Image Shown: Shares of Walmart Inc dropped sharply during afterhours trading on July 25 as the retailer sharply cut its adjusted operating income and EPS guidance for the current fiscal year as inflationary pressures are taking a sizable toll on its bottom-line.

By Callum Turcan

On July 25, Walmart Inc (WMT) issued a business update that saw the retailer sharply cut its adjusted operating income and EPS guidance for fiscal 2023 (period ended January 2023), while boosting its consolidated net sales guidance. The company also adjusted its guidance for the fiscal second quarter. Shares of WMT plummeted during afterhours trading on July 25 as investors began to price in concerns over the retailer’s deteriorating margins.

We anticipated ongoing weakness in Walmart’s business. On July 4, we released an audio report, “Nelson: I Have Been Wrong About the Prospect of Near-Term Inflationary-Driven Earnings Tailwinds,” highlighting our growing concerns about consumer-tied entities in the consumer staples and consumer discretionary spaces. We continue to expect troubles at the big box retailers and across the apparel space, more generally. Here’s what Nelson had to say in early July that remains applicable today:

I simply was not expecting the magnitude of such operating-income drops across consumer-tied companies, and while I think long-term inflation will eventually help drive higher nominal earnings in the longer run when conditions reach “normalization” again, the lag will be much longer than I originally thought. The numbers out of Walmart, Target, and Nike, for example, speak not only to tremendous earnings weakness, but also to the prospect of economic recession in the U.S.

A recession in the U.S. is no reason for panic, however. For starters, we believe most of the fundamental weakness across retail is baked into the stock market, but more generally, investors should not worry about recessionary trends. But why? Well, implicitly embedded within a fair value estimate of a company are expectations of a “normal” economic cycle, complete with peak and trough, with the fair value estimate driven largely by mid-cycle expectations that feed into later stages of the model.

The prospects for an unexpected recession in economic activity in the near term shouldn’t cause much of a change in the fair value estimate of a company either, given not only that a recession is already implicitly embedded in the fair value estimate, as noted, but also that near-term expectations don’t account for nearly as large of a contribution to the fair value estimate as long-term normalized expectations within the valuation construct. Most of a company’s intrinsic value is driven by its performance beyond year 5 in our model, or on a mid-cycle, going-concern basis. A company’s fair value estimate range (margin of safety) also captures various scenarios regarding economic activity, including a bull and bear case.

With that said, recessionary tendencies may cause pricing impacts in the market in the event that consumers/investors use the stock market as a source of income by selling stocks, causing pressure on share prices, but the discounted cash flow (DCF) model already bakes in economic cyclicality and inevitable recessions, if not directly, then implicitly by targeting long-term mid-cycle expectations and via the application of the fair value estimate range. That’s why it’s great to be a long-term investor, scooping shares up when others are forced to sell in the near term, while holding them over long periods, letting compounding work its magic.

Walmart’s Guidance Update

It has become clear that inflationary pressures are taking a toll on Walmart’s bottom line even though its top-line performance is holding up reasonably well. For reference, Walmart’s GAAP revenues and GAAP operating income were up 2% and down 23% year-over-year, respectively, in the first quarter of this fiscal year (period ended April 2022).

Comparable store sales at Walmart US were up 3%, comparable store sales at Sam’s Club were up 10%, and comparable store sales (adjusted for divestment activities) at its international operations were up across the board on a year-over-year basis in the fiscal first quarter.

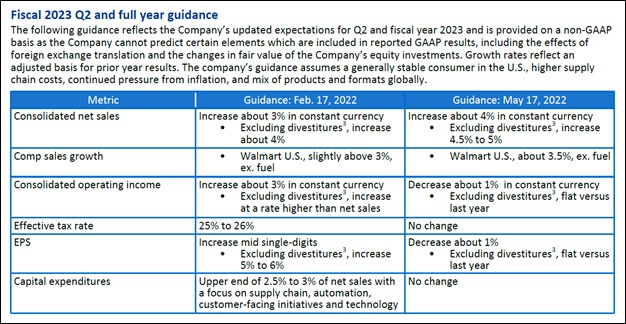

The upcoming graphic down below highlights Walmart’s guidance for fiscal 2023 as of May 2022. Please note that during its fiscal first quarter earnings update, Walmart cut its operating income and EPS guidance while boosting its comparable store sales and consolidated net sales forecasts versus expectations laid out in February 2022.

