Image Source: SmileDirectClub Inc – S-1 SEC Filing

By Callum Turcan

SmileDirectClub (SDC), the teledentistry startup that makes 3D-printed clear aligners which are a cheaper alternative to braces (albeit with drawbacks when compared to the traditional braces route), went public this September at $23/share. The stock has come under pressure since then over concerns regarding its mounting losses. What makes SmileDirectClub different than traditional orthodontics practices is that customers don’t necessarily need to go into an office to get these types of services. The company has its SmileShops where customer’s teeth can be scanned in-store within half an hour, or offers remote impression kits that are shipped to the customer’s house and then shipped back. Another important consideration is that in-person checkups aren’t required, drastically reducing the cost to consumers, as telecommunication checkups are utilized instead.

Covering SmileDirectClub

While revenues at the company almost tripled from 2017 to 2018 and its GAAP gross margin rose by over 1200 basis points during this period to north of 68%, indicating its business model is potentially scalable, rising operating expenses saw its net loss more than double over this timeframe. SmileDirectClub is pouring money into marketing to bolster top line growth, and at some point, management will need to curtail spending growth in order to allow incremental operating profit to flow down to the bottom line. On the plus side, the company was able to trim its non-GAAP adjusted EBITDA losses in 2018 versus 2017 levels by a decent chunk. Considering SmileDirectClub’s GAAP gross margins are expanding alongside revenues, it appears the business model is very scalable, unlike an Uber Technologies (UBER) or Lyft Inc (LYFT).

One of the big concerns facing SmileDirectClub is whether state regulations covering the telehealth industry will change for the better or worse. If (for instance) pressure from dentistry practices and orthodontics lobbying groups were successfully in implementing rules state-by-state that said these types of orthodontics services can only be rendered in-store and require constant in-person checkups (as compared to checkups performed online via telecommunication services), that would force SmileDirectClub to fundamentally change its business model or worse. That being said, the cost of a two-year SmileDirectClub plan is $1,895, markedly lower than traditional offerings which can quickly approach five figures. State regulators would likely take the need for competition in America’s orthodontics and healthcare industry at-large into account before making any big regulatory changes. We will be monitoring this situation going forward.

Covering Align Technology

We recently took a closer look at our valuation model for Align Technology (ALGN), maker of Invisalign (a competing clear aligner product), and want to highlight that we trimmed our fair value estimate for shares of ALGN due to lower than expected earnings leverage. Revenue growth at Align Technology remains strong but the competitive threats from SmileDirectClub are quite substantial as Align generates ~90% of sales from the Invisalign System. Shares of ALGN are trading below our fair value estimate as of this writing, but we can’t stress enough that the very poor technical performance of Align indicates investors are expecting tougher times lay just ahead. We are staying far away from the company.

In general, we like the medical instruments industry, particularly because of the ability for firms to hold patents and trade secrets that enable material shareholder value generation. Some of Align’s patents started expiring in 2017, weakening its competitive position at a time of rising competitive pressures. Here’s what we had to say about Align from its recently updated 16-page Stock Report (which can be accessed here):

“Align Technology makes Invisalign, a proprietary method for treating malocclusion, or the misalignment of teeth. Invisalign uses a series of clear, nearly invisible, removable appliances that gently move teeth to a desired final position. The Invisalign System accounts for approximately 90% of revenue. SmileDirectClub is a new rival. Align has significant opportunity within its current market, but new clear aligner systems from Dentsply Sirona (XRAY) and 3M (MMM) have been approved by the FDA. The company still expects to grow revenue at a solid double-digit rate despite some patent expirations that began taking place in 2017.

The Invisalign system seeks to capitalize on a clinical dental condition that affects a billion people, or roughly 50%-75% of the population of developed countries. As many as 10 million people each year that elect treatment by orthodontists across the globe, of which 6 million are applicable to Invisalign treatment, and ~300 million more people have similar conditions but are unlikely to seek treatment through a doctor.

