Let’s take a look at VBI 9-rated stock AmerisourceBergen, a pharmaceutical sourcing and distribution company that yields 2% as of this writing. We like AmerisourceBergen’s dividend growth story, strong free cash flow generation, guidance raise, and relatively low net debt load. We’ll also cover AmerisourceBergen’s downside risks as well as its upside potential. Shares appear undervalued as things stand today, with ABC trading below the low end of our fair value estimate range.

By Callum Turcan

Pharmaceutical sourcing and distribution company AmerisourceBergen (ABC) just popped up on our radar; its fundamentals are rock-solid and its technical readings indicate Wall Street is starting to take notice. The company just registered a 9 on the Valuentum Buying Index. This American healthcare company has consistently generated meaningful shareholder value by earning a return on invested capital (excluding goodwill) that exceeds its weighted-average cost of capital, indicating management has historically been able to locate and capitalize on quality investment opportunities. We like AmerisourceBergen’s dividend growth trajectory and see its payout as very well covered, keeping in mind the firm yields 2% as of this writing. For reference, AmerisourceBergen’s fiscal year ends in September.

Here is a brief overview of how we view the healthcare products and distribution industry to set the stage for this piece (from our 16-page Stock Report):

The healthcare distributors industry is made up of wholesale medical equipment products distributors, serving the dental, medical and animal health markets, and wholesale drug providers, which distribute pharmaceuticals, medical products/services, and other healthcare technologies. Both sub-spaces are highly competitive and continue to experience growth as a result of the aging population, increased healthcare awareness, and the proliferation of medical technology and testing. Participants face pricing pressure from both customers and suppliers as a result of competition.

Furthermore (additional commentary from our 16-page stock report):

AmerisourceBergen is looking for growth via the animal health market, a fragmented marketplace with potential in both the companion animal and production animal areas. Expanding access to the evolving drug category of biosimilars and follow-on biologics in the US market is another area for growth potential.

Financial Overview

We like AmerisourceBergen’s ability to generate excess cash as its business model is relatively capex-light, though we note the firm’s net operating cash flow has been volatile in the past. From FY2016 to FY2018, for example, AmerisourceBergen’s net operating cash flow dropped from $3.2 billion to $1.4 billion while its GAAP net income climbed from $1.4 billion to $1.6 billion. This cash flow volatility is largely a product of large swings in AmerisourceBergen’s working capital, but note that its net operating cash flow still averaged $2 billion from FY2016 to FY2018 while its capital expenditures averaged $0.4 billion during this period, enabling very consistent free cash flow generation (defined as net operating cash flow less capital expenditures).

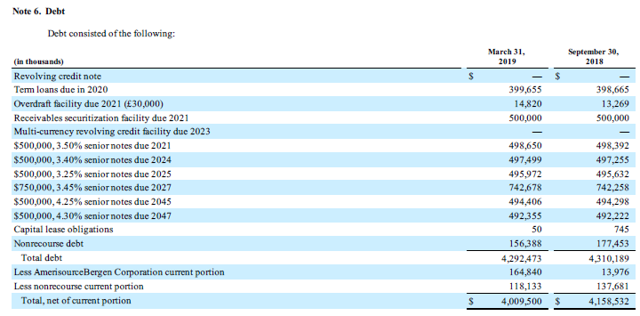

The company spends $0.3 billion annually on its dividend payments, providing for excellent payout coverage as its net debt load is very tame. At the end of its second quarter FY2019, which ended March 31, 2019, AmerisourceBergen was sitting on $4.6 billion in total debt (defined as short-term debt, long-term debt, and long-term financing obligations) versus $2.9 billion in cash & cash equivalents. With less than $1.8 billion in net debt, AmerisourceBergen’s balance sheet is relatively strong, providing for a dividend growth story built on solid foundations. AmerisourceBergen spent roughly $1.1 billion repurchasing its stock over the past three fiscal years on average, which will compete for free cash flow as it relates to dividend increases.

For the most part AmerisourceBergen’s maturities are staggered, with a $0.4 billion term-loan coming due in 2020 followed by $1.0 billion in liabilities maturing in 2021, which could easily be covered with cash on hand and/or future free cash flow generation. It isn’t until 2024 that another $0.5 billion tranche comes due. Having a well-planned credit profile better enables AmerisourceBergen to navigate the turbulent waters of America’s healthcare industry. AmerisourceBergen’s unsecured debt carries an investment grade Baa2 credit rating from Moody’s Corporation (MCO).

Image Shown: A look at AmerisourceBergen’s liabilities as of the end of March 31, 2019. Image Source: AmerisourceBergen – 10-Q for the second quarter of FY2019

What we really like about AmerisourceBergen is management’s commitment to serious payout increases. From late-2009 to mid-2019 (calendar year), the company’s quarterly payout grew from $0.08 per share to $0.40, and we think there is an enormous room for growth in this area as stated previously. Dividend payments serve several purposes. Not only do they reward shareholders with income, but they indicate the level of confidence management teams have in the enterprise’s ability to keep generating free cash flow. AmerisourceBergen is guiding to spend $0.3 billion on capital expenditures in FY2019, enabling $1.4-$1.6 billion in free cash flow generation according to management forecasts.

