Image Source: United Technologies Investor Presentation

United Technologies completed the acquisition of Rockwell Collins and announced plans to separate into three independent companies.

By Kris Rosemann

Key Takeaways

United Technologies completed its acquisition of Rockwell Collins and now plans to separate into three independent companies: an aerospace and defense supply company, a climate control company, and an elevator company. The separation is expected to be completed in 18-24 months.

The acquisition has resulted in a significant increase in financial leverage, and both Moody’s and S&P lowered United Technologies’ credit rating to three notches above junk territory.

United Technologies is prioritizing deleveraging heading into the separation. No material share repurchases will be executed, and we suspect dividend growth to be paused as well. Management has stated the sum of the three to-be-formed companies’ dividends at the time of the separation will at least equal United Technologies’ current payout.

We currently value shares of United Technologies, which yield ~2.4% as of this writing, at $121 each, and its Dividend Cushion ratio has been lowered to 0.3 as a result of the substantial increase in debt.

—–

Deal Completed; Separation Announced

Conglomerate United Technologies (UTX) announced the completion of its $30 billion acquisition of Rockwell Collins November 26 and simultaneously released plans to separate into three independent companies. Management believes the separation, which is expected to be tax free and completed in 18-24 months, will give each industry-leading business greater strategic focus and financial flexibility to deliver innovative customer solutions in their respective verticals.

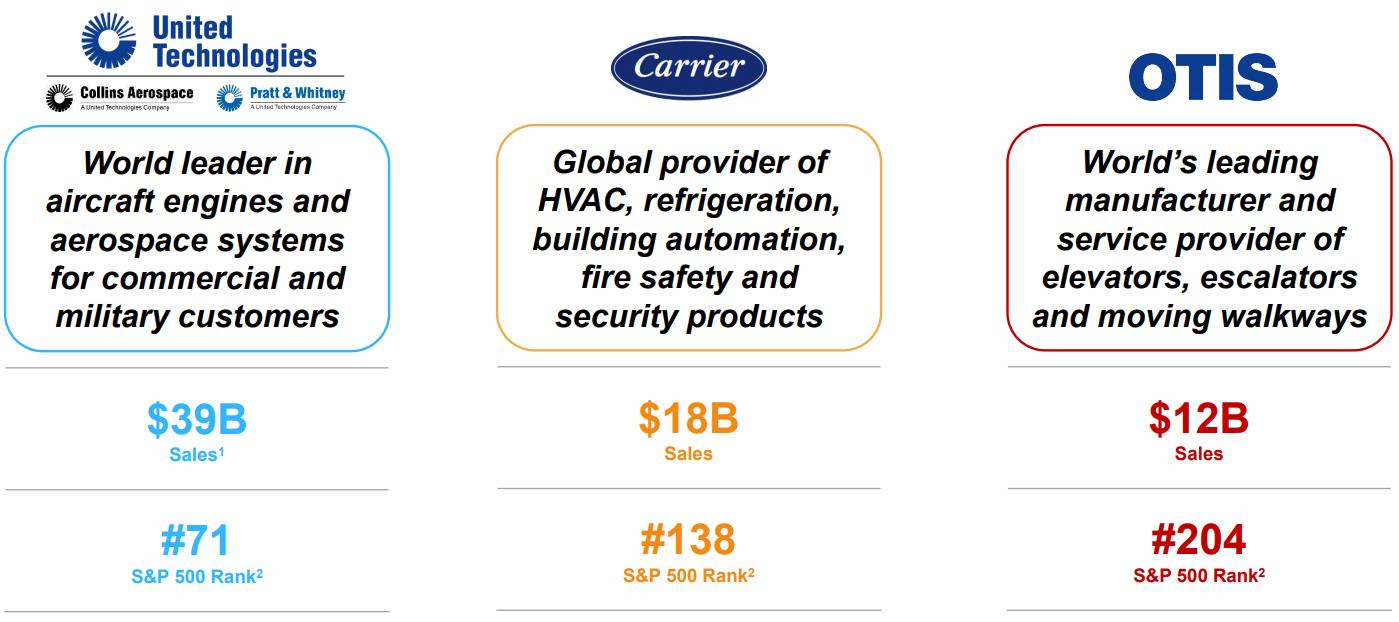

United Technologies will live on as a leading systems supplier to the aerospace and defense industry and will consist of Collins Aerospace Systems and Pratt & Whitney, the former of which was created via the combination of Rockwell Collins and United Technologies’ ‘Aerospace Systems’ business. Otis and Carrier will be the two new independent companies created in the separation. Otis is the world’s leading manufacturer of elevators, escalators, and moving walkways, and Carrier is a global provider of HVAC, refrigeration, building automation, fire safety, and security products.

