What a roller coaster ride in Teva’s shares. After converging to intrinsic value, Teva’s shares have fallen from grace. Unfortunately, our excitement over this big winner has turned to agony. But is the bottom finally in? What has happened in the past is now behind us, and we have to continue to look forward with respect to our analysis of shares.

By Alexander J. Poulos and Brian Nelson, CFA

Best Ideas Newsletter portfolio holding Teva Pharmaceuticals (TEVA) continues to suffer along with the entire healthcare complex as we usher in the New Year. Once a big winner in the Best Ideas Newsletter portfolio even just a few months ago, shares have now fallen from grace. We’re not happy about this at all, and we think it represents a failure on our part in not removing the company from the Best Ideas Newsletter portfolio when we should have. We clearly dropped the ball on this one, and you may be asking: “How did we let this big winner get away from us?”

The answer is quite simple. Lacking exposure to the broader equity market during these “frothy” times, we had decided to let this big winner run after it converged to fair value in April 2015 (and it was only a small position at cost), but the decision to do so has clearly come back to bite us in a big way. You may say that we nailed the valuation dynamics for shares, and the Valuentum Buying Index rating system did what it was supposed to do, but we didn’t execute effectively at the portfolio management level. Said differently, our valuation processes and methodology worked wonderfully, but broader market dynamics kept us involved when we should have taken profits off the table.

What has happened in the past is now behind us, however, and today, we have the difficult task of having to evaluate Teva with a fresh mind on a go-forward basis, both with respect to the company’s ongoing fundamentals and whether it should remain in the Best Ideas Newsletter portfolio. Our experience with Teva is one of the most disappointing situations we’ve ever been in–watching this big winner fall back to cost. Everything about the Valuentum methodology told us to consider removing shares when technicals rolled over at fair value in the mid-$60s. The Valuentum process didn’t fail–we came up short on execution.

Teva Set the Bar Too High and Captured Our Attention

Teva has come under increasing strain post the completion of its merger with Actavis Generics. The tie-up is expected to significantly broaden Teva’s product line-up, offering ample opportunities for margin expansion via the rationalization of product lines combined with the reduction of unnecessary costs as economies of scale kick in. The share price, however, continued its downward decline post-closing of the merger in August 2016. A few notable events are worth examining to gauge whether Teva remains worthy of inclusion in our Best Ideas portfolio.

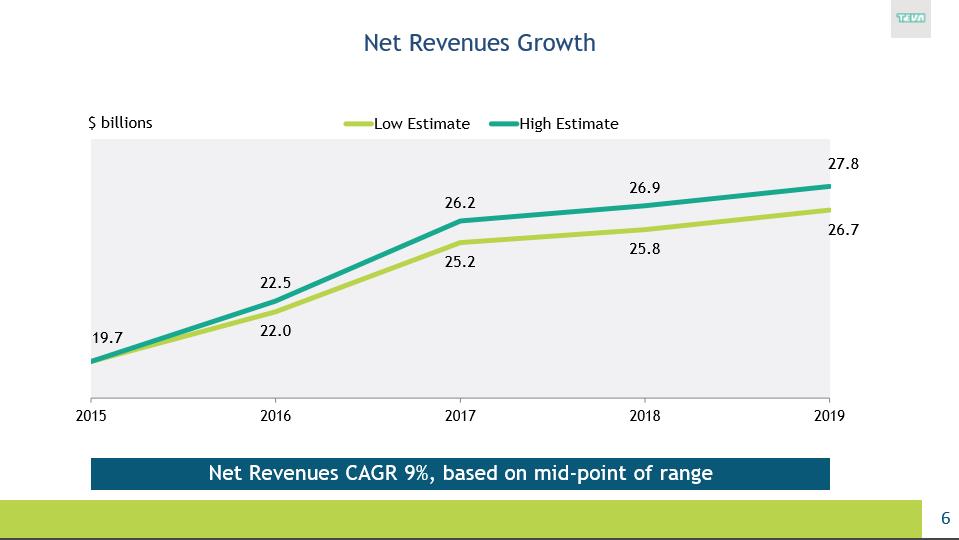

First, the initial enthusiasm on the Street for the acquisition of Actavis Generics ran high as the move was widely expected to drive high-single-digit annual revenue growth through 2019. Optimism simply was running rampant as investors anticipated that the combination of two of the industry’s top generics companies would offer opportunities beyond what either could achieve by their lonesome. Cementing and broadening R&D capabilities, and capturing material cost synergies and tax savings by the end of 2019 were a financial modeler’s dreams, particularly when it came to estimating the value creation generated by the combination.

