By Brian Nelson, CFA

Visa Inc. (V) has probably the best business model in our coverage universe. The company benefits from a network effect, acts as a toll-road operator collecting fees every time one of its cards is swiped, and the credit card giant puts up huge operating and free cash flow margins. Visa is a top “weighting” in the portfolio of the Best Ideas Newsletter, and we don’t see that changing anytime soon. The high end of our fair value estimate range for Visa stands at ~$259 per share.

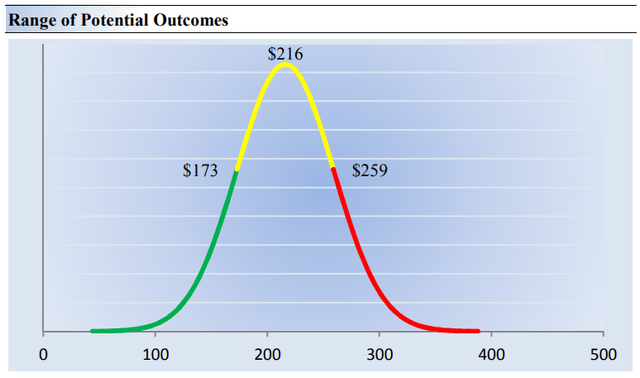

Image: Our estimate of Visa’s range of fair value estimate outcomes. Image Source: Valuentum

Our discounted cash flow process values each company in our coverage on the basis of the present value of all future expected free cash flows. Though we estimate Visa’s fair value at about $216 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Visa. We think the firm is attractive below $173 per share (the green line), but quite expensive above $259 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. We think Visa’s shares could run to the high end of the fair value estimate range.

The credit card company’s second-quarter fiscal 2023 results released April 25 were enough to support our continued positive take on the moaty entity, as it beat the consensus estimate on both the top and bottom line. During its quarter ending March 31, 2023, net revenues advanced 11%, while GAAP earnings per share leapt 20%, to $2.03 per share. Payments volume advanced 10% in the quarter on a year-over-year basis, while total cross-border volume increased 24%. Processed transactions advanced 12% in the quarter from the same period a year ago.

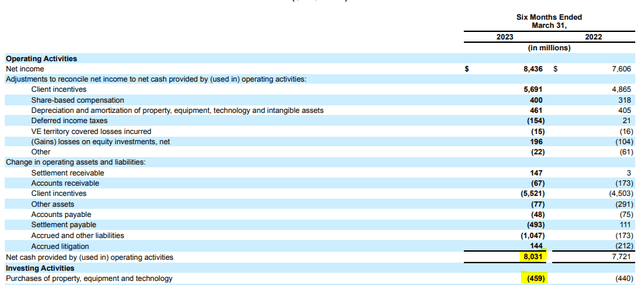

Image: Visa’s operating cash flow of $8 billion, and free cash flow of ~$7.5 billion through the first half of its fiscal 2023 is remarkable. Image Source: Visa

Visa’s growth rates continue to be impressive, and its free cash flow generation remains remarkable. Operating cash flow has come in at $8 billion during the first six months of the year, while the company shelled out ~$460 million in capital spending, good for free cash flow generation of ~$7.5 billion and a free cash flow margin of 47.5%. Very few other companies have this kind of free cash flow margin, and we look forward to a strong back half to Visa’s fiscal 2023.

———-

Tickerized for V, AXP, DFS, COF.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.