It’s been a while since we’ve been this excited about a dividend growth stock. We’ll be looking to add Parker-Hannifin to the Dividend Growth Newsletter portfolio soon.

By Callum Turcan

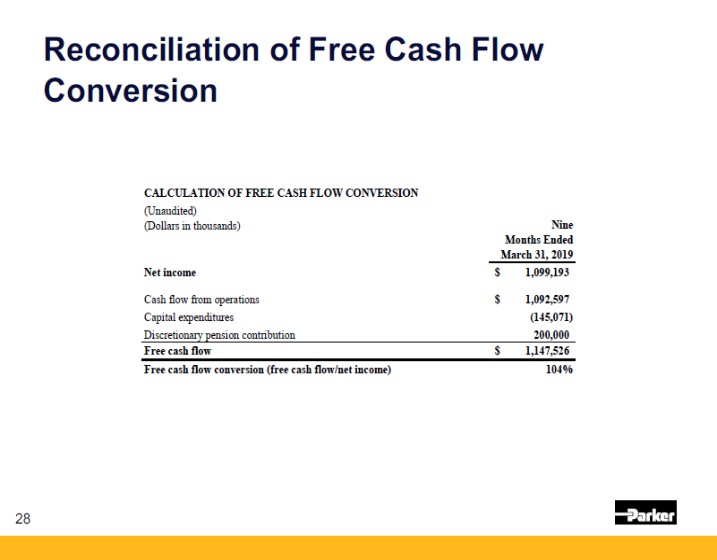

Parker-Hannifin Corporation (PH) is an industrial company that supplies everything from water purification filters to check valves to fuel tank inerting systems to its customers all over the world. The firm yields 2.1% as of this writing and Parker-Hannifin is targeting a dividend payout ratio of 30 – 35% of its net income over the next five years. As Parker-Hannifin continues to grow its bottom line while sporting tremendous free cash flow conversion rate north of 100%, we see the firm as having a very promising dividend growth story. Note that Parker-Hannifin’s fiscal year ends in June. We give Parker-Hannifin a Dividend Cushion ratio of 2.6x which underpins the strength of its dividend growth story. That nearly puts Parker-Hannifin into the Excellent Dividend Safety category but note that its acquisition activity and other factors could change that over time, for the better or for the worse.

Image Shown: Parker-Hannifin’s tremendous free cash flow conversion rate enables the firm to steadily increase its quarterly payout as its business grows, culminating into the dividend growth story we are here to talk about today. Image Source: Parker-Hannifin – IR Presentation

At the end of its fiscal 2018, none of Parker-Hannifin’s customers represented more than 3% of its net sales. The firm has roughly 455,000 customers all over the world and roughly half of its business comes from maintenance, repair, and overhaul operations which helps offset the inherit cyclicality of the industrial space. While the company expects near-term pressure on some of its end businesses, we still expect the company to be materially free cash flow positive in the years to come due to its capital-light business model and ability to generate consistent business.

Parker-Hannifin has consecutively raised its dividend over the past 60 years, earning its status as a Dividend Aristocrat, and keep in mind that growth rate has picked up pace in recent years. In late-2013, the company’s quarterly payout stood at $0.45 per share. By mid-2019, Parker-Hannifin’s quarterly payout had increased to $0.88 per share after its latest dividend increase in April 2019.

Financial Overview

At the end of March 31, 2019 (Parker-Hannifin’s third quarter for its FY2019), the company was sitting on $1.2 billion in cash ($1.1 billion in cash & cash equivalents plus $0.1 billion in marketable securities & other investments). Stacked up against $5.3 billion total debt ($1.0 billion in short-term debt and $4.3 billion in long-term debt), Parker-Hannifin’s net debt load of $4.1 billion is very manageable considering its strong free cash flow generation.

The company generated $1.1 billion, $1.1 billion, and $1.4 billion in free cash flow in FY2016, FY2017, and FY2018, respectively. That was partially a product of its capital-light business with Parker-Hannifin spending $0.15 billion, $0.2 billion, and $0.25 billion on capital expenditures, respectively, during the aforementioned periods. Rising net operating cash flow (which rose from $1.2 billion in FY2016 to $1.6 billion in FY2018) is a product of rising net income generation and a growing business, which combined with its fiscal discipline, has enabled the firm to become a free cash flow cow.

