Image Source: DLR Investor Presentation

In April of this year, we added Digital Realty Trust to the simulated Dividend Growth Newsletter portfolio. We think its addition adds a nice boost to the overall dividend yield to the portfolio.

By Kris Rosemann and Brian Nelson, CFA

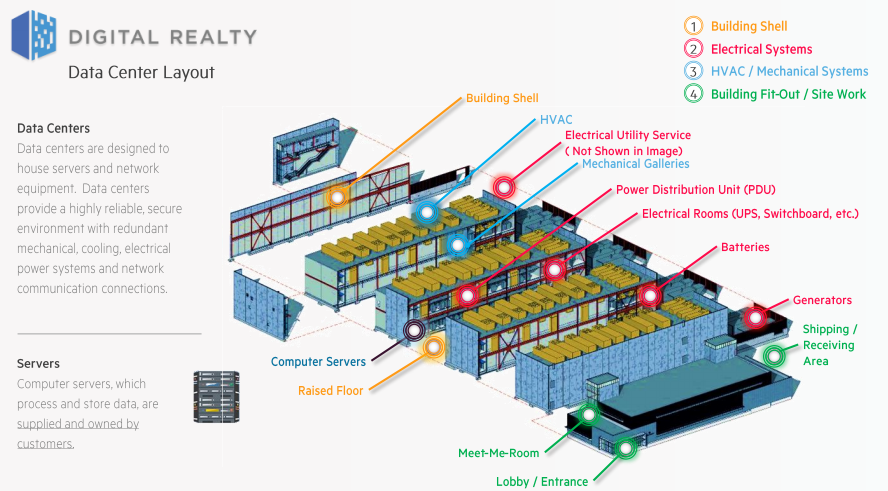

Simulated newsletter portfolio idea Digital Realty (DLR) continues to benefit from the secular trends driving data center demand. The company is among the top-10 largest publicly-traded REITs, and it offers a wide portfolio of data center solutions across the globe (a dozen countries and over 30 metropolitan areas). Digital Realty is well-positioned for the future, as it stands to capitalize on artificial intelligence needs and growth in the Internet of Things (IoT), but it will also benefit from autonomous vehicle growth and positive trends in virtual/augmented reality.

The Cisco Global Cloud Index, for example, estimates that, by 2021, the number of hyperscale data centers will almost double, hyperscale data centers will make up over half of all data center servers, and hyperscale data center traffic will quadruple. North American data center construction continues at a solid rate, but the new supply is being rapidly absorbed by the market. Management estimates that the North American data center space is roughly at equilibrium with a national vacancy rate of 10%. Its top customers include IBM (IBM) at ~6.5%, Facebook (FB) at ~6%, Oracle (ORCL) at ~3% and Verizon (VZ) at about 3%. It has over 2,300 customers in all.

In the first quarter of 2018, results released in April, revenue at Digital Realty leapt 35% on a year-over-year basis, and core funds from operations per-share advanced 7% from the year-ago period to $1.63. Rental rates on renewals in the first quarter were 3.9% higher than the comparable period of 2017 on a cash basis, and management noted growing local origination in key growth markets around the world as reason for optimism related to lease renewals and new bookings. The REIT held more than $9.1 billion in total debt at the end of the first quarter, good for a net debt-to-adjusted EBITDA ratio of 5.3x, and its fixed charge coverage was a healthy 4.3x. We’re not crazy about its leverage, but a high net debt load, unfortunately, is characteristic of the REIT space, in general.

Image Source: DLR Investor Presentation

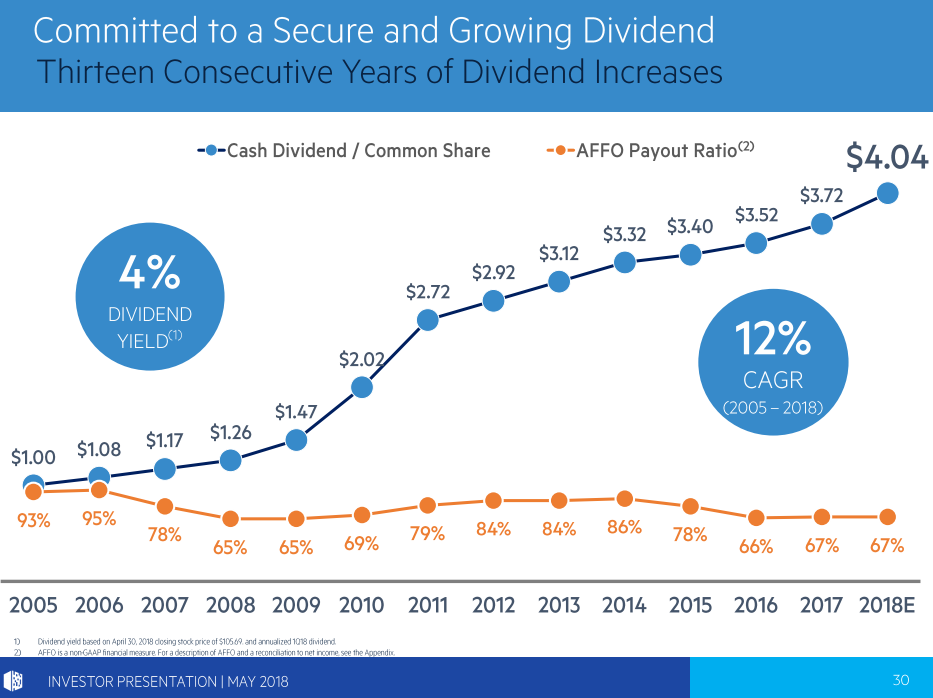

In early March, Digital Realty approved a 9% dividend increase, to $4.04 per share on an annualized basis, with 2018 now marking the thirteenth straight year in which it has raised the payout, each year since its IPO in 2004. The company does not expect to have to tap the outside capital markets for development capital in 2018, instead funding its $1 billion development budget for the year with cash flow from operations and proceeds from asset sales. REITs come with greater risks than net-cash-rich corporates that can stash extra cash on the books from retained earnings, but Digital Realty has a lot of things going for it, and we see no reason to remove this REIT from the simulated Dividend Growth Newsletter portfolio. Shares yield ~3.8% as of this writing.

—–

A version of this article appeared in the May edition of Valuentum’s High Yield Dividend Newlsetter. Subscribe to the High Yield Dividend Newsletter today. See here for more information.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann and Brian Nelson do not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.