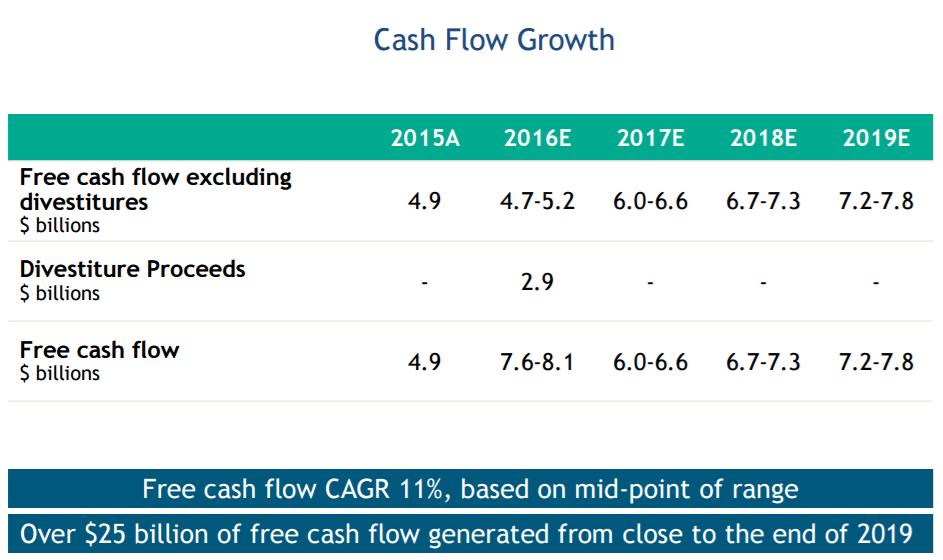

We were enthralled, too, and the pace of expected top line growth was something we could get comfortable with, especially in light of some pressures in its specialty business. What we found most comforting, however, was the sheer amount of expected free cash flow generation of the combination, and how management even felt confident enough to provide a trajectory out to 2019. We love both visibility and transparency when it comes to business models.

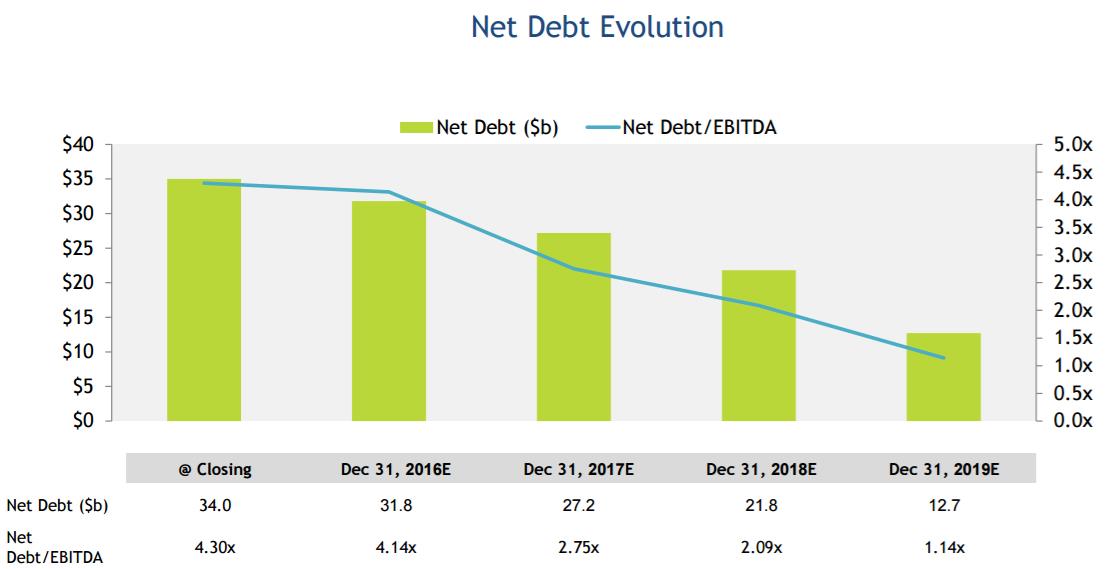

The Teva-Actavis combination was expected to cumulatively bring in more than $25 billion in free cash flow from the close of the deal to the end of 2019. What’s more, such robust free cash flow generation supported by deal synergies would be used to deleverage the company’s post-deal, debt-heavy balance sheet, and at a rapid pace at that. It looked like management had everything figured out. The slides below are management’s initial revenue, free cash flow, and net debt projections published in July of 2016 – going out to 2019. Image Sources: Teva.