Parker-Hannifin spent $0.35 billion on its fiscal 2018 dividend payments, which was easily covered by $1.4 billion in free cash flow. However, it’s worth keeping in mind the company has repurchased a substantial amount of shares over the past few years, including $0.4 billion in fiscal 2018. We don’t see this as a major concern considering both capital allocation strategies are relatively tame but we want to highlight how dividend growth needs to be managed alongside share repurchases and other factors (such as acquisitions).

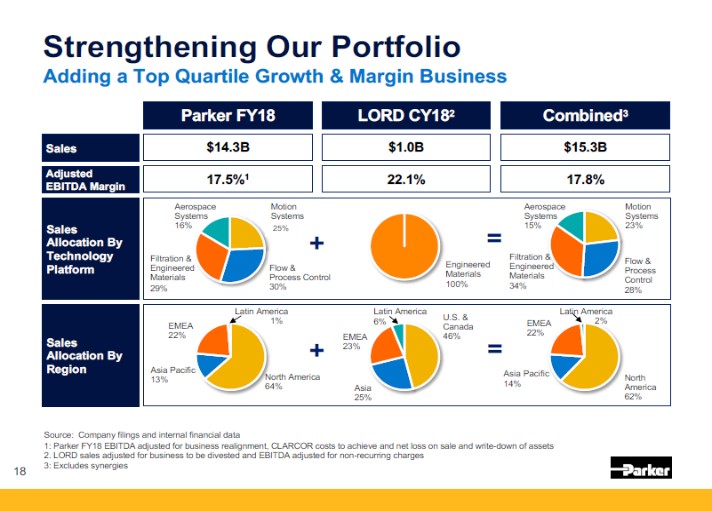

Buying LORD Corporation

In late April 2019, Parker-Hannifin purchased privately-held LORD Corporation for $3.7 billion in cash. LORD Corporation offers “a broad array of advanced adhesives, coatings and specialty materials as well as vibration and motion control technologies” primarily for aerospace, automotive, and industrial uses. LORD Corporation generates $1.1 billion in annual revenue. While there are integration risks to be aware of as Parker-Hannifin merges LORD Corporation’s sales, manufacturing, R&D, logistics, and other operations with its own, we see this deal as largely complementary with Parker-Hannifin’s business model (making it a good fit).

Note that this deal will put medium-term pressure on Parker-Hannifin’s balance sheet as new debt is expected to cover the transaction. Moody’s Corporation (MCO) gives Parker-Hannifin’s unsecured debt a Baa1 investment grade credit rating and reaffirmed that rating on April 30 after news of the LORD Corporation deal broke. With a current ratio of 1.6x at the end of March 2019, Parker-Hannifin should maintain ample liquidity after the deal closes.

During Parker-Hannifin’s third-quarter fiscal year 2019 conference call with investors, CEO and Chairman Tom Williams had this to say about the LORD Corporation purchase;

“This is a strategic portfolio transaction which significantly expands our engineered materials business. It has complementary products, markets and geographies that are aligned to key growth trends, and it’s very culturally aligned with Parker’s values and has a rich history of innovation and product reliability. Strong global brands with long-standing blue-chip customer list that is very similar to our customer list, strengthens material science capabilities, electrification, light weighting, and aerospace offerings, and it’s expected to be accretive to organic sales growth, EBITDA margin and cash flow and EPS, excluding one-time costs and deal-related amortization.”

By 2023, Parker-Hannifin aims to realize $125 million in pre-tax annualized synergies through this acquisition, synergies that appear quite feasible considering the complementary nature of LORD Corporation’s business to Parker-Hannifin’s operations. Those cost savings are expected to come from logistics management, SG&A reductions, and manufacturing efficiency gains. Parker-Hannifin expects to spend $80 million to achieve its expected synergies. The goal of this deal is to capitalize on light weighting (making products like automobiles lighter without sacrificing performance or durability) and electrification trends. Both firms expect the deal to close within the next four to six months.

