Image: Honeywell’s third-quarter 2021 results were mighty impressive. We continue to like what we see at this industrial dividend growth giant. Image Source: Honeywell

By Brian Nelson, CFA

On Friday, October 22, Dividend Growth Newsletter idea Honeywell (HON) reported mixed third-quarter results where revenue growth (+8.7%) fell just short of expectations, while non-GAAP earnings per share bested the consensus mark by a modest margin. GAAP earnings fell just shy of the market’s views heading into the results, but we continue to like Honeywell as an idea in the Dividend Growth Newsletter portfolio.

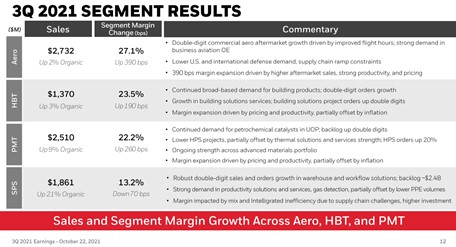

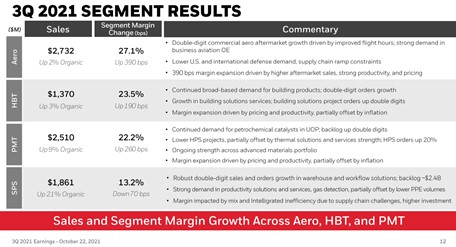

The quarterly headlines were impressive. Organic sales advanced 8% in the quarter, with expansion in all four of its business segments. The company’s operating margin leapt 180 basis points, to 18.6%, while its segment margin advanced to 21.2% in the period. Orders were up “high single digits” and up in the “double digits ex-COVID mask demand.” Here is what Honeywell CEO Darius Adamczyk said about the results:

The third quarter was another strong one for Honeywell, with sales growth in all four segments, significant margin expansion, and exceptional execution even as we faced tough challenges in the supply chain environment. Organic sales grew 8%, led by 38% growth in Aerospace commercial aftermarket, 21% growth in Safety and Productivity Solutions, and 29% growth in UOP and 14% growth in advanced materials within Performance Materials and Technologies. Our focus on operational and commercial excellence enabled us to expand segment margin by 130 basis points to 21.2%, exceeding the high end of our guidance range by 60 basis points. As a result, we delivered adjusted earnings per share of $2.02, up 29% year over year, achieving the high end of our third-quarter guidance range. Our cash performance was strong, and we remain on track to meet our cash flow commitments for the year. We continued to execute on our capital deployment strategy, repurchasing $0.7 billion in shares, announcing our 12th dividend increase in the past 11 years, and completing the acquisition of Performix Inc. to expand our portfolio of automation solutions for the life sciences industry.

Honeywell’s outlook was a bit more cautious than the market was expecting due to a combination of “supply chain constraints, increasing raw material inflation, and labor market challenges,” but the company has done a fantastic job in years past executing in challenging market environments while pursuing productivity enhancements and raising product and service pricing, where appropriate, to offset such cost headwinds.

Image: Honeywell took a haircut to its sales guidance due to supply chain headwinds, but overall, we’re not seeing much to worry about and believe its free cash flow guidance remains quite robust. Image Source: Honeywell

Honeywell’s operating cash flow and free cash flow guidance for 2021 of $5.9-$6.2 billion and $5.3-$5.6 billion, respectively, were unchanged upon the quarterly update, but revenue is expected to take a slight hit to the pace of expansion during the current calendar fourth quarter. A “macro-challenged environment” and “supply chain” constraints are the main culprits, but what gives us continued confidence in Honeywell is its solid backlog growth, which edged higher 7%, to $27.5 billion at the end of the third quarter.

Concluding Thoughts

We loved Honeywell’s third-quarter results, and while we didn’t like the sales guidance adjustment, cash flow trends remain solid, supporting its robust Dividend Cushion ratio of 2.6 and fair value estimate of $243 per share. The company has increased its dividend a dozen times in the past 11 years, and we expect continued dividend growth for many more years to come.

Tickerized for HON, HXL, WWD, GE, BA, ETN, ITW, EMR, JCI, ROP, CARR, TT, PH, ROK, OTIS, CMI, CPRT, SWK, AME, FTV, DOV, IR, GWW, J, IEX, TXT, PWR, MAS, FBHS, PNR, HWM, SNA

—–

Image Source: Value Trap

———-

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.