Vodafone’s Dividend Cut, Alibaba’s Resilience, More Reports

In alphabetical order by company name: A, BABA, PLCE, GES, M, NSANY, RL, TLRY, VOD

—

Good morning,

—

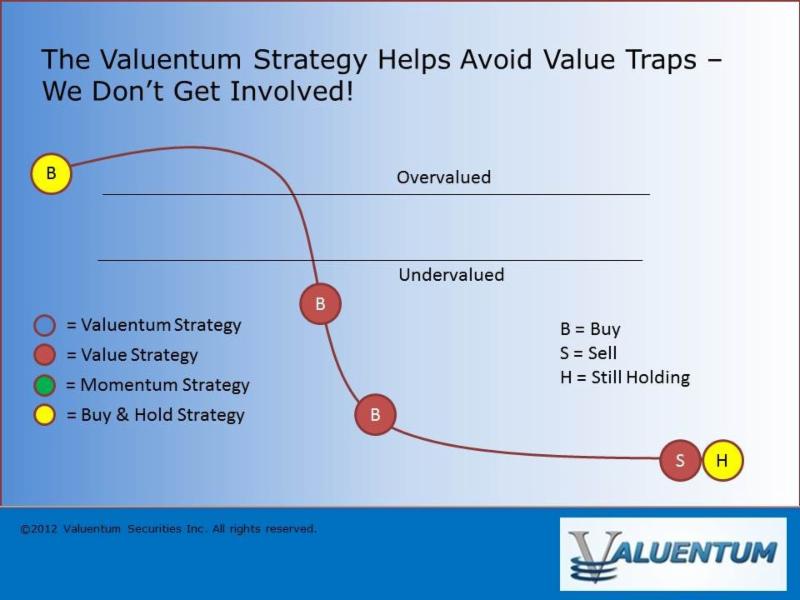

Still buying stocks immediately as they fall and on the way down? There may be no logical basis for doing so. Here’s an excerpt from Value Trap: Theory of Universal Valuation.

—

Image: Excerpt from Value Trap, page 241

—

Order your copy here.

—

The market must eventually agree with you for your idea to work out, so why not wait until the stock starts to move higher first. Waiting a few weeks or a few months/quarters to see if the stock eventually settles and technical/momentum indicators start to improve is vital in helping to avoid value traps, in our view.

—

That’s why we not only like stocks that are undervalued on an enterprise (discounted cash flow) valuation and relative value basis, but also ones that are starting to go up in price (their technical/momentum indicators have started to improve). It just makes sense. Don’t fall for the behavioral fallacy FOMO (fear of missing out). Control your emotions and exercise discipline.

—

—

Now on to important news!

—

———-

—

Agilent (A): Life sciences, diagnostics and applied chemicals company Agilent let shareholders down when it reported second-quarter fiscal 2019 results May 14. Revenue advanced 3% in the period (4% core), and non-GAAP net income of $0.71 was 9% better than last year’s mark. However, Agilent lowered its full-year revenue growth expectations to the range of $5.085-$5.125 billion (was $5.15-$5.19 billion) on account of weakness in the “pharma and food markets” within its Life Sciences and Applied Markets Group. Non-GAAP earnings per share guidance of $3.03-$3.07 for fiscal 2019 was unchanged, so the market is overreacting a bit to the negative top-line revision, in our view. Shares still look fairly valued. View Agilent’s stock page >>

—

Alibaba (BABA): Internet-based Chinese equities are holding up quite well, including JD.com (JD), despite the US-China trade tremors. Alibaba’s fourth-quarter fiscal 2019 results, released May 15, were no exception. During the March quarter, revenue advanced more than 50%, while annual active consumers on its China retail marketplaces reached 654 million, up 18 million from the 12-month period ending December. Adjusted EBITDA didn’t increase quite as rapidly as revenue, but a 29% jump is still quite remarkable in light of global trade tensions and the costs to maintain the pace of top-line expansion. Non-GAAP free cash flow came in at RMB10,714 million (US$1.6 billion). We liked the quarter. We value shares of Alibaba north of $200 each, implying meaningful upside. Alibaba’s stock page >>

