Image Source: Tandem Investor Presentation

Over the past year or so, Tandem Diabetes Care has gone from jockeying for position in the domestic insulin pump market to a global leader in diabetes care technology. Significant growth catalysts remain in place, and the company expects to soon begin realizing meaningful efficiencies of scale as robust top-line growth continues.

By Kris Rosemann

Overview

Tandem Diabetes Care (TNDM) is an innovative medical device company specializing in products for people with insulin-dependent diabetes. It incorporates modern and innovative technology into its offerings, and its competitive advantage is based on its unique consumer-focused approach. The company has commercially launched six insulin pumps, all of which are based in its proprietary technology platform, in the US, and its flagship pump platform, the t:slim X2 Insulin Delivery System, is the smallest durable insulin pump available on the market. The t:slim X2 is the only pump currently available in the US with remote feature update capabilities, which highlights the Tandem’s technology and consumer-focused approach.

Near-Term Expectations and Recent Performance

Tandem expects revenue to grow 39%-47% on a year-over-year basis in 2019 to $255-$270 million, which includes $45-$50 million in international revenue compared to just under $10 million in international revenue in 2018. This substantial top-line growth will be facilitated by the launch of its Basal-IQ technology in international markets and Control-IQ technology domestically. 2019 will mark the first full year of the company having Basal-IQ technology available domestically, which will provide a foundation for ongoing growth in the US market.

Tandem achieved another important milestone in February 2019 when the FDA approved its new t:slim X2 as the first in a new device category called alternate controller enabled (ACE) infusion pumps, and this achievement further highlights the company’s status as an innovator in the insulin pump space in addition to its prior launching of the first touch screen pump in the US, the first pump capable of remote feature updates, among other industry-leading accomplishments.

Management expects ongoing gross margin expansion in the near term, with 2019 guidance for the measure coming in at ~52% compared to 49% in 2018, which was an 8 percentage point improvement over 2017 levels. Drivers of gross margin expansion include growing production volumes, leveraging of fixed overhead costs, manufacturing efficiencies gained from a new facility, the high percentage of pump sales in its product mix, and a growing percentage of infusion set sales subsequent to the launch of its t:lock connector. Long-term gross margin expansion is expected to be provided by reimbursement and new product launches. Potential pressures to gross margin expansion include higher levels of international sales, which carry relatively lower margins, and potentially rising levels of stock-based compensation.

Though it has failed to turn a profit on an annual basis, Tandem is making notable headway in achieving its 25%+ long-term operating margin target, and it anticipates breaking even with respect to adjusted EBITDA in 2019 after the measure came in at negative $15 million in 2018. In the fourth quarter of 2018, it achieved a 1% operating margin, and the company was able to generate positive cash flow from operations in the final quarter of 2018, which was ahead of its expectations.

Management does not expect to be free cash flow positive in the first half of 2019 due to capital spending on its facility and manufacturing equipment, the payment of annual incentive compensation awards, and domestic seasonality, which it indicates is typical of its business as only 17% of annual pump shipments are completed in the first quarter on average. EBITDA is projected to be positive on an annual basis in 2020, and cash flow breakeven is expected to be achieved in the back half of 2019.

Fair Value Estimate and Key Drivers

We currently value shares of Tandem at ~$65 each, which is roughly in-line with recent price levels. This fair value estimate incorporates a number of generous but attainable assumptions, including ongoing robust double-digit top-line growth and a 25% operating margin at the end of our five-year forecast period, which is in-line with management’s long-term target operating margin of 25%+. As of the end of 2018, the company held $129 million in cash, cash equivalents, and short-term investments and no debt on the books, a characteristic we like not only due to the boost it provides to its intrinsic value but also due to the financial flexibility it provides in a dynamic and evolving market.

In addition to the assumptions driving gross margin expansion, the projections incorporated in our fair value estimate assume continued adoption of Tandem’s offerings both domestically and internationally, which will require increased penetration rates for pump therapy in both regions. In the US, management believes it can grow pump penetration to more than 50% of people with type 1 diabetes over the long haul from less than 30% as of late 2018, which would require an estimated 350,000 new adopters of the technology. Outside of the US, the company estimates that there are ~3 million people afflicted with type 1 diabetes that are in its long-term target markets, and ~10% of those are anticipated to be pump users.

Beyond its Control-IQ technology, which is its second automated insulin delivery product, management points to t:sport, its next-generation hardware platform that is roughly half the size of t:slim X2, and t:connect, or its connected (mobile) health offering that will provide the foundation for remote control of its pumps, as key products currently in its pipeline, and the ultimate approval of these products and subsequent offerings will be important in achieving the growth rates assumed in our discounted cash flow model. Potentially accelerating market share gains as a result of innovative products hitting the market could fast-track Tandem’s growth and margin expansion trajectory, with pipeline disappointments providing risks in the opposite direction.