Image Shown: A look at Walmart’s guidance for fiscal 2023 as of May 2022. Image Source: Walmart – First Quarter of Fiscal 2023 Earnings Press Release

As noted previously, Walmart further reduced its consolidated operating income and EPS guidance for fiscal 2023 while boosting its consolidated net sales growth guidance during its July 2022 update.

Walmart’s press release noted that “excluding divestitures, consolidated net sales growth for the full year is expected to be about 5.5%” which represents a nice boost versus its previous forecast calling for 4.5%-5.0% growth when excluding divestments. The retailer maintained its comparable store sales growth guidance of ~3% for the second half of fiscal 2023 as it concerns the performance of Walmart US (for the fiscal second quarter, Walmart US is expected to post ~6% comparable store sales growth, up from previous estimates). Foreign currency movements are expected to represent a ~$1 billion headwind in the fiscal second quarter and a $1.8 billion headwind during the second half of fiscal 2023 as it concerns Walmart’s forecasted consolidated net sales performance.

However, Walmart also noted that “excluding divestitures, operating income for the full year is expected to decline 10 to 12%” and that “excluding divestitures, adjusted earnings per sharefor the full year is expected to decline 10 to 12%.” Previously, Walmart was guiding for its non-GAAP adjusted operating income and EPS to be broadly flat this fiscal year versus fiscal 2022 levels.

Within the July 2022 press release, Walmart noted that its latest guidance changes were “primarily due to pricing actions aimed to improve inventory levels at Walmart and Sam’s Club in the U.S. and mix of sales.” The retailer’s consumers are purchasing greater amounts of low margin consumables (such as food products) and smaller amounts of higher margin hardlines which is having a major impact on Walmart’s bottom-line. Compounding these pressures is the need to move inventory at a faster pace via significant pricing markdowns, particularly for inventories of apparel products at its Walmart US operations.

The retailer’s President and CEO Doug McMillon noted that (emphasis added):

“The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars. We’re now anticipating more pressure on general merchandise in the back half; however, we’re encouraged by the start we’re seeing on school supplies in Walmart U.S.”

As rising food and fuel expenses (consumer staples products) eat into the disposable incomes of the core Walmart U.S. shopper, Walmart’s ability to sell those consumers discretionary products is deteriorating. Walmart now forecasts its operating margin will come in at ~4.2% in the second quarter of fiscal 2023 and ~3.8%-3.9% for all of fiscal 2023. For reference, Walmart’s GAAP operating margin stood at 5.2% in the second quarter of fiscal 2022 and 4.5% in fiscal 2022. Its deteriorating operating margin outlook has seen shares of WMT move towards the lower end of our fair value estimate range.

Concluding Thoughts

Walmart’s outlook is contending with some sizable headwinds, and shares of WMT have sold off accordingly. The Dividend Aristocrat remains a solid free cash flow generator, though its ability to navigate major exogenous shocks is limited given its large net debt load, sizable capital expenditure obligations, and hefty annual dividend obligations. In early August, Walmart will provide investors with another update on its operations and outlook when it reports its fiscal second quarter earnings. As of this writing, shares of WMT yield ~1.7% and we expect the retailer will do whatever it takes to maintain that payout going forward.

Recently, we replaced the Vanguard Consumer Staples Index Fund ETF (VDC) in the High Yield Dividend Newsletter portfolio with the refiner Phillips 66 (PSX) and covered our thoughts on the switch in a June 2022 article (link here). We like downstream operators (companies that run refineries and petrochemical plants) in the current economic environment. Refineries in particular are benefiting from the “juicy” crack spreads (refining margins) seen of late and are well-positioned to navigate inflationary pressures going forward, given their ability to pass on cost input increases to consumers with relative ease. In the wake of Walmart’s latest business update, we see our latest High Yield Dividend Newsletter portfolio change as a prudent move.

—–

Recession Resistant Industry – BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT, CHD, SYY, ADM, LANC, CASY

Tickerized for WMT, TGT, AMZN, VDC, and various apparel stocks.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, and V. Phillips 66 (PSX) and Philip Morris International Inc (PM) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.