—

Children’s Place (PLCE): One of the largest pure-play children’s specialty retailers, Children’s Place put up decent first-quarter 2019 results May 15, with beats on both the top and bottom lines. However, net sales declined 5.5%, primarily driven by a comparable sales decrease of 4.6%. Management noted that “Q1 results significantly exceeded expectations,” and it raised its 2019 adjusted earnings per share guidance to the range of $5.75-$6.25 (was $5.25-$5.75). However, demographic trends may start to work against Children’s Place in the coming years, as 2018 marked the lowest number of babies born since 1986 and the fourth consecutive year of declines. Not only this, but competition from Carter’s (CRI) remains severe in this area, and liquidating rivals Gymboree and Crazy 8 won’t be helping margins much anytime soon. We don’t like the space. Shares of Children’s Place look fairly valued to us. View Children’s Place’s stock page >>

—

Guess (GES): Similar to the children’s specialty retailers, the teen retailers are no easier investments to consider. Making matters worse is that the market is not giving many of them credit for their balance sheet health, and as a result, bidding shares down to the point where management sees little reason to preserve an outsize payout. This is what happened to Guess in late April, where the company cut its dividend, despite a net cash position of ~$175 million. Annualized cash dividends had been ~$75 million, so it had two full years of dividend coverage just sitting on the balance sheet. Management cut the payout nonetheless. Let this be a warning to holders of Abercrombie & Fitch (ANF) and Children’s Place. No dividends may be safe in teen or specialty children’s retail. We plan to take a look at our Guess model, but don’t expect material changes to the fair value estimate at this time. Guess’ stock page >>

—

Macy’s (M): We’ll never include a department store in any newsletter portfolio, but we’re paying very close attention to the group as their underlying resilience has implication across all of mall retail as well as the retail and mall REIT space (VNQ). Macy’s is a situation where the Dividend Cushion ratio is saying that its dividend is not sustainable, meaning the company’s near-7% dividend yield should be looked up skeptically. That said, Macy’s first-quarter 2019 results, released May 15, weren’t terrible as comparable store sales growth advanced modestly (0.6% on an owned basis) for the sixth consecutive quarter. However, secular trends are working heavily against the department store, and big box clothing retail is merely delaying the inevitable, in our view. Macy’s holds a large net debt position, too. We expect to lower our fair value estimate, and new lows are more likely than new highs at Macy’s. View Macy’s stock page >>

—

Nissan (NSANY): Nissan has been in the news lately, and for all the wrong reasons. Former Nissan Chairman Carlos Ghosn is being investigated for financial misconduct, and fiscal 2019 performance, released May 14 was nothing short of ugly. During the year, revenue fell 3.2%, operating profit dropped 44.6%, operating margins were hurt by 2.1 percentage points, all translating into a net income decline of more than 57%. Nissan is struggling with what it describes as “an unfavorable global business climate” and “costs due to its initiatives to improve quality of sales in the US.” In the US, Nissan’s unit sales fell by 9.3% during the year. That said, management is expecting to sell 5.54 million global units in fiscal 2020 (ends in March), up modestly from the 5.516 million units it sold in fiscal 2019. Net revenue, operating profit, and net income are all expected to be down year-over-year, however. We continue to prefer General Motors (GM) as our idea in the automaking space. View Nissan’s stock page >>

—

Ralph Lauren (RL): Our fair value estimate of $124 per share will remain largely unchanged after Ralph Lauren’s fourth-quarter fiscal 2019 results, released May 14. The premium lifestyle retailer beat on both the top and bottom lines, though total revenue still faced pressure. Comparable store sales in North America fell 4% in the period led by a 7% decline in comp sales at brick-and-mortal stores. Management blamed the Easter holiday, but the holiday didn’t seem to impact same-store-sales growth in Europe, where they advanced 5% on a constant-currency basis. Ralph Lauren ended fiscal 2019 with a solid net cash position north of $1.3 billion, and its outlook for fiscal 2020 was rosy calling for net revenue to advance 2%-3% and operating margins to increase 40-60 basis points, both targets on a constant-currency basis. Ralph Lauren has a fantastic Dividend Cushion ratio and a solid dividend yield to boot (2.4%). View Ralph Lauren’s stock page >>

Categories Member Articles