Noteworthy Risks

A very recent example of this risk came in the form of an anomaly in its Control-IQ technology software, which has caused the company to suspend use of the feature in the current clinical trial until a software update is available (expected before the end of March). Management continues to expect the launch of its Control-IQ technology in the back half of 2019, subject to successful study completion and FDA review, but the scenario will provide the company an interesting opportunity to showcase the effectiveness of its remote software update tool and the agility of its R&D capabilities. The company states that “manifestations of this anomaly are rare and have not resulted in any reportable adverse events,” but a threat has been posed to its formerly assumed timeline for the offering’s launch. Prior expectations were for the study to be completed in April with launch targeted prior to the end of the third quarter of 2019.

In addition to material execution risk related to executing on its product pipeline and retaining its innovative approach, other hurdles lie in Tandem achieving its long-term goals and our top-line growth assumptions. The company faces notable competition in the diabetes market and may encounter challengers with substantially more resources than Tandem. Some may eventually set ambitious expectations with respect to bringing next-generation products to market. That said, Tandem’s management is confident in its ability to continue to compete with rivals in this regard, but any slip up in its pipeline could spell material short term pain and impact the trajectory of its growth in the years ahead.

Tandem relies on a select number of domestic distributors for a material portion of its revenues, and none of its independent distributors in the US are required to sell its products exclusively and may sell competing products. In 2018, its top two distributors accounted for 19.4% and 15.6% of total sales, respectively. Tandem also faces typical risks associated with personal medical device providers related to the need to retain adequate coverage or reimbursement for its products by third-party payers such as insurance companies, preferred provider organizations, and other managed care providers, which is necessary to continue adoption of its products.

Upside Potential

Upside potential for Tandem exists in the event it is able to capture a larger than currently anticipated market. Management indicates that in addition to its target for pump penetration to reach 50%+ type 1 diabetes patients, roughly 1.6 million people in the US with type 2 diabetes are candidates for pump therapy. While competition is present in the form of larger entities developing pump products specifically targeted at people with type 2 diabetes, tapping into this market in a greater capacity could provide additional top-line growth, which then has the potential to further expedite the operating leverage management expects to achieve as its business scales.

This may not be an immediately realizable scenario, however, as Tandem admittedly has less experience in marketing and selling to customers with type 2 diabetes. In the event this upside potential is to be captured, regulatory approval for additional devices in its pipeline will be necessary. Expansion into international markets beyond Tandem’s current plans, which include Australia, Italy, New Zealand, Scandinavia, South Africa, Spain, and the UK, could also provide sustained robust top-line growth beyond our current expectations, though such expansion could come at the expense of margin performance in the early stages.

We have already seen Tandem outperform internal expectations on multiple occasions in the recent past, and we can’t rule that out moving forward. Though our assumptions are largely in-line with management commentary, upside surprises are a real possibility, and just as a slip up in Tandem’s pipeline development can impact its growth trajectory, the same can be said for its competitors.

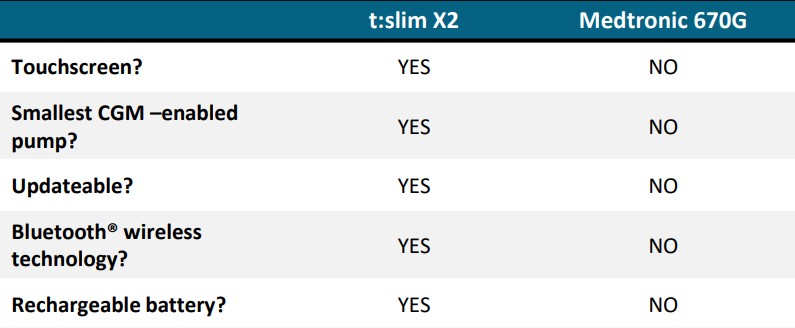

Image Shown: comparative advantages of Tandem’s t:slim X2 over Medtronic’s 670G. Source: Tandem Investor Presentation

Gross margin expansion has been historically driven by volume, efficiency, and reliability, and the potential for any of these three variables to exceed current expectations could expedite the company’s quest for a 25%+ operating margin. New products and reimbursement could augment gross margin expansion moving forward, and the company is working to demonstrate the savings its products can provide for insurance payers with the goal of securing incremental reimbursement. This incremental reimbursement, specifically related to its new Control-IQ technology, has not been factored into management’s guidance.

Conclusion

All things considered, we view Tandem Diabetes Care as fairly valued at current levels, but outperformance could drive shares towards the upper bound of our fair value estimate range (in the high-$70s per share). Execution risk remains in accomplishing the company’s long-term goals, but improving profitability measures and a slowing cash burn are encouraging signs for investors that the company is moving in the right direction as pump penetration rates and adoption of its products continue to increase. The scalabilty of the business is worth watching as it relates to long-term operating margin potential, but we find management’s expectations with respect to gross margin expansion achievable, even if they are not without challenges. Tandem is not as diversified as we would like, when compared to larger and more diverse medical device manufacturers, but unless significant disruption occurs in the insulin-dependent diabetes market, Tandem has a long runway of growth.

Medical Devices: BIO, BRKR, EW, ISRG, MDT, MSA, STE, VAR, WAT, ZBH

Medical Instruments: ALGN, BAX, BDX, BSX, COO, HRC, MTD, NUVA, RMD, SYK, TFX, TMO, WST, XRAY

Related: MDT, PODD

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.