Image Source: Visa

By Brian Nelson, CFA

On January 30, Visa (V) reported strong fiscal first quarter results with revenue and non-GAAP earnings per share coming in ahead of the consensus forecasts. Net revenue increased 10% (up 11% on a constant-dollar basis), while non-GAAP net income increased 11% and non-GAAP earnings per share jumped 14% on a year-over-year basis. During the fiscal first quarter, payments volume increased 9%, total cross-border volume increased 16%, while processed transactions advanced 11%.

Management spoke positively in the press release:

Visa’s strong first-quarter results reflected healthy spending during the holiday season and improving trends in payments volume, cross-border volume, and processed transactions growth. We delivered 10% net revenue growth, 8% GAAP EPS growth and 14% non-GAAP EPS growth. As we continue through 2025, we remain focused on serving our clients and innovating across our three growth levers – consumer payments, new flows and value-added services.

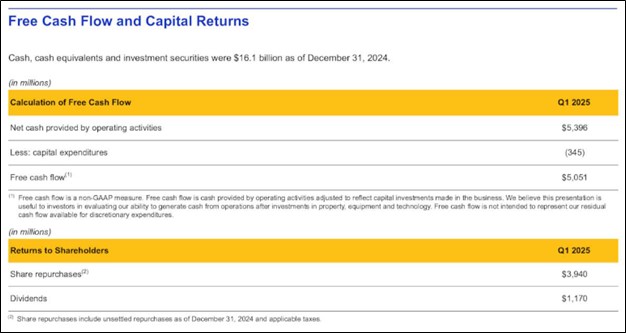

Visa’s cash and investment securities were $16.1 billion at the end of the calendar year versus short-and long-term debt of $20.6 billion. For the three months ended December 31, operating cash flow was $5.4 billion, up from $3.6 billion in the year ago period. Capital spending came in at $345 million in the quarter, with the firm hauling in free cash flow of $5.05 billion, revealing a free cash flow margin of 53%. Looking to full year 2025, management is targeting low double-digit growth in net revenue and low-teens earnings per share growth. We continue to like Visa as a top weighting in the Best Ideas Newsletter portfolio. The high end of our fair value estimate range stands at $365 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.