The DOJ Investigation and Executive Turnover

The entire healthcare complex remains in transition as political pressure continues to be exerted from both sides of the aisle to contain runaway costs as the pending aging demographic-trend bears down on the government’s budget. Teva has set out an ambitious plan where it can be a leader in helping to hold down costs via its line of multi-source generic medications, and the Actavis deal continues to widely be perceived as an excellent way to build scale to offset the cutthroat methods of the generic industry.

We think Teva is actually in a sweet spot, if it can execute effectively, but the company seems to have dropped the ball, given the US Department of Justice’s investigation into price collusion in the generic drug industry. Teva CEO Erez Vigodman has publicly stated that the company is free-and-clear of any wrongdoing, but the uncertainty continues to punish shares, only exacerbated by a civil complaint filed by 20 states alleging the Teva and rival Mylan (MYL) conspired to “artificially inflate prices on an antibiotic and diabetes drug,” too.

Making matters worse is that a few weeks before the legal challenges, Sigurdur (Siggi) Olafsson the head of Teva’s global generic division announced that he would retire at the end of the first quarter of 2017. The announcement only punished shares further as Olafsson was expected to spearhead the integration of Actavis. The market’s fear is now that the initial revenue, free cash flow, and deleveraging projections, outlined just a few months ago, are too aggressive.

While Olafsson will be staying on to aid his successor, a natural learning curve is in place which may hamper the efforts to integrate Actavis and realize the aggressive synergies expected once the deal was struck. Based on management’s lowering of guidance during the third-quarter conference call, combined with the loss of Olafsson, a credible case can be made the company is well behind in its projections and will spend all of 2017 trying to catch up.

Teva’s 2017 Guidance

Image Source: Teva

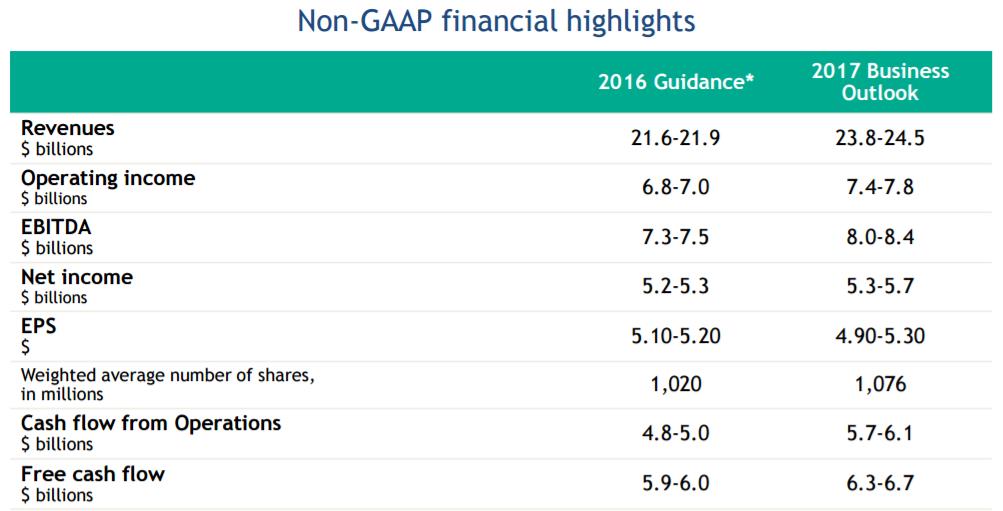

Hoping to assuage the Street’s concerns after a whirlwind of troubling news, Teva issued a business update January 6, 2017, offering updated guidance for 2017. There are a few things worth pointing out about the update.

