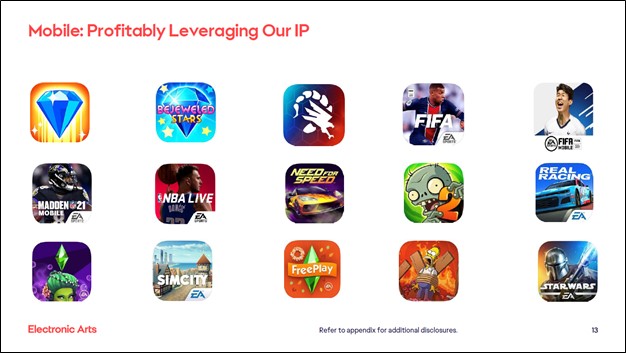

Image Shown: The video game industry has been placing a much greater emphasis on growing their mobile gaming operations in recent years. Part of that strategy has involved leveraging existing IP and well-known gaming titles to appeal to a wide range of users. Image Source: Electronic Arts Inc – Second Quarter of Fiscal 2021 IR Earnings Presentation

Executive Summary: Activision Blizzard, Electronic Arts, and Take-Two Interactive Software have pristine balance sheets, stellar cash flow profiles, and their business models are supported by secular growth tailwinds such as the rise of the global middle class (and more broadly, additional households in emerging economies gaining access to the internet), a growing casual and dedicated video game user base across the globe, and a pivot towards households preferring digitally provided entertainment options to ride out the storm caused by the COVID-19 pandemic. We do not include shares of any of these three companies in our newsletter portfolios at this time but given their stellar financials and promising long-term growth outlooks, we are keeping a very close eye on the space.

By Callum Turcan

As households have largely been “cocooning” indoors to ride out the ongoing coronavirus (‘COVID-19’) pandemic, demand for digitally provided entertainment options has grown considerably. NPD Group, an industry-tracking firm, estimates that US video game sales (software and hardware combined) will reach $13.4 billion in total in across November and December of this year. That would be up 24% from year-ago levels, and note this is only looking at the US market, which is estimated to have 244 million consumers of video game content according to NPD Group. Many of those consumers are considered casual video game players, playing mobile games on their smartphones and tablets, though NPD Group noted the number of more dedicated gamers (measured by hours played per week) is on the rise in both nominal and absolute terms.

Mobile gaming options generally rely on in-game transactions, called microtransactions, to generate revenue. Usually those offerings include aesthetic upgrades or the ability to progress through the video game at a faster pace. For more conventional video game offerings–those normally played on PCs or consoles–video game companies have increasingly been successful in selling add-on content via high-margin digital packages (and in some instances, microtransactions have also been successfully implemented). Longer term, the rise of e-sports offers another revenue generating opportunity for companies in the video game and digital advertising world. Though a nascent part of the video game industry, initial levels of interest have been impressive.

Beyond rising demand for video streaming services, demand for video games, a (usually) cost-effective entertainment option, has also held up incredibly well during the pandemic with several big video game publishers reporting strong financial results of late, too. Furthermore, Microsoft Corporation (MSFT) and Sony Corporation (SNE) recently launched their next-generation consoles, the Xbox Series X and PlayStation 5, respectively. In theory, the console refresh cycle combined with growing demand for indoors entertainment options should provide the video game industry with several major growth catalysts in the coming quarters.

One of the key positive attributes of the the video game publishing industry, generally speaking, is that these companies have strong balance sheets and stellar cash flow profiles (meaning a relatively modest amount of capital expenditures are required to maintain a certain level of revenues, and thus putting the firm in a position to better generate free cash flows). However, the performance of these companies can swing wildly depending on how well their blockbuster properties perform. The hit-or-miss nature of their operations has been a big reason why we haven’t added any videogame stock to the newsletter portfolios in the past, but their business models have become more and more attractive as the years have gone on. In this note, let’s get into the details of Activision Blizzard Inc (ATVI), Electronic Arts Inc (EA), and Take-Two Interactive Software Inc (TTWO), while we discuss broader industry trends.

