Image Source: Author’s Calculations, Chevron Investor Relations

From 2010 to 2017, Chevron’s oil and gas production dropped as output from new producing properties was more than offset by declines at mature fields. By leveraging the company’s extensive unconventional growth runway, management appears to have been able to fix a key structural problem. The revival in Chevron’s upstream production was aided by the completion of two major LNG developments in Australia that offer near-term upside.

By Callum Turcan

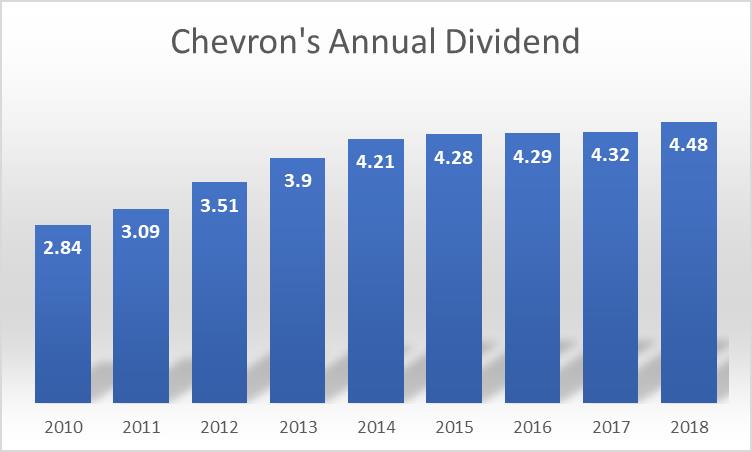

Shares of Chevron Corp (CVX) yield 4.3% as of this writing, and the image above shows annual per share dividend increases from the company since 2010. Its Dividend Cushion ratio currently sits at 1.2. As oil prices followed a generally positive trend from 2010 to 2014, Chevron was able to boost its dividend payments in a notable way, but as we entered “a new normal” in global crude oil markets in 2015 and beyond, the company was forced to keep growth in the payout muted to preserve cash. Lower energy resource pricing weighed on the level of cash flow generated by its upstream operations, an impact that was only exacerbated by a shrinking production base.

Management’s response to lower crude oil prices and a shrinking production base was an aggressive allocation of capital to unconventional plays, including those requiring hydraulic fracturing and horizontal drilling. This was made possible thanks in part to two of Chevron’s long-cycle liquefied natural gas (LNG) projects in Australia being completed, which helped free up capital to be allocated to unconventional opportunities in North America.

Unconventionals Lead the Way

From 2010 to 2017, Chevron’s oil and gas production dropped from 2.8 million barrels of oil equivalent per day (BOE/d) to 2.7 million BOE/d. Natural production declines erode 3%–6% of a mature field’s production every year, but delays at the Chevron-operated Gorgon LNG, Wheatstone LNG, and Big Foot projects also played a role in Chevron’s upstream output slipping lower. After placing a greater emphasis on developing its unconventional portfolio, Chevron’s production increased to 2.9 million BOE/d in the first three quarters of 2018.

Chevron set its 2019 capital expenditure budget at $20 billion, up 9% from its 2018 budget, and the 2019 budget includes $6.3 billion in spending attributed to Chevron’s stake in affiliated companies. Next year, roughly 87% of Chevron’s budget is expected to be allocated towards upstream developments, with the remainder going towards downstream developments and other corporate activities. Chevron’s Permian Basin operations will receive $3.6 billion of that capital next year to enable continued production growth after its stellar performance in the region over the past three years. Another $1.6 billion is allocated towards developing other unconventional plays in Chevron’s portfolio, including the Duvernay in Canada.

Permian Juggernaut

Through its legacy companies, Chevron has been operating in the Permian Basin since the 1920s. Over the course of almost a century, Chevron acquired the lease on 2.2 million net acres in the prolific oil and gas producing region that stretches across West Texas and Southeastern New Mexico. Even better, Chevron pays minimal to no royalties on 80% of that acreage, greatly enhancing its returns in the play. This means that Chevron keeps a greater share of a producing well’s gross revenue due to its ownership of the mineral rights across a large part of its Permian footprint.

