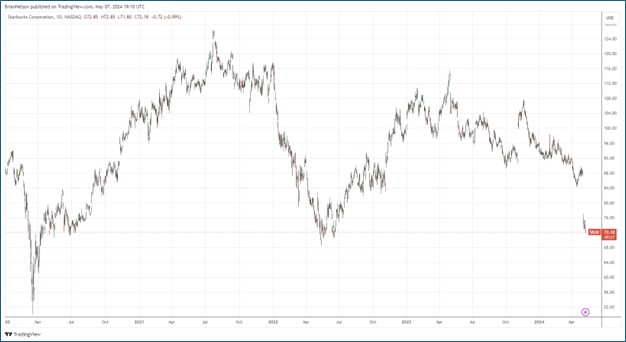

Image: Starbucks’ shares face some challenges as the firm struggles to right the ship.

By Brian Nelson, CFA

On April 30, Starbucks (SBUX) surprised investors with very weak second-quarter 2024 results that showed a miss on both the top and bottom lines. During the fiscal second quarter, global comparable store sales fell 4% as comparable transactions dropped 6%. Weakness was prevalent. North America and U.S. comp sales fell 3%, while international comparable store sales dropped 6%. China comps dropped 11% due to a 8% decline in average ticket and a 4% drop in comparable transactions. During the quarter, Starbucks opened 364 net new stores.

Management admitted that it dropped the ball in the quarter:

In a highly challenged environment, this quarter’s results do not reflect the power of our brand, our capabilities or the opportunities ahead. It did not meet our expectations, but we understand the specific challenges and opportunities immediately in front of us. We have a clear plan to execute and the entire organization is mobilized around it. We are very confident in our long-term and know that our Triple Shot Reinvention with Two Pumps strategy will deliver on the limitless potential of this brand.

While it was a difficult quarter, we learned from our own underperformance and sharpened our focus with a comprehensive roadmap of well thought out actions making the path forward clear. On this path, we remain committed to our disciplined approach to capital allocation as we navigate this complex and dynamic environment.

Comparable store sales suffered, but so did the company’s bottom line in the period. Its GAAP operating margin shrunk 240 basis points on a year-over-year basis as negative operating leverage cut into profits. On a non-GAAP basis, its operating margin fell 150 basis points, while non-GAAP earnings per share dropped 14%, to $0.68, missing consensus by quite a margin.

Looking to the full year of 2024, Starbucks noted on its conference call that global revenue growth is now expected to be in the low-single-digit range, down from prior guidance of 7%-10%. Starbucks also cut its full-year U.S. comparable store sales growth expectation to the range of low-single-digit to flat versus prior expectations of 4%-6%. We’re steering clear of Starbucks as a cautious consumer spending environment and execution remain key issues for the firm. We prefer Domino’s (DPZ) and Chipotle (CMG) instead.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.