United Technologies: Leading Aerospace and Defense Systems Supplier

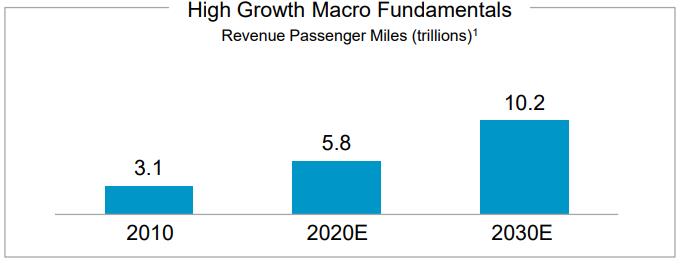

United Technologies expects the formation of Collins Aerospace Systems to result in $500+ million in annual run-rate pre-tax cost synergies by the fourth year after closing, and enhanced digital service offerings were a key factor in the acquisition. The company expects the aerospace and defense systems business (the future United Technologies) to have ~$39 billion in pro forma annual sales in a high-growth market, which management summarizes as GDP++. This growth is at least in part supported by growth in air traffic, as measured by revenue passenger miles, which is expected to grow to 5.8 trillion and 10.2 trillion in 2020 and 2030, respectively from 3.1 trillion in 2010.

The capital intensive aerospace and defense company will have a very long investment cycle with a high aftermarket presence, and it is targeting an EBIT margin in the mid-to-high teens over the long-term. Its Geared Turbofan commercial engine and F135 military engine, the latter of which is a part of the F-35 Joint Strike Fighter program, are driving aircraft engine growth, and a unique technology portfolio should keep it on pace to deliver the next-generation solutions its customers demand. We’re expecting this business to generate robust free cash flow conversion rates despite the aforementioned capital intensity as Rockwell Collins averaged a free cash flow conversion ratio of 110%+ of adjusted net income over the past ten years, and United Technologies’ aerospace business’ free cash flow conversion rate ranges between 80%-100%+ depending where it is in the investment cycle.

Image Source: United Technologies Investor Presentation

Carrier: Provider of HVAC, Refrigeration, Building Automation, Fire Safety, and Security Products

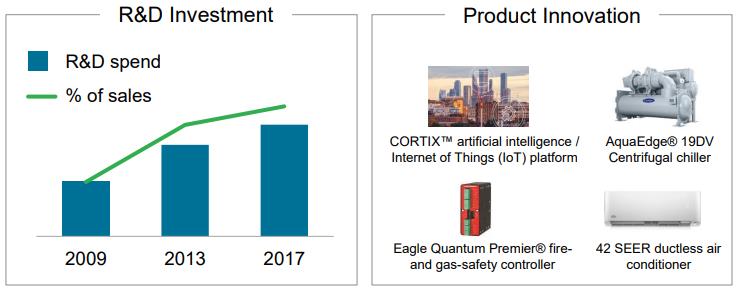

Carrier, the to-be-separated climate control company with annual sales of ~$18 billion, will serve millions of end customers via thousands of channel customers and is a business with mid-level capital intensity. HVAC accounts for roughly half of the business’ sales, and the Americas account for just over half of its revenue. Accelerating new equipment and replacement demand are key drivers of the business, and management expects new product investment to drive sustainable growth above the rate of GDP growth as it continues to pour a growing percentage of sales into R&D spending. The business has released more than 200 new products over the past two years under leading brand names such as Carrier, Kidde, and Edwards. Follow-on M&A should be expected as the company notes there is significant opportunity available for inorganic growth. Carrier is targeting an EBIT margin in the mid-to-high teens over the long haul, and it is exploring the potential divestiture of its fire and safety business.

