Image Shown: Shares of Apple Inc have rebounded strongly from their recent lows as of late August 2022.

By Callum Turcan

Apple Inc (AAPL) reported third-quarter results for fiscal 2022 (period ended June 25, 2022) that beat both consensus top- and bottom-line estimates. Management also noted during Apple’s latest earnings update that supply chain constraints were beginning to ease a bit and that Apple’s near-term growth outlook was improving. We continue to like Apple as an idea in the newsletter portfolios. Shares of AAPL yield ~0.6% as of this writing, and there is an enormous amount of room for Apple to aggressively grow its per-share payout going forward given its financial strength.

Earnings Update

Apple’s GAAP revenues rose 2% year-over-year in the fiscal third quarter to reach $83.0 billion, with 12% growth at its ‘Services’ sales offsetting a 1% decline at its ‘Products’ sales. Broken down by geographic market, Apple reported sales growth in the Americas (up 4% year-over-year), Europe (up 2%), and the Rest of Asia Pacific (up 14%) regions though its sales in the Greater China (down 1%) region and Japan (down 16%) declined last fiscal quarter.

Declines in the Greater China region last fiscal quarter may have been driven in part by COVID-related lockdowns. As headwinds from those lockdowns eventually fade (the risk of new lockdowns in the near term remain), that should positively benefit both Apple’s sales performance and its supply chain (China is an integral part of Apple’s global supply chain).

Looking at Apple’s Product sales, while its iPhone posted 3% year-over-year last fiscal quarter, the rest of its offerings (Mac, iPad, Wearables, Home and Accessories) posted year-over-year sales declines. Fading supply chain hurdles should help Apple better keep up with demand going forward and could help revive the sales performance of its various hardware offerings. On September 7, Apple is hosting a launch event, which reportedly is expected to see the firm announce a new iPhone lineup, and Apple could launch additional hardware and/or services at the event.

The shift towards higher-margin Services sales, which includes revenues generated by its App Store, Apple Care, various digital subscriptions (such as Apple TV+), and more, is helping Apple maintain its strong gross margins in the face of major exogenous shocks. In the fiscal third quarter, Apple’s Products gross margin declined by ~150 basis points year-over-year to reach 34.5%, as inflationary pressures and supply chain hurdles took their toll. However, Apple’s Services gross margin rose ~170 basis points year-over-year to reach 71.5% last fiscal quarter. As its Services sales continued to grow as a share of Apple’s total quarterly revenues, rising segment-level gross margins in this area along with a favorable sales mix shift supported Apple’s gross margin performance last fiscal quarter, with its GAAP gross margins coming in at 43.2% (down marginally year-over-year).

Apple’s operating expenses rose 15% year-over-year in the fiscal third quarter as the company needs to invest heavily in R&D to remain competitive while competition for tech talent is fierce, requiring sizable pay boosts to retain key employees. The firm’s GAAP operating income declined 4% year-over-year to reach $23.1 billion last fiscal quarter. A large increase in its income tax provision (versus levels seen in the same period last fiscal year) along with the modest decline in its operating income, which were somewhat offset by a meaningful year-over-year reduction in Apple’s outstanding diluted share count, saw Apple post $1.20 in GAAP diluted EPS in the third quarter of fiscal 2022 (down 8% year-over-year).

On a side note, we use an average expected corporate tax rate in our enterprise cash flow model covering Apple that broadly mirrors the 15% corporate minimum tax rate recently enacted into law in the US through the ‘Inflation Reduction Act,’ keeping certain allocations, credits, and deductions allowed by the new tax regime in mind.