The teen market remains one of the largest growth opportunities for Invisalign, and it has been a source of strength in recent quarters. Align continues to invest in product applicability to increase doctor confidence. The company also continues to invest in its technology to optimize its fitting process, and international opportunities are material. Align continues to target growth in the general practitioner dentist market as evidenced by its recent launch of Invisalign Go. The company’s long-term target model includes revenue growth of 20%-30%, a gross margin of 73%-78%, and an operating margin of 25%-30%.”

Additionally, Align was forced to close its Invisalign stores (roughly a dozen) earlier this year due to an arbitration ruling as Align had a non-compete agreement with SmileDirectClub. Align has a supply agreement with SmileDirectClub that expires in 2019 and isn’t expected to be renewed, and as an aside, the firm also owns a large equity stake in SDC (around ~19% before the IPO and other activities, which might have changed the percent equity ownership interest) that will likely get divested over time. That non-compete agreement runs through 2022 and prevents Align from selling certain services in physical stores. Align sells its Invisalign system directly to brick-and-mortar stores (such as dentist offices) who then sell the clear aligner product and related services to relevant consumers.

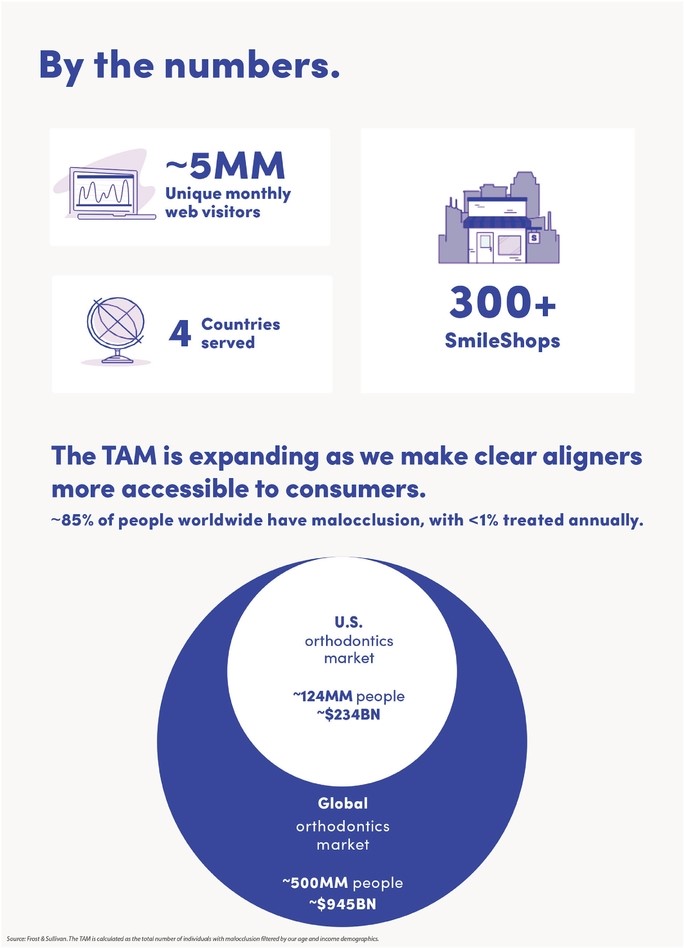

SmileDirectClub is very optimistic on the growth runway the orthodontics and telehealth industry offers as you can see in the graphic below. There’s room for several players in this space, but existing firms are clearly getting disrupted by newer entrants.

Image Shown: SmileDirectClub is optimistic about the size of the total addressable market it seeks to disrupt. Image Source: SmileDirectClub Inc – S-1 SEC Filing

Concluding Thoughts

While SmileDirectClub’s growth trajectory is quite intriguing, we prefer to wait until we get a better idea of the regulatory landscape the start-up faces and what its financial performance will look like now that it’s a public entity in the limelight. For Align, we are staying firmly away from the company as competitive pressures will continue to mount going forward. Neither company pays out a common dividend at this time.

Medical Instruments Industry – ALGN BAX BDX BSX COO HRC MTD RMD SYK TMO

Related – XRAY MMM, XLV

—-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.