—

Markets are starting to look toppy.

—

By Brian Nelson, CFA

—

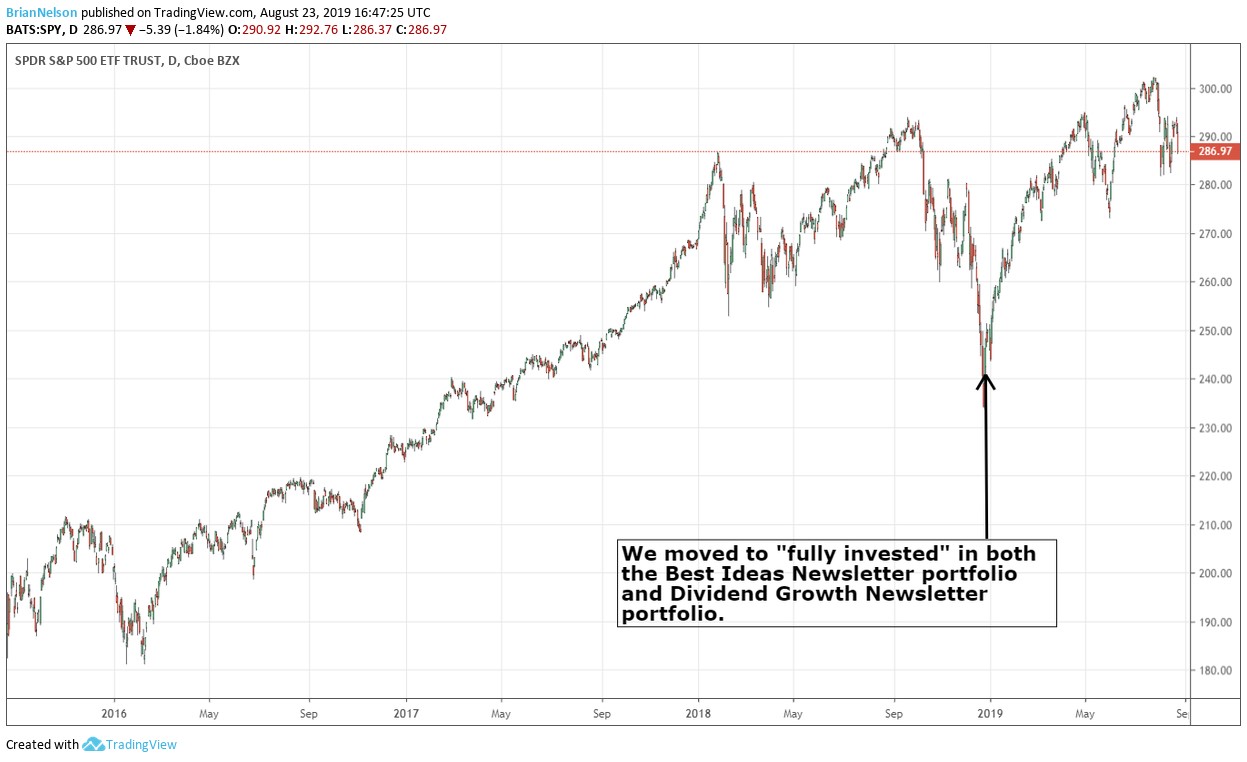

The markets are under heavy pressure Friday, August 23, as China escalated the trade war with new retaliatory tariffs on $75 billion worth of U.S. goods (soybeans and autos), including a 5% tariff on U.S. crude oil prices. Removing the Energy Select Sector SPDR (XLE) from the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio August 14 looks to have been a savvy move. Following the much-anticipated speech from Fed Chairman Powell today, President Trump responded with a series of tweets that showed tremendous frustration with the current situation. Here is the Twitter thread, reproduced below:

—

As usual, the Fed did NOTHING! It is incredible that they can “speak” without knowing or asking what I am doing, which will be announced shortly. We have a very strong dollar and a very weak Fed. I will work “brilliantly” with both, and the U.S. will do great. My only question is, who is our bigger enemy, Jay Powell or Chairman Xi?

—

Our Country has lost, stupidly, Trillions of Dollars with China over many years. They have stolen our Intellectual Property at a rate of Hundreds of Billions of Dollars a year, & they want to continue. I won’t let that happen! We don’t need China and, frankly, would be far better off without them. The vast amounts of money made and stolen by China from the United States, year after year, for decades, will and must STOP. Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bringing your companies HOME and making your products in the USA. I will be responding to China’s Tariffs this afternoon. This is a GREAT opportunity for the United States. Also, I am ordering all carriers, including Fed Ex, Amazon, UPS and the Post Office, to SEARCH FOR & REFUSE, all deliveries of Fentanyl from China (or anywhere else!). Fentanyl kills 100,000 Americans a year. President Xi said this would stop – it didn’t. Our Economy, because of our gains in the last 2 1/2 years, is MUCH larger than that of China. We will keep it that way!

—

Shares of Apple (AAPL), Nike (NKE) and Caterpillar (CAT) sold off aggressively on the news. It seems like China is not backing down anytime soon, and we get the sense that the country will put tremendous pressure on American agriculture and autos, if continually pushed by the White House. We’re not making any moves in the Dividend Growth Newsletter portfolio or Best Ideas Newsletter portfolio at this time. We’re available for any questions.

—

—

—

—

—

Related: FXI, MCHI, RL, WHR, HP, UA, UAA, SPY, DIA, QQQ, USO, OIL

—

———-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.