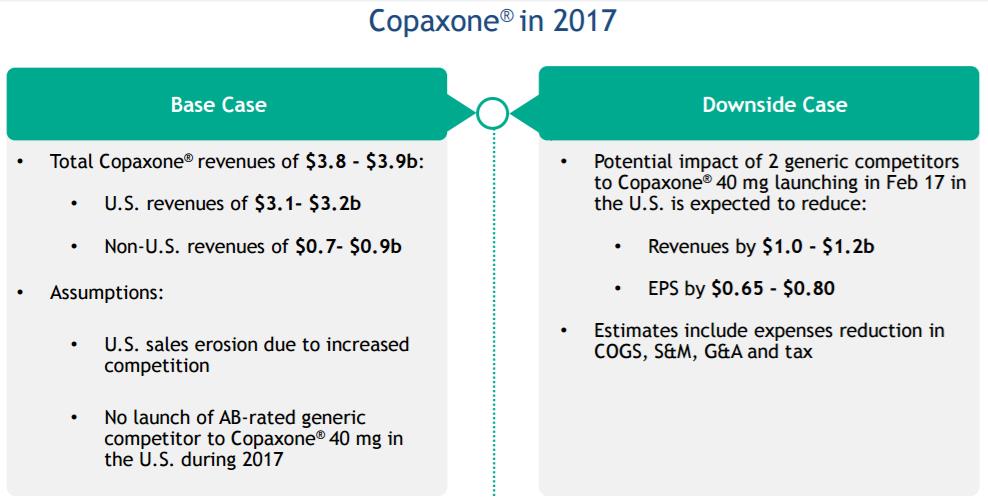

First, utilizing the mid-point of Teva’s lowered revenue forecast for 2017, the company expects to be over $1 billion short of the low-end of revenue guidance issued in July. Management stated that, “the majority of the…gap is attributable to not being able to realize new launches in our Teva legacy business in a way consistent with our past track-record.” If new worries about the legacy business weren’t enough, investors in Teva have to continue to worry about the revenue and profit trajectory of its branded multiple-sclerosis drug Copaxone, which accounts for a meaningful portion of the company’s profits (~36% of total profit). Copaxone’s profit margins are considerable, and any material disruption could add further uncertainty to the future path of Teva’s revenue and profit stream.

Certainly, the company has been fighting to preserve its Capaxone revenue and profit stream against generics for some time, but the ongoing success of this is even difficult for management to predict. Teva’s base-case forecast for Copaxone revenues and profit is reflected in the image above, but should the company face a downside case for the drug, as outlined by management, revenue and earnings-per-share could be impacted by $1-$1.2 billion and by $0.65-$0.80, respectively, or the latter to the range of $4.10-$4.50 per share in 2017 (base case: $4.90-$5.30 per share, as show in the image immediately above).

Image Source: Teva

Under what appears to be a “downside-case” scenario, as outlined by management, Teva’s shares are trading at ~8.6 times forward earnings, and that’s a multiple that implies a lot of things going wrong relative to a base-case outcome. Specifically, embedded in that downside range is the assumption of the potential impact that two generic competitors to Copaxone 40mg will launch in February 2017 (next month) at the beginning of the year. Management notes that such sensitivity analysis assumes it will combat the potential lost revenue with expense reductions (COGS, S&M, G&A, etc.).

Though the investment community may have good cause to lose faith in the precision of management’s guidance, it appears that even if a downside case came to fruition, Teva’s shares still appear to be rather cheap. Most importantly, while free cash flow appears to have come in a little below expectations for 2016, expected free cash flow in 2017 ($6.3-$6.7 billion) is anticipated to be higher than what management had anticipated in July 2016 ($6-$6.6 billion). Of course such expectations are fraught with execution risk and estimation uncertainty, but even if Teva comes in at the low end of that range ($6.3 billion), the company has an implied free cash flow yield of nearly 17% on the basis of 1,076 million shares outstanding at a share price of $35.20 (or a market capitalization of $37.9 billion).

We find this almost hard to believe. Even if free cash flow is halved, Teva’s shares still look incredibly cheap. If management is successful in defending Copaxone, upside could be considerable on the basis of valuation – and if Teva delivers on the promise of its specialty pipeline (shown below), the company’s future revenue and free cash flow streams would gain another pillar in its foundation. Teva is certainly one risky stock, but it looks like the market has punished it way too aggressively given only a fraction of its free-cash-flow generating capacity.

Image Source: Teva

Role of the Dividend

In light of the increase in Teva’s debt load as a result of the Actavis Generics acquisition coupled with a few key events that bring into question management’s ability to accurately forecast its business, we’re not too enthused by the safety of the payout. While management addressed on the conference call that there are no plans at this time to reduce the dividend, if Copaxone losses are faster than the company anticipates, the Dividend Cushion ratio suggests the risk is very high of a cut (it has a very poor Dividend Cushion ratio on a base-case outcome, suggesting material risk).

That said, Teva is included in the Best Ideas Newsletter portfolio, so we don’t include shares solely for the dividend. At a free cash flow yield of ~17%, however, we think the prudent move today is to watch how Teva’s business evolves. In a marketplace where free cash flow yields have been bid down to the low-single-digits, even under a worst-case scenario, Teva’s shares appear to be beaten down too much. The speculative position will remain in the Best Ideas Newsletter portfolio, and we believe the market continues to overreact to uncertainty.