Image Shown: Shares of dividend growth idea UnitedHealth Group Inc moved higher by ~5% during normal trading hours on July 15 after reporting a stellar earnings update. The health care giant once again raised its full-year earnings guidance for 2022 in conjunction with its latest earnings update. Shares of UNH have held up quite well year-to-date in the face of volatile capital markets.

By Callum Turcan

On July 15, UnitedHealth Group Inc (UNH) reported second quarter 2022 earnings that beat both consensus top- and bottom-line estimates. The health care giant also boosted its non-GAAP adjusted EPS guidance to $21.40-$21.90 for 2022, up from $21.20-$21.70 previously, in conjunction with it second quarter earnings update. Please note that this is the second time UnitedHealth Group has increased its earnings guidance for 2022 (it also boosted its full-year forecasts back in April 2022), and we appreciate management’s confidence in UnitedHealth Group’s near term outlook.

We include UnitedHealth Group as an idea in the Dividend Growth Newsletter portfolio, and shares of UNH yield ~1.3% as of this writing. At the high end of our fair value estimate range, we assign UnitedHealth Group a fair value estimate of $599 per share, well above where UNH is trading at as of this writing.

UnitedHealth Group has a fortress-like balance sheet, “moaty” business characteristics, a bright growth outlook, and is a stellar free cash flow generator.

Earnings Update

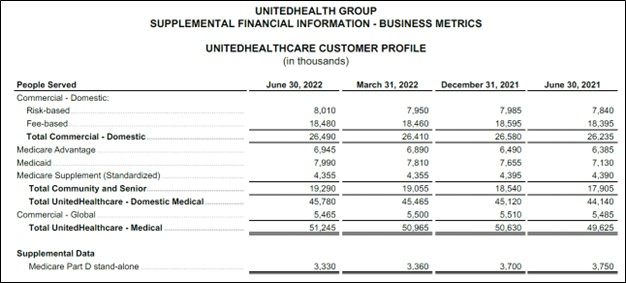

As of the second quarter of 2022, UnitedHealth Group’s enormous health care insurance business (run by its UnitedHealthcare division) catered to 51+ million customers along with an additional 3+ million customers via the standalone Medicare Part D plans. On a year-over-year basis, UnitedHealthcare’s customer base (excluding its standalone Medicare Part D plans) grew ~1.6 million in the second quarter, though the customer base of its standalone Medicare Part D plans declined moderately during this period.

The company’s health insurance operations are backed up by its longstanding relationships with all types of entities across the health care landscape, including its own health care service provider operations (that we will cover in just a moment), its sheer scale in the industry, and its financial firepower. In our view, it would be incredibly difficult for any company to replicate this kind of reach, highlighting why we view UnitedHealth Group as having moaty business characteristics, one with ample pricing power.

Image Shown: UnitedHealth Group’s health care insurance business, run by its UnitedHealthcare division, continues to grow its core customer base. Image Source: UnitedHealth Group – Second Quarter of 2022 Earnings Press Release

UnitedHealth Group’s health care service provider business is run by its Optum division which includes its ‘Optum Health,’ ‘Optum Insight,’ and ‘OptumRx’ segments. This part of its business offers a wide variety of offerings through its urgent care centers, pharmacy benefits managers (‘PBMs’), specialty pharmacy operations, ambulatory care systems, virtual health care delivery systems, and much more. Additionally, Optum provides analytical, research, and consulting services along with related technology offerings to entities operating within the health care sector that aim to improve patient outcomes, support administrative activities, and for various other purposes.

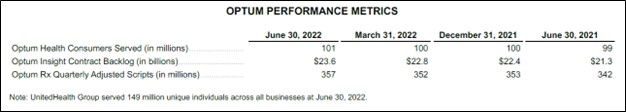

In the second quarter of 2022, Optum Health served 101 million customers (up 2 million year-over-year), Optum Insight’s contract backlog stood at $23.6 billion (up $2.3 billion year-over-year), and OptumRx filled 357 million scripts on an adjusted basis (up 15 million year-over-year). We appreciate that UnitedHealth Group has been doing great of late, and demand for its offerings remains robust.