On an adjusted basis (“adjusted for business to be divested and EBITDA adjusted for non-recurring charges”), Parker-Hannifin notes that LORD Corporation generated $1.0 billion in annual sales with an adjusted EBITDA margin of 22.1% in FY2018 (in terms of the portion of the business Parker-Hannifin doesn’t plan on getting rid of). Note that in FY2018, Parker-Hannifin generated $14.3 billion in sales with an adjusted EBITDA margin of 17.5%, so this acquisition (in theory, we will be monitoring the integration process) could offer profitability upside before taking expected synergies into account.

Image Shown: Parker-Hannifin expects the LORD Corporation acquisition to enhance its adjusted EBITDA margin and grow both its domestic and international presence. Image Source: Parker-Hannifin – IR Presentation

Parker-Hannifin has successfully integrated large acquisitions into its core operations in the past, including its purchase of CLARCOR Inc for $4.3 billion (includes the assumption of debt) in a cash deal back in early 2017. CLARCOR was a major provider of filtration products that when combined with Parker-Hannifin’s offerings, enabled Parker-Hannifin to become a key provider of equipment for product purification and separation needs. More broadly, Parker-Hannifin’s acquisitions tend to be focused on complementary offerings that when combined with its own, enable its customers to have all their industrial equipment needs meet by just one company (at least in certain areas).

Our Thoughts

We recently updated our 16-page Stock Report and our two-page Dividend Report covering Parker-Hannifin. Here are a couple of key excerpts from the updated Stock Report;

“When it comes to industrial entities, Parker-Hannifin is among the strongest. It boasts top quartile performance in free-cash-flow generation and return on invested capital. Investors should keep a close eye on Parker-Hannifin’s operating margins as well, which have expanded nicely as of late. Parker-Hannifin has set the following targets for fiscal 2023: organic sales growth of 150 basis points above the broader industrial markets growth, an operating income margin of 19%, an EPS CAGR of 10%+, and free cash flow conversion at or above 100% of net income.”

Keep in mind we give Parker-Hannifin an Excellent ValueCreation rating and rate its Economic Castle as Attractive. Here are what we see as Parker-Hannifin’s key strengths (from the Dividend Report);

“Parker-Hannifin serves a wide range of end markets, and roughly half of its business comes from maintenance, repair, and overhaul operations, both factors helping to mitigate cyclicality to a degree. The company has raised its dividend for 60 consecutive years, and it has grown the payout at an impressive rate in recent years. Parker-Hannifin has produced $1+ billion in free cash flow in each fiscal year since 2010, and free cash flow conversion is consistently greater than 100%. Efficiency initiatives are projected to help expand operating margins to 19% by fiscal 2023 from nearly 15% in fiscal 2017. This margin expansion is anticipated to fuel a 10% CAGR in EPS through 2023, which will only add to the firm’s dividend potential.”

No company is without its flaws, and Parker-Hannifin is no different. The company operates in a very competitive industry, but firms that target reoccurring business (maintenance, overhaul, and repair activities) tend to perform well which is why we are neutral on the electrical equipment industry. Parker-Hannifin’s net debt load needs to be managed in-line with its free cash flow generation capabilities, and how its acquisition activity plays out could have major implications for its net debt position over the long-term. Integration risks are always prevalent as well. Here are what we see as Parker-Hannifin’s potential downside risks (also from the Dividend Report);

“With such a strong Dividend Cushion ratio, it can be difficult finding material weaknesses in Parker-Hannifin’s dividend. Competing uses of cash have the potential to impact the firm’s pace of dividend expansion moving forward. For example, the company is in the midst of a robust share repurchase program and bought back ~$1.3 billion in shares in fiscal 2015-2018. The firm is tied to a number of cyclical end markets, and coinciding troughs in these markets’ economic cycles could impact free cash flow generation and the trajectory of dividend growth. Though Parker-Hannifin is expecting pressure in a number of its end markets in the near term, we aren’t concerned about the health of its dividend due to its strong free cash flow generation.”

Concluding Thoughts

Parker-Hannifin’s dividend growth trajectory looks very promising and we will be monitoring the integration of LORD Corporation’s operations into its own going forward. Due to management’s past successes when it comes to merging industrial operations into one cohesive unit, there is ample room for optimism. As of this writing, Parker-Hannifin trades near the midpoint of our range of fair value estimate outcomes and yields 2.1%. Strong EPS growth expectations sets the stage for its promising dividend growth potential.

Electrical Equipment: A, EMR, GRMN, LII, PH, PNR, ROP, TRMB

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.