Image Source: Verizon

By Brian Nelson, CFA

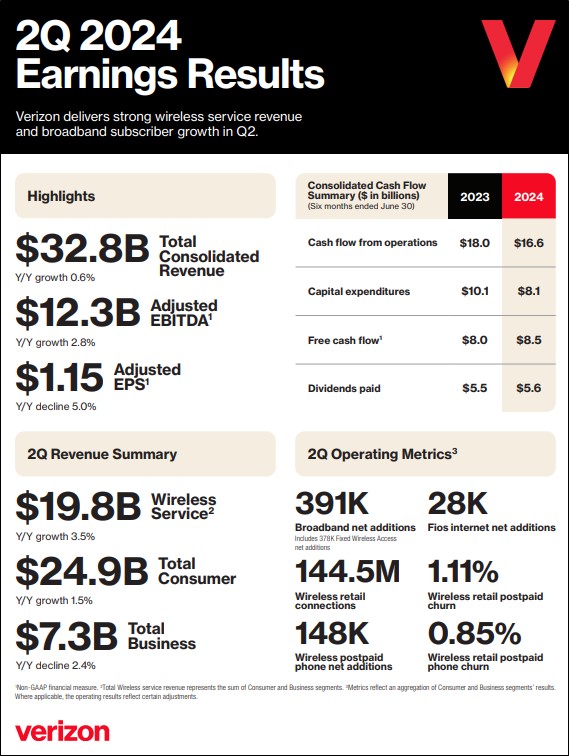

On July 22, Verizon (VZ) reported mixed second-quarter results with revenue missing the consensus expectation but non-GAAP earnings per share coming in line. Total operating revenue was up 0.6% from the same quarter a year ago, but consolidated net income fell to $4.7 billion from $4.8 billion in last year’s quarter. Consolidated adjusted EBITDA was $12.3 billion, up from $12 billion in the second quarter of 2023. Earnings per share, excluding special items, was $1.15 in the quarter, worse than the $1.21 mark in the second quarter a year ago.

On the wireless side of its business, total wireless service revenue increased 3.5% on a year-over-year basis, with retail postpaid phone net additions of 148,000, and retail postpaid net additions of 340,000. On the broadband side of its operations, the company generated the eighth consecutive quarter of 375,000 broadband net additions, with the tally coming in at 391,000 in the quarter. Total fixed wireless net additions were 378,000 in the quarter, and at the end of the quarter, Verizon had more than 3.8 million fixed wireless subscribers, up 69% year-over-year. The company had 11.5 million total broadband subscribers at the end of the quarter, up 17.2% year-over-year.

Management’s commentary spoke of improvements to its business:

The sequential and year over year improvements in the second quarter were a reflection of operational excellence and the moves we made to bring choice, value and control to our customers’ lives. Our industry-leading network serves as a catalyst for how our millions of customers live their lives, and serves as the backbone for new and emerging technologies. We continue to build and expand on our strengths and successes with new products and services, and we are confident that this upward momentum will position us for future growth.

Cash flow from operations didn’t fare as well as we would have liked. Cash flow from operations during the first half of 2024 was $16.6 billion, down from $18 billion in the same period a year ago. Free cash flow did improve to $8.5 billion in the first half of 2024 versus $8 billion in the first half of last year, but the improvement came in the form of lower capital expenditures, which were $8.1 billion in the first half versus $10.1 billion in the same period a year ago. Verizon ended the quarter with total debt of $149.3 billion and an unsecured debt to consolidated adjusted EBITDA ratio of 2.5x.

Looking to 2024, Verizon reaffirmed its outlook. It expects total wireless services revenue growth in the range of 2%-3.5%, adjusted EBITDA growth of 1%-3%, adjusted earnings per share of $4.50-$4.70, and capital expenditures in the range of $17-$17.5 billion for the year. Dividends paid for the first half of 2024 totaled $5.6 billion, so Verizon is doing a good job covering dividends with free cash flow, despite pressure on operating cash flow. Shares of Verizon yield ~6.4% at the time of this writing.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.