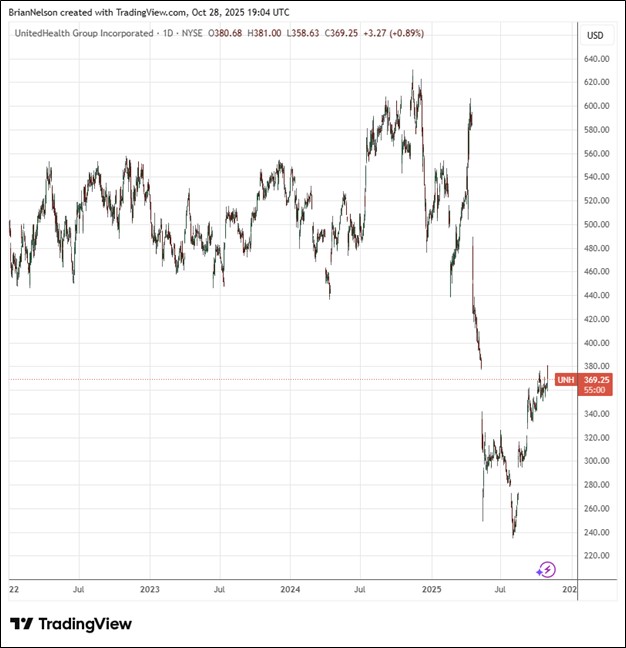

Image Source: TradingView

By Brian Nelson, CFA

On October 28, UnitedHealth (UNH) reported better than expected third quarter results, with revenue and non-GAAP earnings per share exceeding the consensus forecast. Third-quarter revenue grew 12% year-over-year, to $113.2 billion, while adjusted earnings came in at $2.92 per share. In the quarter, UnitedHealthcare revenues grew 16%, while Optum revenues grew 8% year-over-year. Cash flow from operations were $5.9 billion, or 2.3x net income. Its medical care ratio (MCR) of 89.9% was in line with expectations that it outlined in the second quarter.

Management had the following to say about the quarter and outlook:

We remain focused on strengthening performance and positioning for durable and accelerating growth in 2026 and beyond, and our results this quarter reflect solid execution toward that goal.

UnitedHealth Group continues to work through an elevated cost environment: “The year-over-year increase (in the medical care ratio) of 470 basis points was primarily driven by the previously described significantly elevated cost trends, as well as the ongoing effects of the Biden-era Medicare funding reductions and changes to the Part D program from the Inflation Reduction Act.” Looking to 2025, UnitedHealth Group raised its adjusted earnings guidance to at least $16.25 per share. We continue to include UnitedHealth in the newsletter portfolios.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.