Image Shown: Shares of Visa Inc have shot upwards over the past year and we continue to like the name as a top holding in our Best Ideas Newsletter portfolio.

By Callum Turcan

One of our favorite companies out there is Visa Inc (V). The company generates robust free cash flows, its outlook is supported by powerful secular growth tailwinds, the firm doesn’t take on credit risk as it doesn’t issue out credit cards (making Visa a “pure play” on the shift from cash to card around the world), and generally speaking, the company has been very shareholder friendly. We continue to like Visa as a top holding in our Best Ideas Newsletter portfolio, a position it has been for some time now.

Solid Financials

During its fiscal 2019 (period ended September 30, 2019), Visa spent $8.6 billion repurchasing its Class A common stock, up from $7.2 billion the prior fiscal year. Share buybacks are management’s preferred way of rewarding Visa’s shareholder base, and considering shares of Visa are trading below our fair value estimate of $190 as of this writing, we continue to view buybacks as an effective use of capital. Visa generated $12.8 billion in net operating cash flows in fiscal 2019 while spending just $0.8 billion on capital expenditures, allowing for ~$12.0 billion in free cash flows to fully cover $8.6 billion in share repurchases on top of $2.3 billion in dividend payments.

From fiscal 2018 to fiscal 2019, Visa’s outstanding diluted Class A common stock share count fell from 2,329 million to 2,272 million. That helped Visa generate $5.44 in non-GAAP EPS in fiscal 2019, up 18% from fiscal 2018 levels. On a GAAP basis, Visa reported strong year-over-year EPS growth of 20% in fiscal 2019. Growth was driven by rising payments volume (up 9% year-over-year on a constant currency basis), cross-border volume (up 6% year-over-year on a constant currency basis), and processed transactions (up 11% year-over-year) in fiscal 2019. Reduced non-operating expenses and a lower effective corporate tax rate combined with a smaller share count further enhanced Visa’s EPS growth last fiscal year.

At the end of September 2019, Visa was sitting on $7.8 billion in cash and cash equivalents plus $4.2 billion on investment securities (please note we aren’t including restricted cash here). While Visa had a total debt load of $16.7 billion at the end of this period, its very modest net debt load is quite tame given the strength of its free cash flow profile. Furthermore, please note none of Visa’s debt was maturing within a year as of the end of its fiscal 2019.

Growth Trajectory to Continue

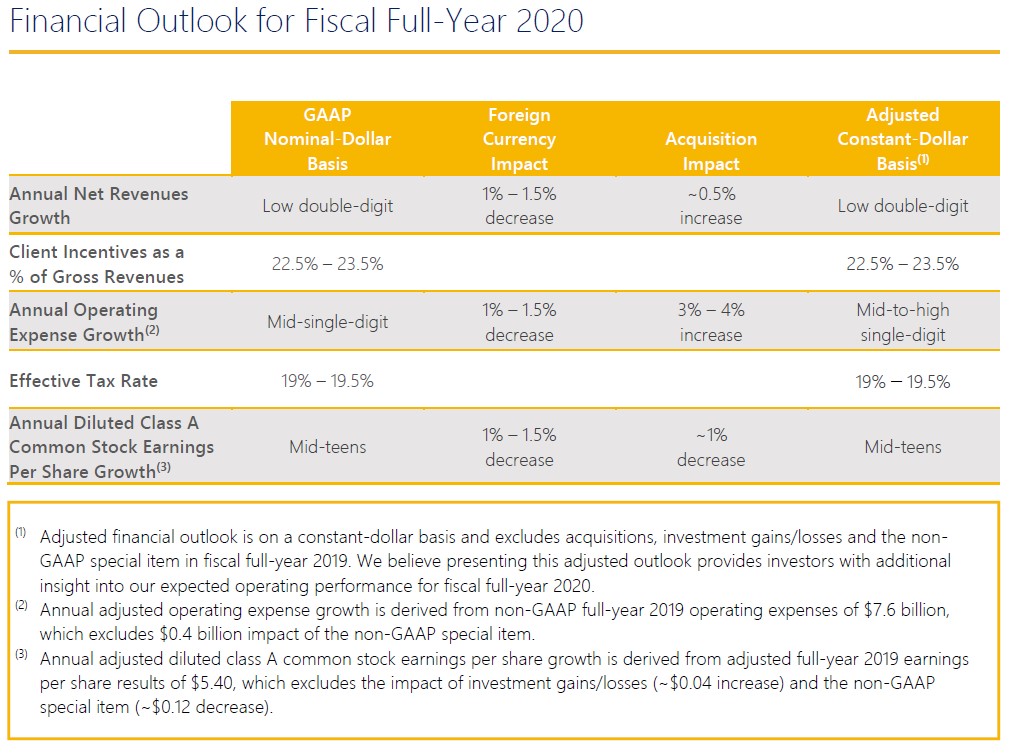

Going forward, Visa is targeting material top-line growth and managed operating expense growth on an annual basis. Adjusted revenue growth is expected in the low double-digit range this fiscal year, while adjusted operating expense growth is expected in the mid-to-high single-digit range. That implies Visa is expecting modest/meaningful adjusted operating margin expansion in fiscal 2020, but we caution that due to elevated renewal activity, client incentives as a percent of gross revenue is expected to increase year-over-year in fiscal 2020.

