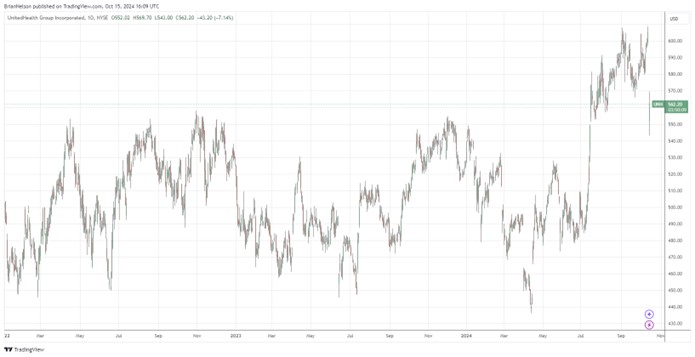

Image: UnitedHealth’s shares have done well the past few years, but a gloomy outlook for 2025 has prompted a selloff.

By Brian Nelson, CFA

United Health (UNH) reported better than expected third quarter results on October 15. Third quarter revenue grew $8.5 billion, to $100.8 billion, thanks to growth in people served at Optum and UnitedHealthcare. Adjusted earnings from operations came in at $9 billion, which includes the Change Healthcare business disruption impacts, but excludes the cyberattack and direct response costs. Adjusted earnings per share was $7.15 in the quarter.

The big concern in the quarter was the firm’s medical care ratio:

The third quarter 2024 medical care ratio was 85.2% compared to 82.3% last year. Among factors contributing to the increase were the previously noted CMS Medicare funding reductions, medical reserve development effects and business and member mix. The company did not have any favorable earnings impacting medical reserve development in the quarter.

Cash flow from operations was strong, however, coming in at $14 billion in the quarter, roughly 2.2 times net income thanks to the timing of cash receipts. For the first nine months, free cash flow totaled $19.2 billion, down on a year-over-year basis but still robust. During the first nine months of 2024, the company returned over $9.6 billion to shareholders in the form of dividends and buybacks. Return on equity was 26.3% in the quarter, showcasing the firm’s ability to generate value for shareholders, something we expect to continue.

Looking to 2024, UnitedHealth Group lowered the high end of its guidance to the range of $27.50-$27.75 compared to $27.50-$28.00 previously due in part to higher than expected business disruption impacts for the affected Change Healthcare services. On the conference call, the company noted that its “2025 adjusted profit could be $30 per share (Seeking Alpha),” which was below consensus of $31.17 per share for the year. Though its medical care ratio advanced in the quarter and it continues to navigate the impact of cyberattack and direct response costs, we’re huge fans of UnitedHealth’s robust free cash flow generation, and we still like shares in the Best Ideas Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.