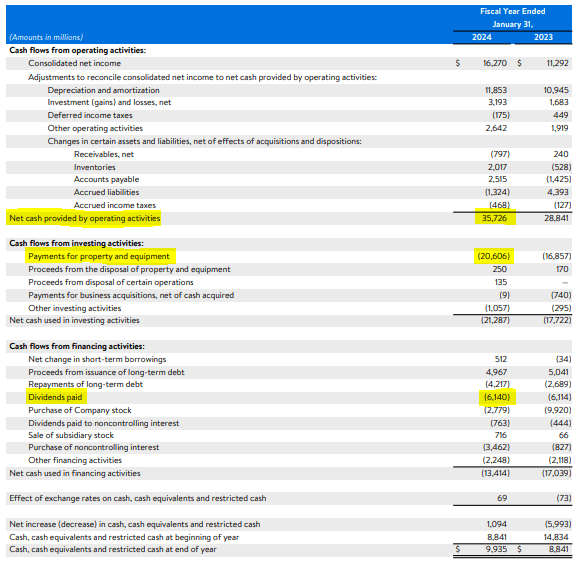

Image: Walmart’s free cash flow generation during fiscal 2024 was superb and comfortably covers its cash dividends paid.

By Brian Nelson, CFA

On February 20, Walmart (WMT) reported excellent fourth quarter fiscal 2024 results, raised its dividend, and announced that it would acquire Vizio (VZIO) in a $2.3 billion all-cash deal. Walmart continues to be well-positioned in the current retailing environment after the step-change in prices over the past 12-18 months due to heightened levels of inflation, as consumers trade down to lower-priced value items. Shares of Walmart advanced followed the release of its report, and while they are trading above our fair value estimate at the time of this writing, we see upside to the high end of our fair value estimate range. The company’s Dividend Cushion ratio stands at 2.5x, implying a very healthy dividend poised for further expansion.

During its fourth quarter, Walmart’s consolidated revenue increased 5.7% thanks in part to better-than-expected comparable store sales growth in the U.S. (+4%) led by strong transactions growth (+4.3%), offset in part by weaker average ticket (-0.3%). The company’s e-commerce business grew 23% across the globe, and now surpasses $100 billion in annualized revenue. Its global advertising business advanced ~33% in the period, and the company announced that it had agreed to buy Vizio to bolster Walmart Connect, the company’s advertising platform that offers businesses the ability to reach Walmart’s vast customer base. Impressively, Walmart’s consolidated adjusted operating income advanced 13.2% in the quarter, a solid pace for such a behemoth as Walmart. Adjusted earnings per share increased to $1.80 from $1.71 in the quarter from the prior-year period.

Walmart continues to be a fantastic free cash flow generator. For fiscal 2024, operating cash flow came in at $35.7 billion, up $6.9 billion from last fiscal year, and the company hauled in free cash flow of $15.1 billion, up $3.1 billion on a year-over-year basis. Cash dividends during the fiscal year were $6.14 billion, so Walmart has very nice free cash flow coverage of the payout. Inventories also fell $1.7 billion, to ~$54.9 billion at the end of the fiscal year. Walmart ended the fiscal year with $46.9 billion in total debt and $9.9 billion in cash and cash equivalents. Looking to fiscal 2025, Walmart is targeting net sales growth in the range of 3%-4% and consolidated operating income growth of 4%-6%. For fiscal 2025, adjusted EPS is expected in the range of $6.70-$7.12 on a pre-split basis ($2.23-$2.37 on a post-split basis), and Walmart upped its annualized dividend payout ~9% for fiscal 2025, to $2.49 on a pre-split basis ($0.83 per share on a post-split basis).

All things considered, Walmart is doing a fantastic job executing on its value proposition, and the company is in a sweet spot with respect to consumer trends given the step change in prices the past few years that is causing consumers to trade down to value offerings. The firm’s comp sales are coming in better than expected, and its free cash flow generation remains well in excess of its cash dividends paid, providing ample support for further dividend hikes. Walmart will execute a 3-for-1 stock split on February 23 and will begin trading on a post-split basis February 26. Though Walmart retains a massive net debt position, perhaps its only drawback from a financial standpoint, the company is a fantastic dividend grower and perhaps one of the best considerations within the retail space these days. Shares yield ~1.4% at the time of this writing.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for WMT, VZIO, TGT, DG, DLTR, FIVE, COST, OLLI, CAG, CPB, FARM, MAMA, GIS, SJM, KHC, KLG, KR, NGVC, SFM, SPTN, USFD

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.