the country will likely be harmed.

See: “China Trouble: Plenty of Pain to Go Around”

Valuentum’s Take

Nearly every metric we receive about the economic trejectory of China is starting to look relatively bearish. We have no interest in any firm that is completely dependent on the emerging nation for revenue and earnings expansion. We continue to hold a put option on the broader market in the portfolio of our Best Ideas Newsletter.

Related Companies: Vale (VALE), Rio Tinto (RIO), BHP (BHP), Yum! Brands (YUM)

Related ETFs: FTSE China 25 Index Fund (FXI), Australian Dollar Trust (FXA)