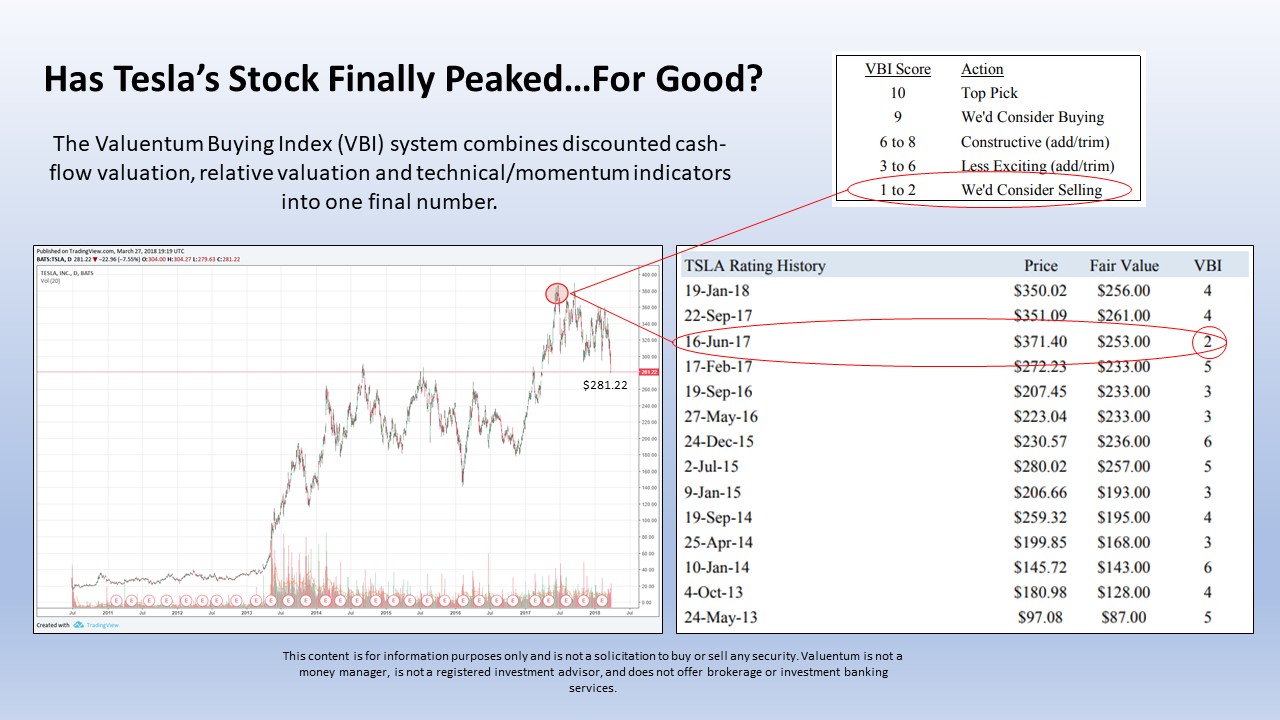

Tesla’s shares have been overpriced for some time, but the Valuentum Buying Index system didn’t raise a big red flag until mid-June of last year. Shares have been getting hammered.

By Brian Nelson, CFA

What more can we say about Tesla (TSLA) other that the stock, itself, may very well be made up of “castles in the air?” A tremendously debt-heavy balance sheet and considerable free-cash-flow burn shouldn’t have merited an equity market capitalization that it once had, and recent developments have moved to deflate some of its bubble. The future for Tesla is far from guaranteed, too, and it looks like autonomous driving may not be coming to a town near you anytime soon after all.

A fatal crash in Arizona March 18 resulted in Uber suspending its self-driving tests, and news that Toyota (TM) would halt its Chauffer autonomous system program shortly followed. Then Nvidia (NVDA), which had been working aggressively to gain share in the automotive market, said it would suspend its self-driving vehicle testing, too. Making matters worse is the most recent tragedy, which resulted in a deadly crash involving a Tesla Model X, where the National Transportation Safety Board noted that it was “unclear if automated control system was active at time of crash.”

We’re not getting swept up in the news, but we do think that public concerns about the safety of self-driving vehicles will only grow. Autonomous driving is a fantastic idea in concept, but we’re talking about some serious real-life situations where having a human behind the wheel may matter. Could parents let their children walk to school (on the cross walks) if self-driving vehicles proliferate? Even one wrongful death could be considered too much, even with data estimating that “94% of crashes involve human error.” Many believe that the “public will be the crash-test dummy for this dangerous experiment” of self-driving cars, and it seems like they might be right.

All eyes will be on Tesla’s quarterly update, where many believe the company will again miss its Model 3 production target. We’re not seeing much value in Tesla’s shares even after the sell-off, and we continue to like shares of General Motors (GM), which offer both nice value and a good dividend yield to boot. Investing in Tesla is too much like gambling.

Update: Moody’s recently downgraded Tesla’s debt further into junk-rated territory. See here.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.