Image Source: Tenneco fourth quarter earnings presentation

We think shares of Tenneco are undervalued as the company gears up to complete a business separation in the back half of 2019, but we’re not interested in the stock as a great deal of uncertainty surrounds not only the company itself but the auto supplier industry in general. Expectations for a decline in global light vehicle production in 2019 coupled with heightened concerns over the pace of global economic growth do not bode well for the group, and the auto landscape is one that may see material change in coming years.

By Kris Rosemann

The auto and transportation space continues to evolve, and companies in all verticals within it are working to set themselves up for long-term success. Auto parts suppliers are jockeying for positioning as an increasing number of specialized suppliers have resulted from changes across the group in recent years. Consolidation may only be beginning as investors and operators mull the future of transportation, and auto technology continues to shift the way we move.

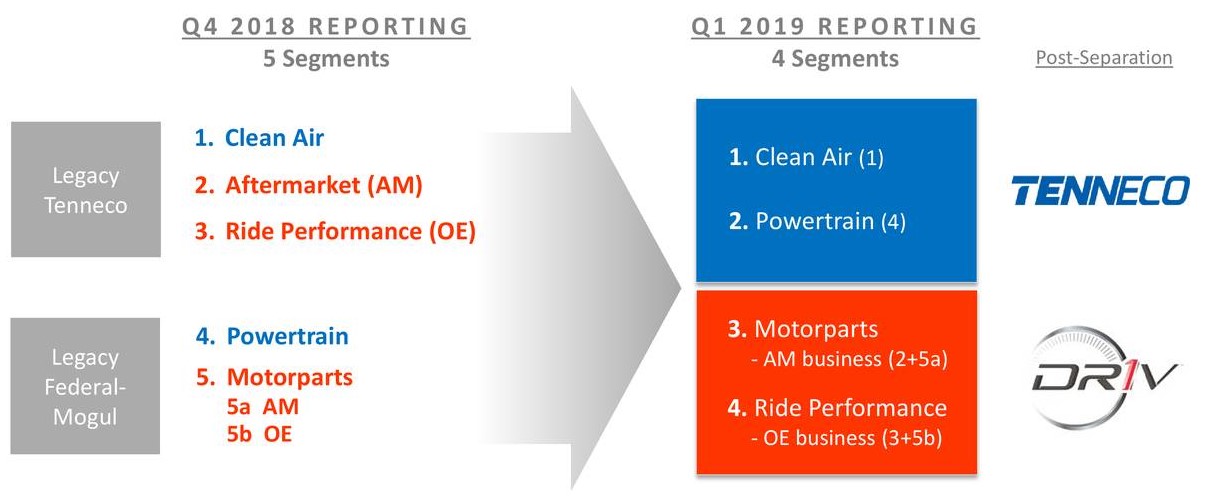

We’ve lowered our fair value estimate for auto parts supplier Tenneco (TEN) after rolling its model forward and incorporating its recent purchase of Federal-Mogul, which came at an enterprise value of $5.4 billion. The recently-combined company plans to separate into two independent, publicly traded companies in the second half of 2019. The new Tenneco will retain Tenneco’s clean air business and Federal-Mogul’s powertrain business, while the newly created company, to be named DRiV, will contain Tenneco’s aftermarket motorparts and original equipment ride performance and Federal-Mogul’s motorparts business.

While we’re not particularly fond of the financial leverage of the post-acquisition company, we like the strategic focus a separation should bring, and DRiV and the new Tenneco will be targeting net debt-to-adjusted EBITDA ratios of 1.5x-2.0x and 1.0x-1.5x, respectively, over the mid to long term. DRiV will hold a relatively higher level of debt due to the less cyclical nature of the aftermarket businesses it will be comprised of, and proceeds from the spin-off will be used to reduce debt at the new Tenneco.

Management expects the combined company’s pro forma revenue growth to outpace global light vehicle production by 6-7 percentage points in 2019, as it anticipates global light vehicle production to fall 2% in the year from 2018 levels and combined Tenneco pro forma revenue growth of 4%-5%. Outperformance is expected to be driven by strength in its commercial truck and off-highway and industrial businesses and light vehicle program launches.

Near-term margin headwinds for Tenneco include higher steel costs, tariffs, and unfavorable market mix as a result of lower volumes in its China and aftermarket businesses. Dis-synergies associated with one-time acquisition and separation costs will also help keep the company’s value-added adjusted EBITDA margin (excludes pass-through revenue from its clean air business) roughly flat in 2019 on a year-over-year basis despite incremental gross synergies of ~$80 million expected.

Upon completion of the separation, DRiV will be one of the largest multi-line aftermarket suppliers and original equipment ride performance and braking suppliers with more than $6 billion in annual revenue. Long-standing relationships with original equipment manufacturers should give it a leg up, and management is quick to point to investment in growth areas such as intelligent suspension and new mobility models as reasons for optimism as the global auto space evolves. The new Tenneco will be among the world’s largest pure-play powertrain companies supplying original equipment markets with a focus on fuel economy, power output, and criteria pollution requirements for gas, diesel, and electric powertrains. We like the renewed focus the separation should bring in these areas of intersection of evolving technology and secular trends, but the new Tenneco will be tied, at least in part, to global light vehicle production, which may face pressure in the near term.

Federal-Mogul was taken private by activist investor Carl Icahn via his firm Icahn Enterprises (IEP) in 2017 when it purchased the remaining 18% of the company it did not already own. Icahn Enterprises received the equivalent of 9.9% of Tenneco’s Class A shares outstanding and nearly 24 million Class B non-voting shares, which together represent ~36% of Tenneco’s total shares outstanding. While Icahn may be cashing out on a portion of his vast span of assets within the auto and transportation space, he stated, “We expect to be meaningful stockholders of Tenneco going forward.”

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.