Boeing’s Financials Are Absolutely Frightening

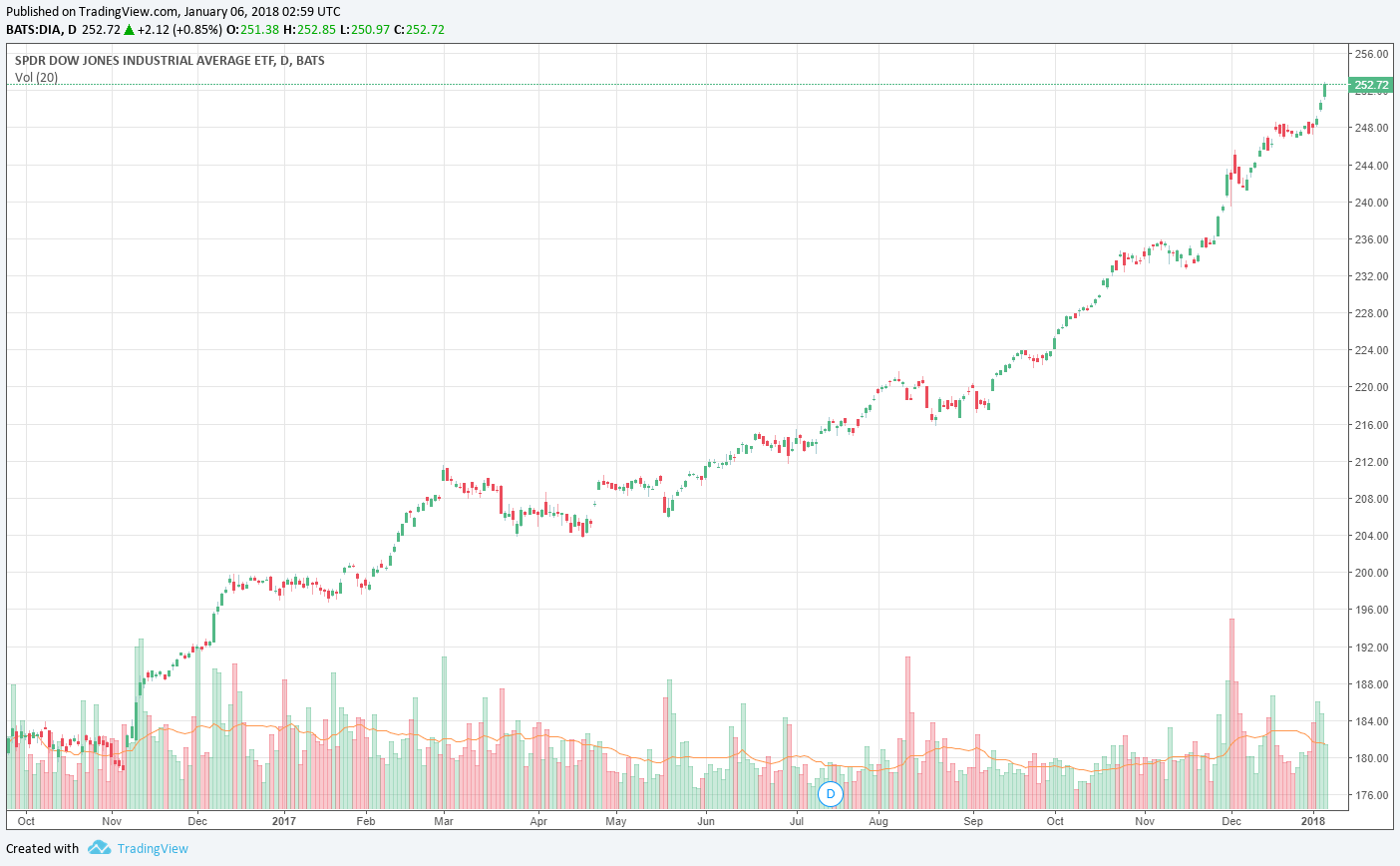

By Brian Nelson, CFA On November 18, 2020, Boeing (BA) announced that the US Federal Aviation Administration (FAA) withdrew its order that had grounded its 737-8s and 737-9s (737 MAX) that had been involved in two terrible accidents during the past few years, a Lion Air flight that killed 189 people and an Ethiopian Airlines jet crash that claimed the lives of 157 more. We’ll never forget these tragedies and the impact on the families and the aviation industry, more generally. In January 2017, we had added Boeing to the Dividend Growth Newsletter portfolio, but we had removed it March 16, 2018, prior to the unfortunate and high-profile accidents that occurred several months after. During the short time it … Read more