By Brian Nelson, CFA

On May 22, Target (TGT) reported mixed first quarter results that showed in-line revenue performance but a modest miss on the bottom line relative to the consensus forecast. Target’s results were not as good as Walmart’s (WMT) as Target’s first-quarter comparable sales fell 3.7%, while Walmart’s total U.S. comps showed a nice advance during its first quarter. Target’s adjusted earnings per share in the quarter of $2.03 showed a modest decline from the $2.05 mark it achieved in the same quarter of 2023.

Nonetheless, Target CEO Brian Cornell was optimistic in his comments in the press release:

Our first quarter financial performance was in line with our expectations on both the top and bottom line, tracking the trajectory we outlined for this year and setting up a return to growth in the second quarter. Our topline performance improved for the third consecutive quarter, with growth in our digital business led by strength in our same-day fulfillment services. Consumers continue to respond to the newness and value that we offer across our shopping experience, and we’re pleased with early results from the relaunch of Target Circle. Looking ahead, our team will deliver for our guests through lower prices, a seasonally relevant assortment, ease and convenience, as we keep investing in our strategy and efficiency initiatives to get back to growth and deliver on our longer-term financial goals.

Though Target is working hard to get back on track, it’s difficult for us to grow excited about dabbling in Target’s shares given the stiff 3.1% decline in total revenue in the first quarter coupled with increased competition from Walmart and Costco (COST) that won’t be going away. Looking ahead to the second quarter, Target’s management expects comparable store sales to increase 0%-2% and adjusted earnings per share to come in the range of $1.95-$2.35.

ESG Matters

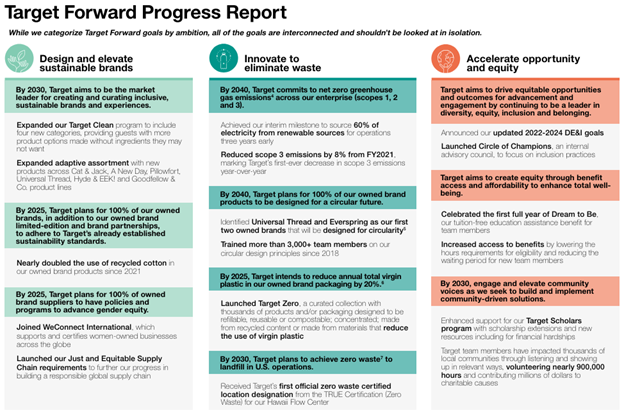

Image Source: Target

The company’s sustainability strategy is called Target Forward and focuses on three initiatives: design and elevate sustainable brands, innovate to eliminate waste, and accelerate opportunity and equity. “By 2025, Target plans for 100% of owned brand suppliers to have policies and programs to advance gender equity.” By 2040, the firm is committed “to net zero greenhouse gas emissions across (its) enterprise.”

By 2030, Target “plans to achieve zero waste to landfill in its U.S. operations.” Target is also heavily focused on renewable energy, and by 2030, is committed “to source 100% of electricity from renewable sources for its operations.” Target is also looking to reduce plastic in its owned brand packaging by 20% by 2025. Women make up 56% of the company’s total workforce and 38% of its Board of Directors.

Concluding Thoughts

For the full year, Target is looking to drive a 0%-2% increase in comps and adjusted earnings per share to come in the range of $8.60-$9.60. Though digital comps and same-day services are key areas of resilience, we’re skeptical Target will achieve its comp expectations for the year without a substantial change in the trajectory of its operations. We think Walmart and Costco are much better positioned for the current market environment than Target.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.