Elevated renewal activity may cause some volatility in Visa’s near-term financial performance. Normally, Visa renews about 20% of its business partnerships by payment volume each year, but that figure hit closer to 30% in fiscal 2019. While the firm’s near-term financials will come under pressure from rising client incentives as a percentage of gross revenue, please note Visa’s longer term outlook will be augmented by favorable pricing movements for its services (especially positive pricing actions seen in fiscal 2019, and to a lesser extent, expected gains this fiscal year).

Both Visa’s GAAP and non-GAAP adjusted EPS growth is expected in the mid-teens range this fiscal year, but we caution Visa is expecting its effective adjusted corporate income tax rate to grow marginally in fiscal 2020 versus fiscal 2019 levels (Visa’s effective non-GAAP adjusted corporate income tax rate was 18.9% last fiscal year). The upcoming graphic down below provides an overview of Visa’s expectations for fiscal 2020.

Image Shown: Visa is expecting that adjusted top-line growth will exceed adjusted operating expense growth in fiscal 2020, which combined with share buybacks is largely why the company expected to generate mid-teens GAAP/non-GAAP EPS growth this fiscal year. Image Source: Visa – Fourth Quarter Fiscal 2019 Earnings Presentation

Growth is coming from numerous avenues. In Europe, Visa recently (according to its latest quarterly conference call with investors) “renewed two portfolios with leading UK issuers, one in debit and one in commercial credit” while also recently renewing its “strategic partnership” with Banco Bilbao Vizcaya Argentaria SA (BBVA) over the next seven years. Better known as BBVA, the Spanish bank has a large presence in Spain, Portugal, and Turkey with operations all across Europe and elsewhere in the world.

The Spanish bank is making a bigger push into US markets and on November 20, BBVA announced that BBVA USA is launching “its biggest broadcast and digital marketing campaign in a decade” with an eye towards Texas and Alabama. In 2020, BBVA plans to push more aggressively into Arizona, Florida and Colorado. Visa mentioned that its renewed agreement with BBVA will “allow Visa and BBVA to grow much faster during this period” which happens to come at a time when BBVA is expanding in a market Visa knows very well. BBVA USA is also seeking to expand and enhance its small business operations by teaming up with financial tech player Wise, and part of that offering includes a Visa-branded debit card.

Looking now at Turkey, Visa recently announced that it had signed a deal with state-run Ziraat Bank to renew its partnership concerning the bank’s consumer credit and debit business. Furthermore, Visa was happy to announce that the firm had “won new issuance of their [Ziraat Bank’s] commercial credit portfolio” which highlights the ability for Visa to build on its existing relationships to win over new business and ultimately create additional revenue streams. This is another reason why we really like Visa. Here’s some additional thoughts on that issue from Visa’s management team:

“…network of networks, all of these partnerships and capabilities we’ve discussed as well as many others come together in our offering to provide a powerful network of networks for consumers, businesses, and governments to move money to anyone, anywhere. Each new network endpoint, be it a card, an account, or a business, compounds the value of capabilities we offer to partners and improves the customer experience through a single Visa connection.

To close, in 2019 we delivered strong broad-based results and we made great progress positioning the business for future growth. We deepened partnerships. We expanded access with new players. We increased customer engagement and value-added capabilities, and we expanded our acceptance points and our network of networks.”

Shareholder Friendly Strategies to Continue

Looking ahead, Visa expects to keep generously rewarding its shareholder base during its fiscal 2020 as management expects the firm will generate over $12.0 billion in free cash flow this fiscal year (emphasis added):

“Moving on to capital, cash flow, dividends, and buybacks, capital spending in fiscal year 2020 is likely to be around $800 million, up a little over 10%. Based on our earnings outlook and capital spending plan, free cash flow from operations is anticipated to be in excess of $12 billion, and we anticipate returning at least $12 billion to shareholders in dividends and stock buybacks. The Visa board has authorized a 20% increase in our quarterly dividend to $0.30 for the first quarter of fiscal 2020, in line with our dividend policy. This puts our payout ratio in the 20% to 25% range.”

We really appreciate Visa’s dividend growth story but please note that part of the strength of Visa’s 5.6x Dividend Cushion ratio, which is very high, is due to the firm’s dividend payout being low, relatively speaking. While we model strong double-digit annual dividend increases in Visa’s per share payout over the next several years, the company’s future dividend obligations remain very tame. Shares of Visa yield just 0.7% on a forward-looking as of this writing, keeping its impressive capital appreciation performance over the past few years in mind.

Concluding Thoughts

Visa is likely to remain a top holding in our Best Ideas Newsletter portfolio for some time as we strongly prefer exposure to companies with top quality free cash flow profiles that are supported by strong secular growth tailwinds and decent (or better) balance sheets. The global shift from cash to card, the growing need for cross-border payment processing solutions, the need to reduce onerous payment processing errors and more are all major opportunities for Visa. To stay ahead of the game, Visa will often utilize acquisitions (Visa completed its purchase of Verifi, a leader in technology solutions that seek to reduce chargebacks, in September which came on the heels of Visa acquiring control of Earthport, a provider of cross-border payment solutions, earlier on in calendar year 2019).

While our fair value estimate for Visa sits at $190 per share, comfortably above where V is trading at as of this writing, we think that should the company continue to exceed expectations, Visa may test the upper end of our fair value range estimate (currently at $228 per share) over time.

Financial Tech Services Industry – MA MELI PYPL VRSK V

Related: BBVA

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.