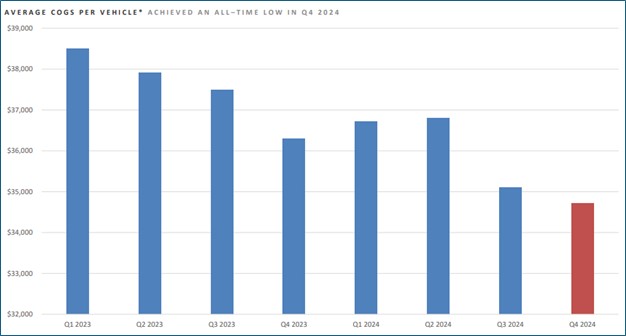

Image: Tesla continues to attack costs with average cost of goods sold per vehicle reaching an all-time low in the fourth quarter of 2024. Image Source: Tesla

By Brian Nelson, CFA

Tesla (TSLA) reported disappointing fourth quarter results on January 29 with revenue and non-GAAP earnings per share coming in below the consensus forecasts. Total revenue advanced just 2% in the quarter, and total gross profit fell 6%, while income from operations dropped 23% on a year-over-year basis. Tesla’s profitability faced pressure as the firm navigated reduced S3XY vehicle average selling prices. Adjusted EBITDA, however, increased 25%, and non-GAAP earnings per share came in at $0.73, up 3% on a year-over-year basis.

Tesla had the following to say about its outlook:

Q4 was a record quarter for both vehicle deliveries and energy storage deployments. We expect Model Y to once again be the best-selling vehicle, of any kind, globally for the full year 2024, and we have made it even better, with the New Model Y now launched in all markets. In 2024, we made significant investments in infrastructure that will spur the next wave of growth for the company, including vehicle manufacturing capabilities for new models, AI training compute and energy storage manufacturing capacity.

Affordability remains top of mind for customers, and we continue to review every aspect of our cost of goods sold (COGS) per vehicle to help alleviate this concern. In Q4, COGS per vehicle reached its lowest level ever at <$35,000, driven largely by raw material cost improvement, helping us to partially offset our investment in compelling financing and lease options.

The Energy business achieved another record in Q4 with its highest-ever gross profit generation. Construction of Megafactory Shanghai was completed in December and will begin ramping this quarter. Powerwall deployments achieved another record quarter as we continue to ramp Powerwall 3 production and launch in additional markets.

2025 will be a seminal year in Tesla’s history as FSD (Supervised) continues to rapidly improve with the aim of ultimately exceeding human levels of safety. This will eventually unlock an unsupervised FSD option for our customers and the Robotaxi business, which we expect to begin launching later this year in parts of the U.S. We also continue to work on launching FSD (Supervised) in Europe and China in 2025.

In the fourth quarter, Model 3/Y production fell 8% on a year-over-year basis, while other models production advanced 25%. Model 3/Y deliveries increased 2%, while other models deliveries advanced 3%. Tesla’s quarterly net cash provided by operating activities increased 10%, to $4.8 billion, while capital spending increased 21%, to $2.8 billion, resulting in free cash flow of $2.03 billion, down 2% on a year-over-year basis. Free cash flow for the full year 2024 was $3.58 billion, down 18% on a year-over-year basis. Tesla ended the calendar year with $36.6 billion in cash, cash equivalents and investments. Though free cash flow faced pressure during 2024, the company remains a net cash rich, free-cash-flow generating powerhouse.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.