Image Source: Tesla

By Brian Nelson, CFA

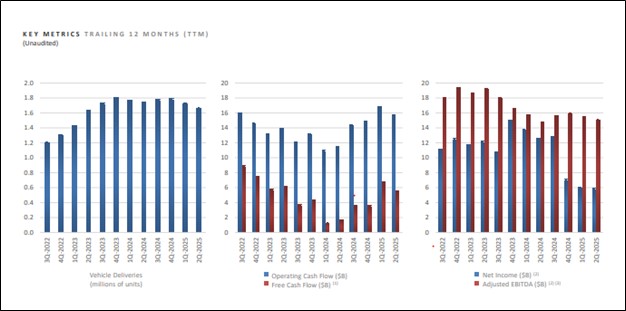

Tesla (TSLA) recently announced second quarter results that were mixed at best. Revenue beat expectations but fell 11.8% year-over-year, while non-GAAP earnings per share of $0.40 was in-line with what the Street was expecting. Total gross profit fell 15% in the quarter on a year-over-year basis while income from operations dropped 42%. Adjusted EBITDA fell 7%, while non-GAAP earnings per share dropped 23%. Management had the following to say about the results:

Q2 2025 was a seminal point in Tesla’s history: the beginning of our transition from leading the electric vehicle and renewable energy industries to also becoming a leader in AI, robotics and related services. Our first Robotaxi service launched in Austin in June. While the service is limited in initial scope, we believe our approach to autonomy – a camera-only architecture with neural networks trained on data from our global fleet of millions of vehicles – allows us to continually improve safety, rapidly scale the network and improve profitability.

We continue to expand our vehicle offering, including first builds of a more affordable model in June, with volume production planned for the second half of 2025. Additionally, we continued development of Semi and Cybercab, both slated for volume production in 2026.

The Energy business is more critical than ever. The availability of clean, reliable energy is necessary for economic growth and an imperative for the development and commercialization of AI enabled products and services. As electricity demand grows, our Megapack product helps to increase utilization of existing generation and transmission capacity, resulting in a more efficient use of the electric grid. When paired with solar PV, Megapack is cost competitive with traditional fossil fuel generation assets and can be deployed 4x faster than traditional fossil fuel plants of the same capacity. Trailing twelve-month Energy storage deployments achieved their 12th consecutive quarterly record.

Despite a sustained uncertain macroeconomic environment resulting from shifting tariffs, unclear impacts from changes to fiscal policy and political sentiment, we continue to make high value investments in CapEx and R&D, while ensuring a strong balance sheet. Our priorities remain the same: delivering affordable and compelling autonomy-capable models that maximize our global fleet of vehicles as our autonomy software continues to rapidly progress, growing the Energy business and advancing our robotics efforts.

Tesla’s cash flow from operating activities was $2.54 billion in the quarter, while it spent $2.4 billion in capex, resulting in free cash flow of $146 million. Its cash and investment balance was up 20% from last year, to $36.8 billion. All things considered, Tesla’s second quarter results weren’t great. The company experienced a decline in vehicle deliveries, lower regulatory credit revenue, reduced vehicle pricing, and a decline in Energy Generation and Storage revenue due to lower average sales prices. Meanwhile, operating income was impacted from higher operating expenses driven by AI and other R&D projects. We remain on the sidelines.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.