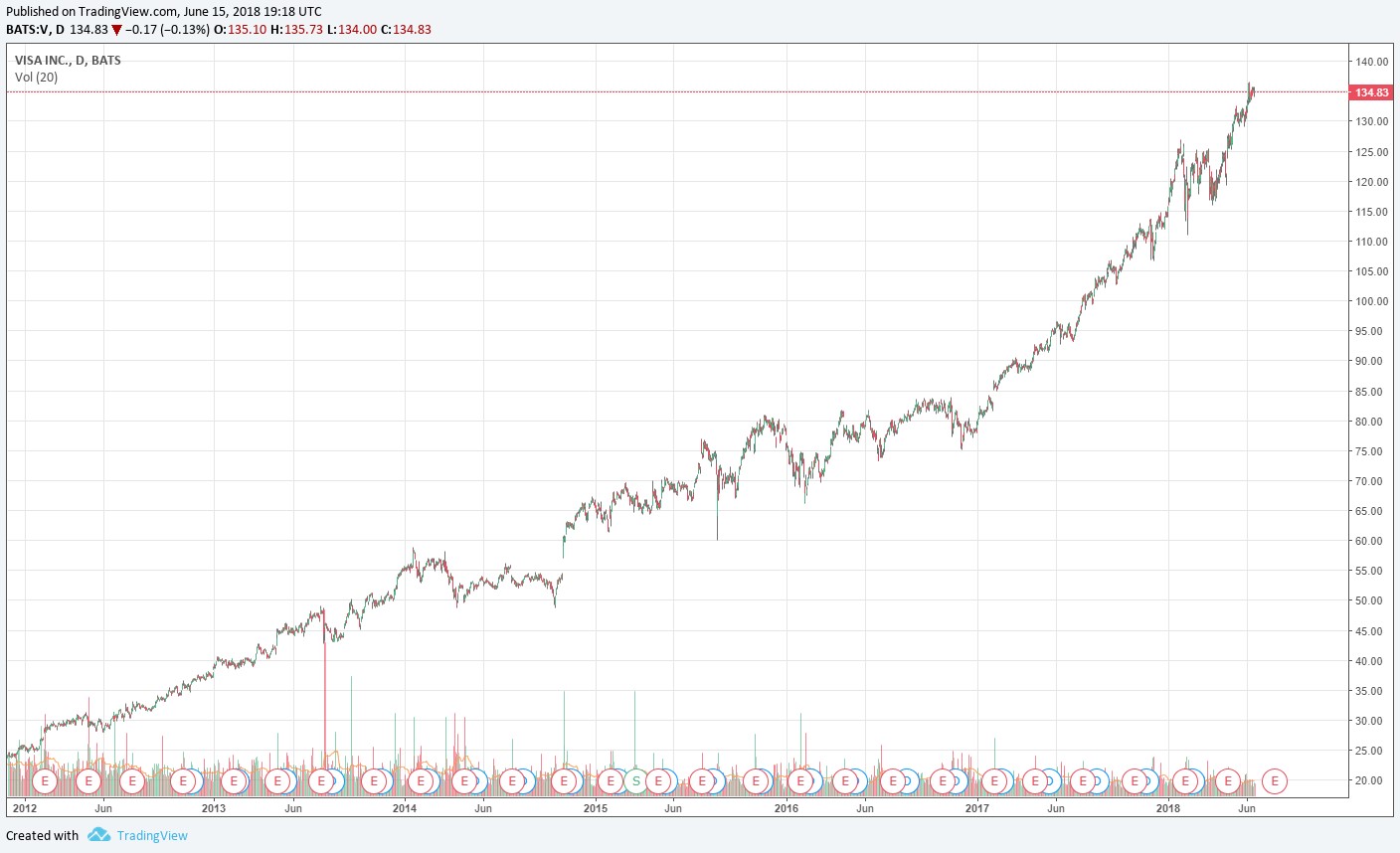

Image shown: The performance of Visa since it was added to the Best Ideas Newsletter portfolio.

The Best Ideas Newsletter portfolio has a habit of identifying outperforming stock ideas.

By Brian Nelson, CFA

The Valuentum team has put together an incredible track record during the past several years, and frankly, if you haven’t already, you have to read through the analysis of the history of the simulated Best Ideas Newsletter portfolio. It goes into why we think the way we do and provides a variety of references to our processes and methodology.

The analysis can be downloaded at the following link (pdf):

https://valuentum.com/downloads/20180530/download

For the team to achieve what it was able to do, despite a ~25% cash “position” in the simulated Best Ideas Newsletter portfolio, and in the context of the vast majority of active fund managers underperforming their respective benchmarks, is quite amazing. What I wanted to introduce in this note, however, is the concept of prudence. It’s something that we talk about frequently in passing, but I wanted to offer a couple examples. We sometimes make shifts in the portfolio that are independent of our views of the stock.

In the Dividend Growth Newsletter portfolio, for example, we steadily reduced the “weighting” in big-winner Microsoft (MSFT) over time (January 2015 & June 2016) from its original 8% “weighting” at inception of the newsletter portfolio at the beginning of 2012. Microsoft, itself, had remained in the Dividend Growth Newsletter portfolio as one of our favorite dividend growth ideas (and it does to this day), but as its equity price continued to advance, taking some exposure of this winner off the table can make sense. Had things, for example, not continued to work out for Microsoft, we would have given back a lot of “gains.”

The example in the Best Ideas Newsletter portfolio is Visa (V). At the end of 2017, Visa was an 8%-9% “weighting” thanks to its fantastic performance in recent years. That’s a heavy weighting! Generally speaking, we would grow very concerned as positions advance to the high-single digit level percentage range, and significantly so in the double-digit percentage range, due to growing concentration risk. A 10%+ weighting in a portfolio is a big weighting, in our view.

Though compounding is a fantastic dynamic (holding over time), the point is that over time, too, a constituent can sometimes become too large a portion of the portfolio, and even if we still like the company, sometimes prudence necessitates scaling back exposure, if only a little. For example, we reduced the “weighting” in Visa by 20% in August 2013, at a time when the company was already reflecting a 60% “gain.” Had we not scaled back our exposure, it’s likely Visa would have grown to an uncomfortably large percentage of the portfolio.

Hindsight will always be 20/20, and while simulated newsletter portfolio returns would have been even better had we stuck with the outsize positions of Microsoft or Visa in the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio, respectively, being prudent is often a quality that is measured most appropriately when broader markets are under pressure. I hope that you’ve been enjoying this publication all these years, and I hope you enjoy this edition of the Best Ideas Newsletter.

<The June edition of the Best Ideas Newsletter was released June 15, 2018.>

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.