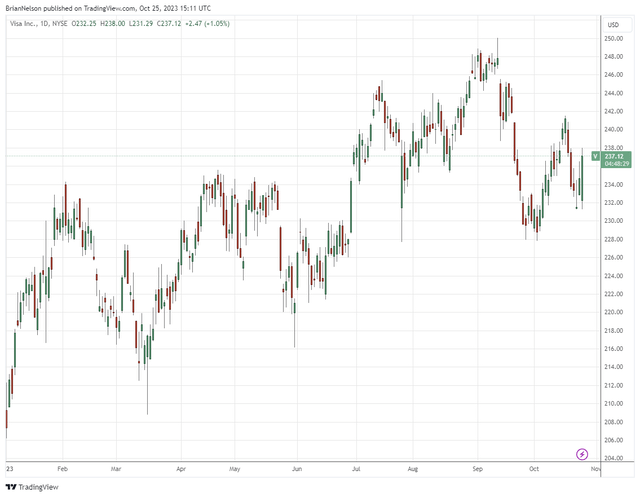

Image: Visa has been a strong performer thus far in 2023.

By Brian Nelson, CFA

On October 24, Best Ideas Newsletter portfolio holding Visa (V) reported excellent fourth-quarter results for its fiscal 2023. Net revenues advanced 11% on a year-over-year basis, while non-GAAP net income and non-GAAP earnings per share leapt 18% and 21% year-over-year, respectively, in the period. For the fiscal year, Visa generated an impressive 64.4% operating margin. Payments volume increased 9% and cross-border volume advanced 16%, showcasing that the consumer remains very healthy thanks in part to low unemployment rates, despite concerns over higher mortgage costs, student loan repayments, and general economic uncertainty as savings accrued during the COVID-19 pandemic wane. We continue to be big fans of Visa as our top payments-related idea.

Here is what CEO Ryan McInerney had to say about the performance in the press release:

We finished our fiscal year with strong fourth quarter performance, as net revenues grew 11% and GAAP EPS grew 22%. Throughout the year, we have seen resilient consumer spending, ongoing recovery of cross-border travel spend versus 2019 and continued growth across our new flows and value added services businesses. As we enter a new fiscal year, I am confident in our ability to deliver against a backdrop of geopolitical and economic uncertainty. There is tremendous opportunity ahead and I am as optimistic as ever about Visa’s role in the future of payments.

Looking ahead to its fiscal 2024, on a non-GAAP nominal-dollar basis, Visa is targeting annual net revenue expansion in the range of high single-digit to low double-digit growth with high single-digit annual operating expense growth, a combination that is expected to drive an annual diluted earnings per share increase in the low-teens range. In conjunction with the strong fiscal fourth-quarter report, Visa also raised its dividend 16%, to $2.08 per share on an annualized basis, and gave the thumbs up on a new $25 billion share buyback program. Visa ended its fiscal year with roughly a net-neutral balance sheet and generated ~$19.7 billion in free cash flow during the fiscal year.

Though Visa’s forward estimated dividend yield of ~0.9% remains paltry compared to that of the average of the S&P 500 (even after the strong dividend hike), we like the company’s competitively-advanced, high-margin business and think the company best fits as one of our top capital-appreciation ideas for consideration, rather than a pure dividend growth play. Visa is now trading roughly in-line with our fair value estimate following its quarterly report, but we could see shares run to the high end of our fair value estimate range of $283 per share.

Please select the image below to download its 16-page stock report.