Image Source: Taiwan Semi

By Brian Nelson, CFA

On July 17, Taiwan Semiconductor Manufacturing (TSM) reported mixed second quarter results with earnings per ADR exceeding the consensus estimate, but revenue falling a bit short relative to the consensus forecast. In the quarter, consolidated revenue came in at NT$933.79 billion, net income was NT$398.27 billion, and diluted earnings per share was NT$15.36 (US$2.47 per ADR unit). On a year-over-year basis, second quarter revenue increased 38.6%, while net income and diluted earnings per share both increased 60.7%.

On a sequential basis, second quarter results showcased a 11.3% increase in revenue and a 10.2% increase in net income. In US dollars, second quarter revenue was $30.07 billion, beating guidance of $28.4-$29.2 billion, and up 44.4% on a year-over-year basis and 17.8% from the prior quarter. TSM’s gross margin for the quarter was 58.6%, the midpoint better than guidance of 57%-59%, and its operating margin was 49.6%, better than guidance calling for 47%-49%. Net profit margin was 42.7% in the quarter. Looking to third quarter guidance, here is what the company had to say on the conference call:

Based on the current business outlook, we expect our third quarter revenue to be between $31.8 billion and $33 billion, which represents an 8% sequential increase or a 38% year- over-year increase at the midpoint. Based on the exchange rate assumption of $1 to TWD 29, gross margin is expected to be between 55.5% and 57.5%. Operating margin between 45.5% and 47.5%. In addition, we maintain our 2025 capital budget to be between $38 billion and $42 billion.

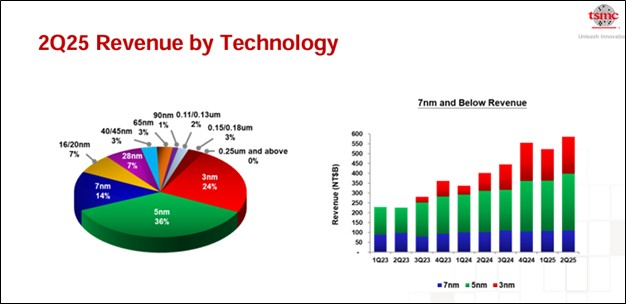

In the second quarter, TSM’s shipments of 3-nanometer accounted for 24% of total wafer revenue, while 5-nanometer accounted for 36%, and 7-nanometer accounted for 14%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 74% of total wafer revenue. The company ended the quarter with NT$2,634.43 billion in cash and marketable securities and NT$883.67 billion in long-term interest-bearing debts. Free cash flow was NT$199.85 billion in the quarter, up from NT$171.99 billion in the second quarter of 2024. We liked TSM’s second quarter results and third quarter guidance and continue to like shares in the ESG Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.