Image Shown: UnitedHealth Group’s Optum division is steadily meeting the health care needs of a greater number of consumers. Image Source: UnitedHealth Group – Second Quarter of 2022 Earnings Press Release

By integrating its health care insurance operations with its health care service provider operations, UnitedHealth Group aims to generate substantial synergies across its portfolio. These synergies seek to reduce costs, integrate health care activities across multiple entities, and improve patient outcomes. Here, we will stress once again that these operations would be incredibly difficult for a competitor to replicate.

UnitedHealth Group is continuously searching for more effective ways of providing health care-related services. During the second quarter of 2022, UnitedHealth’s medical care ratio–health care costs divided by health care premiums–stood at 81.5%, down from 82.8% in the same period last year (a lower medical care ratio is a positive for UnitedHealth Group).

Financial Overview

Putting it all together, UnitedHealth Group’s GAAP revenues grew 13% year-over-year to reach $80.3 billion in the second quarter of 2022 due to solid growth at both its UnitedHealth and Optum divisions. Its GAAP operating income climbed higher 19% year-over-year to reach $7.1 billion as UnitedHealth Group benefited from revenue growth, economics of scale, and meaningful improvements in profitability at its UnitedHealthcare division.

Its non-GAAP adjusted diluted EPS came in at $5.57 in the second quarter, up from $4.70 in the same period in 2021, as UnitedHealth Group benefited from strong net income growth and a reduction in its diluted outstanding weighted-average share count on a year-over-year basis.

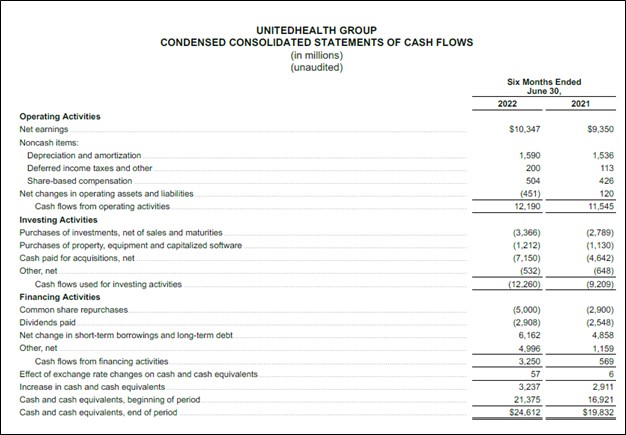

The company generated $11.0 billion in free cash flow during the first half of 2022 while spending $2.9 billion covering its dividend obligations and another $5.0 billion buying back its stock. We are enormous fans of UnitedHealth Group’s stable cash flow profile. Additionally, UnitedHealth Group is very shareholder friendly.

Image Shown: We are big fans of UnitedHealth Group’s ability to generate sizable free cash flows in almost any operating environment. Image Source: UnitedHealth Group – Second Quarter of 2022 Earnings Press Release

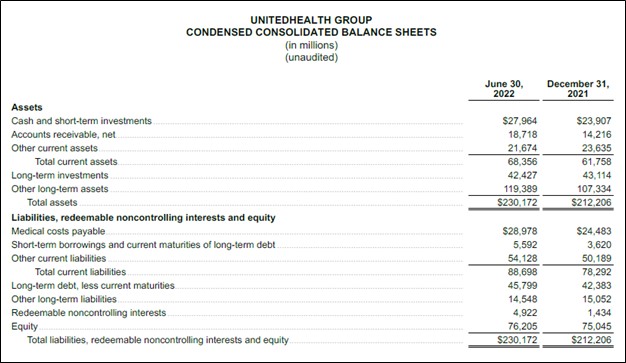

At the end of June 2022, UnitedHealth Group had $70.4 billion in cash, cash equivalents, and long-term investments on hand versus $51.4 billion in total debt (inclusive of short-term debt) on the books. Its fortress-like balance sheet, stellar free cash flow generating abilities, and dividend growth track record (its quarterly dividend more than tripled from June 2015 to June 2022 on a per share basis after management increased the firm’s payout 14% on a sequential basis in June 2022) underpin our expectations that UnitedHealth Group will push through substantial payout increases going forward.