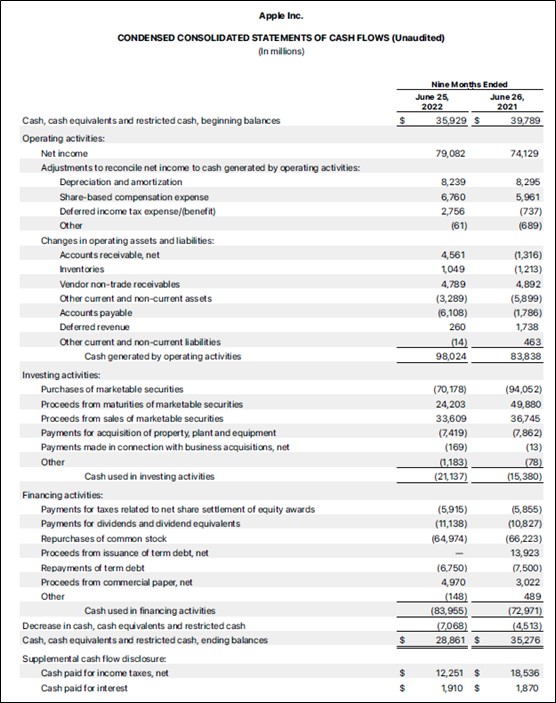

During the first three quarters of fiscal 2022, Apple generated $90.6 billion in free cash flow, up from $76.0 billion in the same period in fiscal 2021. Apple spent $11.1 billion covering its dividend obligations and another $65.0 billion buying back its stock during the first three quarters of fiscal 2022, activities that were fully covered by its free cash flows. In almost any operating environment, Apple is a stellar free cash flow generator.

Image Shown: Apple is a free cash flow generating powerhouse. Image Source: Apple – Third Quarter of Fiscal 2022 Earnings Financial Statements

Apple exited the fiscal third quarter with $59.6 billion in net cash on hand (inclusive of noncurrent marketable securities and short-term debt). We are huge fans of Apple’s fortress-like balance sheet. Though management has committed to delivering a net cash/debt neutral position sometime in the future (largely via enormous share repurchases and substantial dividend increases), for now Apple’s balance sheet is an immense source of strength.

In our view, shares of Apple have been and continue to trade well below their intrinsic value (the top end of our recently updated fair value estimate range sits at ~$202 per share), and we view its share repurchases as a great use of capital. Additionally, Apple possesses the financial firepower to increase its dividend payout in a big way or pursue a significant acquisition that favorably augments its longer-term growth runway going forward.

We would prefer Apple retain a net cash position on hand over the long haul, while still remaining committed to distributing cash to shareholders. Apple’s management team noted that “we continue to believe there is great value in (its) stock and maintain (its) target of reaching a net cash neutral position over time” during its latest earnings call.

Management Commentary

Apple provided a snapshot of how management views the company’s near-term performance unfolding in the face of various exogenous shocks during the firm’s latest earnings call (emphasis added, lightly edited):

“As we move ahead into the September quarter, I’d like to review our outlook… Given the continued uncertainty around the world in the near term, we are not providing revenue guidance but we are sharing some directional insights based on the assumption that the macroeconomic outlook and COVID-related impacts to our business do not worsen from what we are projecting today for the current quarter.

Overall, we believe our year-over-year revenue growth will accelerate during the September quarter compared to the June quarter despite approximately 600 basis points of negative year-over-year impact from foreign exchange.On the product side, we expect supply constraints to be lower than what we experienced during the June quarter. Specifically related to Services, we expect revenue to grow but decelerate from the June quarter due to macroeconomic factors and foreign exchange.” — Luca Maestri, Senior VP and CFO of Apple

Furthermore, Apple pegged its operating-expense guidance for the current fiscal quarter at $12.9-$13.1 billion (up 1% sequentially and up 14% year-over-year at the midpoint) and for the firm’s gross margin to come in at 41.5%-42.5% (down ~120 basis points sequentially and down ~20 basis points year-over-year at the midpoint). Inflationary pressures are still expected to weigh on Apple’s margins in the near term, though its revenue growth trajectory is expected to pick up the pace going forward, which we really appreciate, especially given the foreign currency headwinds Apple has been facing of late.

The strong US dollar has weighed quite negatively on the top-line performance of major US corporates with substantial international sales. Apple generates the bulk of its revenues outside of the US and is moderately exposed to foreign currency movements. With that in mind, Apple’s near-term outlook appears bright as the company gets ready to enter fiscal 2023 on a high note.

Concluding Thoughts

Apple is a financial powerhouse given its immense free cash flows and fortress-like balance sheet, and its near term outlook is beginning to improve. We are huge fans of Apple as the company possess ample capital appreciation and dividend growth upside potential. As Apple’s Services sales grow at a percentage of its total revenues, the company’s margins should expand materially over the coming fiscal years, in our view. There is a lot to like about Apple and we continue to include shares of AAPL in our newsletter portfolios.

—–

Technology Giants Industry – META, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, TXN, EBAY, ADP, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for AAPL and various AAPL supplers.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long VRTX call options. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (META), Korn Ferry (KFY), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.