On Friday, BMO Capital cut its dividend outlook for Cliffs Natural Resources (click ticker for report: ). The iron and coal producer currently yields in excess of 8% at current levels, but we’ve long thought its yield was unsustainable.

On Friday, BMO Capital cut its dividend outlook for Cliffs Natural Resources (click ticker for report: ). The iron and coal producer currently yields in excess of 8% at current levels, but we’ve long thought its yield was unsustainable.

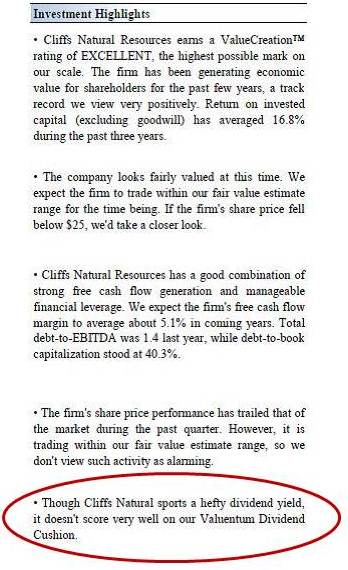

In our 16-page report on the firm, our investment highlights section includes (see image to the right) that the firm’s dividend doesn’t score very well on the Valuentum Dividend Cushion. We encourage readers that are focused on dividend income to use the Valuentum Dividend Cushion to better safeguard their income portfolio against a potentially devastating dividend cut.

Unfortunately, accidental high yielders always seem like a great bargain, but we’ve seen that’s rarely the case. The Valuentum Dividend Cushion has recently predicted cuts at Roundy’s (click ticker for report: ), SuperValu (click ticker for report: ) and JC Penney’s (click ticker for report: ) well in advance, and we think Cliffs will follow suit if current trends persist and access to additional capital is limited. The market demand for the firm’s products has been weak, and lower demand from China over the long-term has escalated fears that iron ore pricing will fall even more.

Resource companies are particularly vulnerable to cyclical demand, and we predict lower mid-cycle earnings for many of the mining firms in our coverage universe (than in previous cycles). Returning cash to shareholders seems like a great idea when commodity markets are hot, but we think firms tend to overestimate how long the boom will last.

Though we don’t think shares of the resource firm are overvalued, we’re not rushing to add the firm to the portfolio of our Dividend Growth Newsletter. Please see ‘why we think dividend growth investing needs to be forward looking‘ on how assessing the future safety of a firm’s dividend can spare investors from unnecessary capital losses.