Image Shown: At the end of the second quarter of 2022, UnitedHealth Group had a nice net cash position on hand. Image Source: UnitedHealth Group – Second Quarter of 2022 Earnings Press Release

Pending Acquisition Updates and Further Guidance Commentary

UnitedHealth Group is in the process of acquiring Change Healthcare Inc (CHNG) through a ~$13 billon deal that has faced sizable regulatory headwinds (the merger agreement was extended to the end of this year). This deal aims to bolster UnitedHealth Group’s billing and payment solutions operations, though the acquisition may ultimately not end up going through. Additionally, UnitedHealth Group is working on acquiring LHC Group Inc (LHCG) through a ~$5.4 billion deal that would improve its ability to provide in-home health care services. Through its Optum UK unit, UnitedHealth Group is also working on acquiring UK-listed EMIS Group Plc for approximately GBP£1.2 billion (~USD$1.5 billion), which provides software, services, and technology used in the health care sector.

These deals, if completed, will not significantly weaken UnitedHealth Group’s financial health given its large net cash position on hand at the end of June 2022. UnitedHealth Group is a highly acquisitive entity, though it possesses the ability to quickly rebuild its balance sheet if needed given its strong free cash flows. Here is what management had to say regarding the firm’s cash flow outlook during UnitedHealth Group’s second quarter earnings call (emphasis added):

“Our capital capacities remain strong. Second quarter cash flows from operations were $6.9 billion, or 1.3 times net income, and we continue to expect full year cash flows of about $24 billion. In the first half of this year, we returned nearly $8 billion to shareholders through dividends and share repurchase. In June, our board increased the dividend by 14%. And we deployed more than $7 billion in capital to enhance our care delivery capacities and consumer strategies to improve outcomes and experiences for the people we serve, and for the benefit of the broader health system.” — John Rex, EVP and CFO of UnitedHealth Group

UnitedHealth Group expects it will continue churning out “gobs” of cash flow going forward. These types of bolt-on deals underpin UnitedHealth Group’s longer term growth ambitions, with management also noting that (emphasis added, edits for clarity provided by the company):

“First, there is strong momentum throughout our business. The people we serve are continually seeking value… high-quality care, at fair costs… and our colleagues across Optum and UnitedHealthcare are raising the bar every day. You see that manifested in our business performance — and the strong growth in our core platforms… double-digit growth across the benefits businesses… a growing revenue backlog in Optum Insight… robust growth in our pharmacy services and expansion across Optum Health.

We see tremendous opportunity ahead… and we remain confident in our ability to deliver our long-term 13% to 16% earnings per share growth objective… and further advance our mission to help people live healthier lives and to help make the health system work better for everyone.” —Andrew Witty, CEO of UnitedHealth Group

The company’s bright longer term growth outlook underpins its promising dividend growth trajectory. Historically, UnitedHealth Group has done a solid job integrating new assets into its company-wide operations.

Concluding Thoughts

We are primarily focused on UnitedHealth Group’s immense dividend growth runway which is backed up by its rock-solid cash flow profile, fortress-like balance sheet, promising growth outlook, and its moaty business characteristics. Additionally, shares of UNH have held up quite well in the face of capital market volatility, and we see room for additional capital appreciation upside potential as well. UnitedHealth Group remains one of the favorite dividend growth ideas and we like the firm in our Dividend Growth Newsletter portfolio.

—–

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Related: CHNG, LHCG, XLV

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, META, GOOG, VRTX, and XLE and is long call options on DIS and META. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.