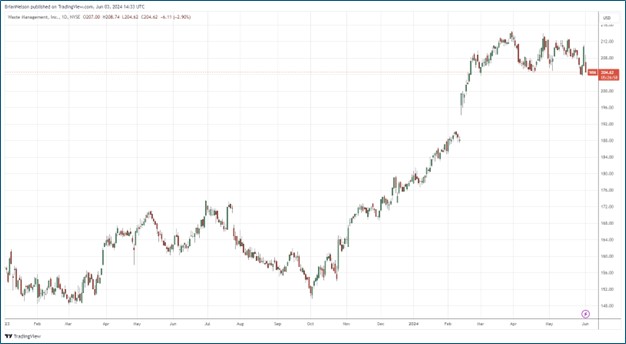

Image: Waste Management’s shares have done quite well the past 12-18 months.

By Brian Nelson, CFA

On June 3, Waste Management (WM) confirmed a prior report from the Wall Street Journal that it would acquire medical waste services company Stericycle (SRCL). The news comes a week or so after Stericycle said it was exploring a sale of the company. Waste Management will acquire Stericycle for $62 per share in cash, or for an enterprise value of ~$7.2 billion after considering Stericycle’s net debt. The agreed-upon price represents a ~24% premium to the company’s 60-day volume weighted average price as of May 23, 2024, or the last trading day before the report that made public Stericycle was up for sale.

There are a lot of reasons to like the deal. For starters, the tie-up will bolster Waste Management’s position in the growing healthcare market, while providing customers with greater options to partner with a single service provider with a larger suite of environmental solutions. Management also believes that its logistics and cost optimization efforts will facilitate more than $125 million in projected annual synergies, resulting in a post-synergy transaction multiple that is below Waste Management’s current multiple. The deal is expected to be accretive to Waste Management’s earnings and cash flow within one year of close, too.

The oligopolistic nature of the waste business is something that we like a lot, and while Waste Management’s deal for Stericycle will be more complementary in nature bringing in an incremental suite of medical waste and secure information destruction services, we have no qualms with the acquisition. Once the deal closes as early as the fourth quarter of 2024, Waste Management expects its net debt-to-EBITDA ratio to be ~3.4x, but it will pause share repurchases to help in its goal to achieve a targeted net debt-to-EBITDA ratio in the range of 2.75-3.0x roughly 18 months after the acquisition’s close. We like Waste Management, but our favorite idea in the waste space is Republic Services (RSG).

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.