Image Source: Tesla

By Brian Nelson, CFA

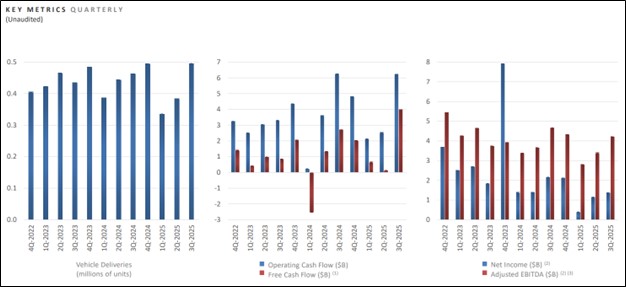

On October 22, Tesla (TSLA) reported mixed third quarter results, with revenue beating the consensus forecast, but non-GAAP earnings per share missing expectations. Total revenue increased 12%, to $28.1 billion, but total gross profit increased a modest 1%, as its GAAP gross margin was squeezed 185 basis points in the period. Income from operations came in at $1.6 billion, which dropped 40% year-over-year, as its operating margin fell 501 basis points. Adjusted EBITDA fell 9% with its adjusted EBITDA margin dropping 348 basis points. Non-GAAP net income fell 29%, while non-GAAP earnings per share fell 31% in the quarter.

Management summarized its quarterly performance as follows:

In Q3, the Tesla team achieved record vehicle deliveries globally, showing strength and growth across all regions, while also achieving record energy storage deployments across the residential, industrial and utility sectors. This strong performance resulted in both record revenue and free cash flow generation in the quarter.

We continue to launch new products that excite our customers across automotive and energy. We launched the Model YL and Model Y Performance and further expanded our vehicle offering with the Model 3 and Model Y Standard, our most affordable vehicles. We also unveiled the Megapack 3 and Megablock, which will further simplify large battery installations by reducing cost and time to deploy. We believe our scale and cost structure will enable us to navigate the shifting market dynamics across the globe more effectively than our peers, with advances in AI making our products the most compelling in the market.

Our focus remains on scaling our core hardware business by maximizing our deliveries and deployments, as these products will deliver increasing value to our customers over time via services powered by AI. Every Tesla vehicle delivered today is designed for autonomy while every Tesla energy storage product is capable of being enhanced and optimized by our virtual power plant or Autobidder functionality. We continue to deliver a fleet of products that brings AI into the real world as we pursue a future of sustainable abundance as outlined in our Master Plan Part IV.

While we face near-term uncertainty from shifting trade, tariff and fiscal policy, we are focused on long-term growth and value creation. We are prudently making the necessary investments in our business, including future business lines, that we believe will drive incredible value for Tesla and the world across transport, energy and robotics.

Tesla’s cash flow from operations was roughly flat year-over-year at $6.24 billion and the company slowed capital spending to $2.25 billion, resulting in free cash flow of nearly $4 billion in the quarter. Cash and cash equivalents totaled $41.65 billion at the end of the quarter versus $7.7 billion in debt and finance leases, resulting in a net cash position of nearly $34 billion. Tesla delivered 497,099 vehicles in the quarter, up 7%, buoyed by a pull-forward in demand from the expiration of the $7,500 government tax credit. Though fourth quarter results may be pressured, the company remains a net cash rich, free cash flow generating powerhouse. The high end of our fair value estimate range stands at $345 per share, however, well below where shares are currently trading.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.