Image Source: United Technologies Investor Presentation

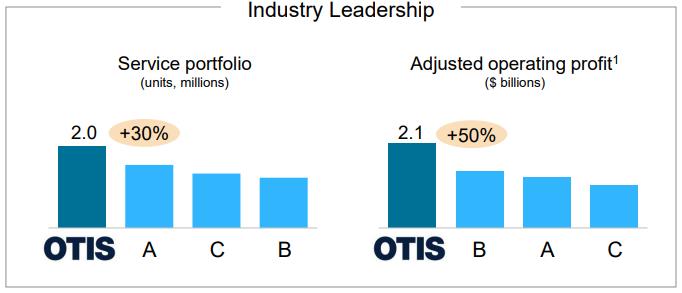

Otis: The World’s Leading Manufacturer of Elevators, Escalators, and Moving Walkways

Otis is the global elevator leader with a 165 year heritage with ~$12 billion in annual sales, and it boasts the largest service portfolio in the market with more than 2 million units under maintenance. Its aftermarket presence is significant and helps shield it from potential cyclicality to a degree as more than half of its sales come from services as opposed to new equipment sales, which also helps keep its overall capital intensity low relative to other legacy United Technologies businesses but also keeps growth expectations roughly in line with GDP. It is nicely diversified geographically with roughly an even percentage of sales coming from the Americas, Asia, and the EMEA region. Management believes its productivity runway is a significant one with the transformation of its service portfolio underway as it targets a mid-to-high teens EBIT margin over the long haul. The company should remain nicely positioned as the leader in its market as it has its next generation of connected solutions now entering its service base.

Image Source: United Technologies Investor Presentation

Financial Leverage and Dividend Implications

Moody’s downgraded United Technologies’ credit rating to Baa1 from A3 after placing the rating on review for downgrade following the Rockwell acquisition announcement as a result of a significant increase in financial leverage that came with the deal, and S&P cut its credit rating for the company after the acquisition was completed and separation plan announced. S&P lowered its rating one notch to BBB+, which matches Moody’s rating as both are three notches above junk territory, and it too cited materially increased indebtedness as the key driver for the lower rating. Higher than expected one-time separation costs, which are currently estimated to be in the $2.5-$3 billion range, have the potential to put additional pressure on profit levels and thus the credit rating.

Management stated that all three of its to-be-separated businesses will work to maintain investment grade credit ratings, and it is committed to strengthening its credit metrics as it looks to set each of the three businesses up to have capital structure and allocation plans tailored to their specific needs. United Technologies is planning for the sum of the three companies’ dividends, and all quarterly dividends leading up to the separation, to be no less than its current quarterly dividend of $0.735, and it does not expect to make significant share repurchases before the separation is executed as it focuses on deleveraging. We’re not expecting an increase in the quarterly dividend either, though management did not explicitly address dividend growth.

Outlook and Conclusion

United Technologies also issued updated guidance for the remainder of 2018. It now expects sales of $64.5-$65 billion, up $500 million from prior guidance, but there are not changes from its previous expectations for 6% year-over-year organic revenue growth. Adjusted earnings per share guidance has been lowered to a range of $7.10-$7.20 from $7.20-$7.30 as a result of dilution from the acquisition, and free cash flow guidance was reduced to $4.25-$4.5 billion from $4.5-$5 billion. $0.15-$0.20 accretion to adjusted earnings per share is expected in 2019 from the purchase of Rockwell, along with $500-$750 million in free cash flow accretion from the deal.

Shares of United Technologies yield ~2.4% as of this writing, and its Dividend Cushion ratio has been lowered to 0.3 due to the massive increase in financial leverage. We currently value shares at $121 each, but the realization of synergies, potential snags in the timing of spin-offs, and integration risk have the potential to weigh on shares. Shares look to be trading roughly in line our fair value estimate, so we’re not interested in adding exposure to the company at this juncture, especially given its sizable debt load. Nevertheless, we look forward to evaluating the businesses leading up to and after the separation.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.