Guidance Commentary

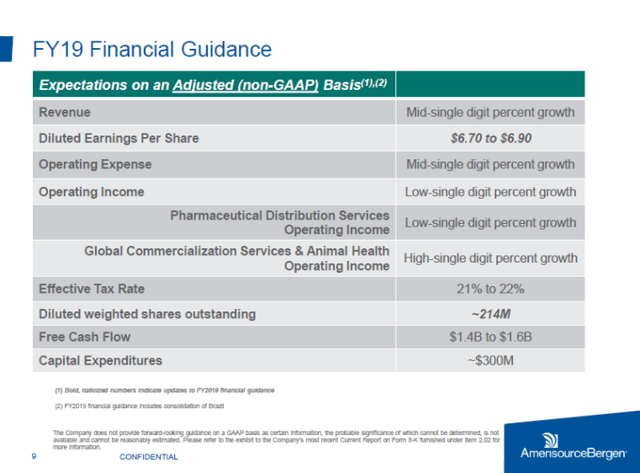

Last quarter, AmerisourceBergen raised its non-GAAP adjusted EPS forecast for FY2019 from $6.65-$6.85 to $6.70-$6.90, indicating growing confidence in its fundamentals. AmerisourceBergen generated non-GAAP adjusted EPS of $6.49 in FY2018, implying 5% annual growth at the midpoint of its FY2019 guidance. Management is also guiding for modest single-digit revenue growth this fiscal year. On an operating income basis, AmerisourceBergen expects stronger growth at its ‘Global Commercialization Services & Animal Health’ division than its ‘Pharmaceutical Distribution Services’ division in FY2019, but both segments are still expected to grow this fiscal year.

As an additional bonus, management now sees AmerisourceBergen’s diluted share count moving down to 214 million in FY2019 (versus previous guidance of 215 million shares) compared to 220 million in FY2018, a product of share buybacks. We see shares of AmerisourceBergen as being significantly undervalued as of this writing, trading below the low end of our range of potential values, which is derived from our rigorous discounted free cash flow analysis. That indicates share buybacks, as long as they are kept within reasonable parameters, represent good uses of capital. Deleveraging is also a possibility, as we prefer companies with large net cash balances versus those with net debt loads, but we expect AmerisourceBergen will continue to return a large amount of cash to shareholders.

Image Shown: AmerisourceBergen expects modest top-line and bottom-line growth in FY2019. Management recently revised the company’s non-GAAP adjusted EPS estimate for FY2019 up by $0.05 at the midpoint, indicating growing confidence in AmerisourceBergen’s ability to perform. Image Source: AmerisourceBergen – IR Presentation

What We Think

Here is a concise except from our two-page Dividend Report that sums up how we view AmerisourceBergen’s key strengths, particularly as it relates to its dividend coverage;

It’s hard not to like AmerisourceBergen’s revenue and adjusted operating income growth over the past several years. Revenue has advanced more than 70% since fiscal 2011. The US pharma market continues to provide the company with growth opportunities, and management recently finalized the largest and most complex contract in its history with Walgreens Boots Alliance Inc (WBA). The firm is targeting free cash flow that exceeds net income and returning 30%+ of free cash flow to shareholders each year via dividends and buybacks. Cash flow from operations has fallen to $1.4 billion in fiscal 2018 from ~$3.2 billion in fiscal 2015, though free cash flow of ~$1.1 billion in fiscal 2018 was still far in excess of annual cash dividend obligations of $333 million.

Some Wall Street analysts have noted that AmerisourceBergen may be a takeover target, a thesis supported in part by its low net debt load, strong free cash flow generation, and its historic ability to earn a very strong return on invested capital (excluding goodwill), a strength we see as continuing into the future. McKesson Corporation (MCK) and Cardinal Health Inc (CAH), in theory, could be potential buyers as they represent AmerisourceBergen’s main competitors. Keep in mind that this theory needs to be weighed against AmerisourceBergen’s potential legal liabilities as it relates to the ongoing opioid crisis in America, which could be extensive. We are activity monitoring this situation closely.

As always, keep in mind that when doing equity analysis, one should monitor a potential investment’s upside and downside risks. Here is how we view AmerisourceBergen’s potential weaknesses, from our two-page Dividend Report;

AmerisourceBergen has a lot going for it, including immense scale in its sourcing and distribution businesses, but ongoing investments in its infrastructure will be necessary for supply chain support; capex is but a fraction of operating cash flow, however. We very much like management’s focus on generating economic profit (ROIC>WACC), but acquisitions will be a part of its future. Share buybacks will be ongoing, eating up capital that could otherwise go toward a higher dividend payment, but we have no real qualms with the firm’s financial health. Long-term debt was ~$4.6 billion at the end the second quarter of 2019 (cash stood at ~$2.9 billion), indicating AmerisourceBergen’s dividend growth story will have to contend with a net debt position.

Other downsides include Walgreen’s representing a third of its FY2018 revenue, followed up by Express Scripts at 13%, keeping in mind Express Scripts is now owned by Cigna Corporation (CI) after Cigna’s enormous $67.0 billion deal (including debt) was completed last year. AmerisourceBergen’s top ten customers represented 68% of its FY2018 revenue, highlighting how losing any one of its key customers could have a materially adverse impact on its financials.

Concluding Thoughts

AmerisourceBergen’s dividend growth story looks great, as its current payout represents only a moderate slice of its annual free cash flow generation. While its net operating cash flow has historically been volatile, the company continues to be very free cash flow positive, aided by its capex-light business model. That, combined with its relatively low net debt load, provides for tremendous dividend coverage. We caution, however, that this dividend growth story will have to compete for capital with AmerisourceBergen’s share repurchasing program, as those buybacks are quite material uses of cash. Management’s recent guidance raise for FY2019 provides for additional certainty in AmerisourceBergen’s ability to continue performing well over the coming quarters. This is a company that’s worth keeping on your radar, and one now rated 9 on the Valuentum Buying Index.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.