Activision Blizzard’s Strong Financials and Looming Catalyst

On October 29, Activision Blizzard Inc reported third quarter earnings for 2020. The video game giant’s GAAP revenues were up 26% year-over-year during the first nine months of 2020, supported by strong demand for its core gaming offerings geared towards more dedicated gamers (those that play video games on PCs and consoles) and microtransactions from both its dedicated gamer base and video game offerings geared towards more casual gamers (namely those playing solely/primarily on their smartphones and tablets). Activision Blizzard’s GAAP operating income grew by almost 86% year-over-year during this period, aided by economies of scale and controlled operating expense growth.

Activision Blizzard’s portfolio is vast and includes the blockbuster Call of Duty and World of Warcraft franchises. Last calendar year, Activision Blizzard launched World of Warcraft: Classic and that subscription-based video game offering has held up well according to management commentary during the firm’s latest earnings call. After the third quarter ended, Activision Blizzard launched Call of Duty: Cold War in mid-November (its latest edition of that franchise) which should help keep the momentum going in the right direction. Here we would like to stress that the performance of Call of Duty and World of Warcraft will have an outsize impact on Activision Blizzard’s financial performance going forward.

Back in 2016, Activision Blizzard announced it had acquired Major League Gaming to support its e-sports ambitions (reportedly, the deal was for less than $0.1 billion). The company’s Overwatch franchise launched the Overwatch League back in early-2018, and that e-sports endeavor has been more or less a success in terms of user engagement. For reference, Overwatch was launched back in May 2016, and Overwatch 2 is reportedly under development. Here is what management had to say regarding these endeavors during the firm’s latest earnings call (emphasis added):

“Overwatch continues to have a large and dedicated community, with an average 10 million monthly players in the quarter, more than four years since launch. Millions more have engaged through the 2020 season of the Overwatch League, with the grand finals being the most watch event in the League’s history.” — Daniel Alegre, COO and President of Activision Blizzard

In recent years, Activision Blizzard has also pushed deeper into the mobile gaming environment. That strategy involved the company acquiring King Digital Entertainment in February 2016 through an all-cash deal with an equity value of approximately $5.9 billion, which added Candy Crush to Activision Blizzard’s portfolio. During Activision Blizzard’s latest earnings report, management highlighted that its King Digital segment had 249 million monthly active users (‘MAUs’), with Bubble Witch, Candy Crush, and Farm Heroes posting strong performance. Additionally, Call of Duty: Mobile has proven to be quite popular. Here is what Activision Blizzard’s management team had to say regarding the firm’s Call of Duty strategy during the company’s latest earnings call (emphasis added);

“Call of Duty is the first community benefit from our pursuit of this franchise based strategy. With over 100 million monthly players, the Call of Duty community is larger than ever before. And with expansion across all platforms the franchise has transformed into a truly social experience that engages and connects our players in truly epic ways. Through Modern Warfare and our free-to-play game Warzone, over two-thirds of players playing groups of friends, demonstrating the rich social connections enabled by our games. On mobile, Call of Duty has been downloaded over 300 million times worldwide and has become the highest grossing new game in the U.S. app stores since its launched last October.

By expanding to mobile, we’ve brought in tens of millions of new players in countries far beyond our traditional audiences. With the game now in final large-scale testing in China and over 50 million players already preregistered, we see a clear path to continue growing Call of Duty’s reach, engagement, and player investment on mobile in the largest mobile gaming market in the world. Deep engagement in premium Call of Duty content as well as the addition of free-to-play experiences across mobile, console, and PC drove the number of monthly players in the community to over three time the year ago level in this third quarter and hours played were seven times higher than a year ago.

As the community engages, they consume more content. More players are purchasing premium content than ever before and these growth rates highlight the tremendous power of the combination of our premium and free-to-play business model. We expect to continue the Call of Duty momentum when we deliver Black Ops Cold War in two weeks. And our marketing has changed to reflect the scale and size of our own proprietary network.” — Bobby Kotick, CEO of Activision Blizzard

We are big fans of Activision Blizzard’s pristine balance sheet, as the firm exited September 2020 with $7.4 billion in cash and cash equivalents on hand versus $3.6 billion in long-term debt on the books (and no short-term debt). The company generated just under $1.1 billion in free cash flow during the first three quarters of 2020. Activision Blizzard spent $0.3 billion covering its dividend obligations and did not repurchase a significant amount of this stock during this period.

