Image Source: Verizon

By Brian Nelson, CFA

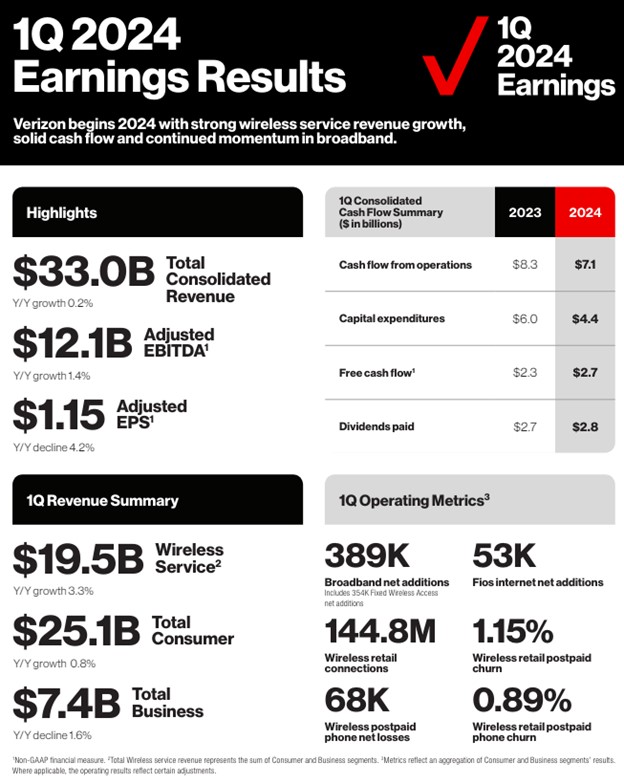

On April 22, Verizon (VZ) reported mixed first-quarter results. During the period, total operating revenue grew a modest 0.2% thanks in part to pricing actions, to $33 billion, while consolidated net income fell to $4.7 billion from $5 billion in the year-ago period. Adjusted earnings per share came in at $1.15, which compares to $1.20 in last year’s quarter.

However, consolidated adjusted EBITDA came in at $12.1 billion, which was up from the $11.9 billion mark it registered in the year-ago period. Total wireless service revenue increased 3.3% thanks in part to pricing actions and a higher mix of premium pricing plans, while total broadband net additions totaled 389,000, revealing continued momentum in this area.

Management had some positive things to say about the quarter and outlook:

Our strong results show that our team is delivering. Our performance in the first quarter sets us up for a successful 2024. We are on track to meet our financial guidance and to deliver positive Consumer postpaid phone net adds for the year. Our fixed wireless subscriber base is continuing to grow rapidly, and our network remains the best in the industry, by far.

Verizon generated $7.1 billion in cash flow from operations during the first quarter of the year, while it spent $4.4 billion in capital expenditures, translating into free cash flow of $2.7 billion, which was a nice improvement from the $2.3 billion it achieved in the year-ago period.

Verizon sports a lofty dividend yield in part because of its huge net debt position, which depresses equity value in the enterprise valuation process (i.e. discounted cash flow valuation). At the end of the first quarter of 2024, its net unsecured debt totaled $126 billion. Its net unsecured debt to consolidated adjusted EBITDA isn’t much to worry about, however, coming in at 2.6x at the end of the quarter.

Looking ahead to 2024, Verizon is targeting total wireless service revenue growth in the range of 2%-3.5%, with adjusted EBITDA expansion of 1%-3%. Adjusted earnings per share is targeted in the range of $4.50-$4.70, while capital spending is expected in the range of $17-$17.5 billion. We like the progress that Verizon is making, but the company’s large net debt position is something that we’re not particularly fond of. Shares yield ~6.6% at the time of this writing.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.