Our fair value estimate for Activision Blizzard sits at $71 per share (under our “base” case scenario), and the top end of our fair value estimate range sits at $89 per share (under our “bull” case scenario). As of this writing, shares of ATVI appear to be fairly valued as they are trading just modestly higher than our fair value estimate. Should its recent Call of Duty title launch prove to be successful, that could potentially provide a powerful catalyst to Activision Blizzard’s share price in the near-term.

Electronic Arts’ Pristine Balance Sheet and Push into Mobile Gaming

Electronic Arts Inc reported second quarter earnings for fiscal 2021 (period ended September 30, 2020) on November 5. The video game company is perhaps best known for its blockbuster Battlefield, The Sims, Apex Legends, FIFA, and Madden NFL titles. During the first half of fiscal 2021, Electronic Arts’ GAAP revenues were up 2% year-over-year which represents a significantly slower growth rate than its peers. Part of this subdued performance is likely due to its latest edition of its Battlefield franchise, Battlefield 5, getting stale given that the game launched back in November 2018. Here is what management had to say regarding the firm’s Battlefield timetable during the firm’s latest earnings call (emphasis added):

“DICE is creating our next Battlefield game with never before seen scale. The technical advancements of the new consoles are allowing the team to deliver a true next-gen vision for the franchise. We have hands on play testing underway internally and the team has been getting very positive feedback on the game as we’ve begun to engage our community. The next Battlefield is set to launch in holiday 2021, we’re excited to share a lot more about the game in the spring.” — Andrew Wilson, CEO of Electronic Arts

In the first half of fiscal 2021, Electronic Arts’ GAAP operating income dropped by 9% year-over-year as incremental operating expenses more than consumed incremental revenues. The company exited September 2020 with $6.0 billion in cash, cash equivalents, and short-term investments combined. Stacked up against $0.6 billion in short-term debt and $0.4 billion in long-term debt on the books at the end of this past September, Electronic Arts’ balance sheet remained pristine. Electronic Arts generated just under $0.4 billion in free cash flow during the first half of fiscal 2021 and spent less than $0.1 billion buying back its stock. The company does not pay out a common dividend at this time.

Like Activision Blizzard, Electronic Arts is also seeking to push deeper into the mobile gaming arena. The company launched FIFA Mobile in Japan this past October according to recent management commentary, and please note FIFA Mobile originally launched back in October 2016. At the start of November 2020, Electronic Arts launched a new season for FIFA Mobile and these “refresh” cycles are meant to keep the game interesting and current for its user base. During Electronic Arts’ latest earnings call, management noted that the company’s nascent blockbuster property, Apex Legends (which launched February 2019) continued to experience strong levels of engagement from its users. The firm reportedly intends to launch a mobile version of the game in calendar year 2021.

Pivoting now to Electronic Arts’ e-sports operations, management had this to say during the firm’s latest conference call (emphasis added):

“Our esports programs are scaling the new records in viewership also. Our new Madden NFL episodic content featuring NFL athletes, celebrities and top Madden NFL players is bringing great entertainment to a much wider audience. And our recent FIFA 21 challenge, which paired esports stars with celebrity soccer players was our most watch[ed] esports event to date with viewership that place it amongst top esports broadcast worldwide.” — CEO of Electronic Arts

Though these are early days for the potentially lucrative world of e-sports, it appears the space is starting to really take off. We are keeping an eye on developments. Electronic Arts’ financial performance underwhelmed during the first half of fiscal 2021, but it appears that its medium-term outlook is improving as the firm further expands its mobile presence while getting ready to launch another potential blockbuster Battlefield title. Shares of EA have steady sold off over the past few months, likely due to the lack of near-term catalysts, in our view, though its longer term outlook remains bright.

Take-Two’s Solid Balance Sheet Facilitates Acquisition Strategy

On November 5, Take-Two Interactive Software Inc reported second quarter earnings for fiscal 2021 (period ended September 30, 2020). During the first half of fiscal 2021, Take-Two’s GAAP revenues grew by 20% and its GAAP operating income grew by 56% on a year-over-year basis, with management citing the strong performance of NBA 2K, PGA Tour 2K21, Mafia: Definitive Editions, and Mafia: Trilogy as key to driving this growth during the firm’s latest earnings call. Please note Take-Two also publishes the blockbuster Grand Theft Auto and Red Dead Redemption video game franchises.

Though Take-Two&rsquo