It is worth noting that Chevron operates a large conventional legacy position in the Permian, and management differentiates between the two to highlight the firm’s unconventional growth trajectory in the basin.

During Chevron’s third quarter conference call, management stated that the company is operating 20 rigs and participating in the activities of 21 additional rigs (seven net to Chevron when adjusting for working interests) that are actively developing unconventional Permian plays. Elevated levels of drilling activity enabled Chevron to grow its unconventional Permian production by 80% in the third quarter of 2018 compared to the year-ago period; the addition of 150,000 BOE/d to Chevron’s unconventional Permian output brought the division’s production up to 338,000 BOE/d.

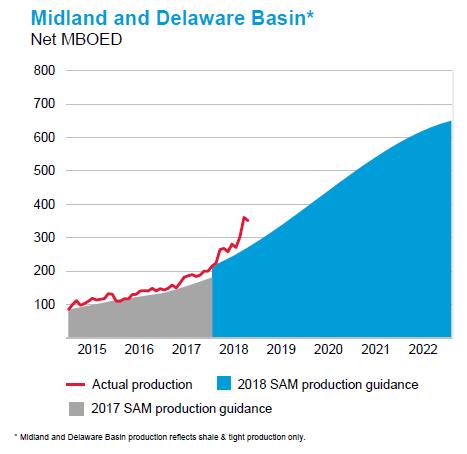

On a company-wide basis, Chevron produced just under 3 million BOE/d during the third quarter of 2018. Its unconventional Permian output stood at just 100,000 BOE/d in 2015, highlighting the powerful impact developing this asset has had on Chevron. As illustrated in the image below, this is just the beginning of Chevron’s strategy in the region. The company plans to double its unconventional Permian production from current levels by the end of 2022 and is already well ahead of schedule.

Image Source: Chevron Corporation – November 2018 Presentation

Up North

In Canada, Chevron is developing the Duvernay formation in partnership with Kuwait Foreign Petroleum Exploration Company, which is owned by state-run Kuwait Petroleum Corporation. Chevron owns 70% of the joint-venture and acts as operator, with KUFPEC owning the remaining interest. The joint-venture has acquired leaseholds on 330,000 gross acres in the liquids-rich Duvernay shale play, which is located in Central Alberta. Unconventional development activities are being utilized to develop the Duvernay formation, with the primary targets being condensate and natural gas liquids-rich well locations.

At the end of last year, Chevron and KUFPEC announced that the JV was moving forward with full-scale development across 55,000 gross acres within the Kaybob region in the Duvernay play. This program involves drilling up to 250 wells and working with regional midstream players to ensure the proper infrastructure is in place as production growth gets underway.

There is plenty of existing infrastructure in the area, but rising production volumes will require further capacity expansions. By early-2018, Chevron had turned 92 wells in the Duvernay play online (that includes wells completed before the development program was launched). As development activities continue, the addition of significant Duvernay production volumes to Chevron’s asset base should complement soaring Permian output.

LNG Projects Operational

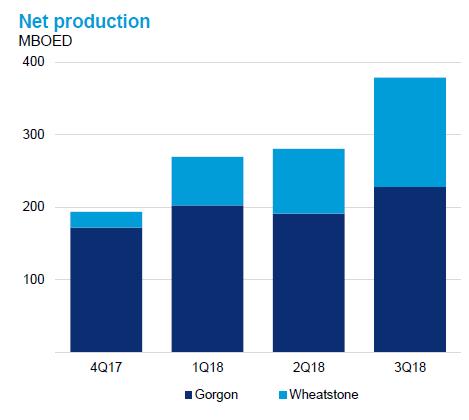

Chevron is the operator of two massive liquefied natural gas export terminals in Australia that were completed over the past three years. The first development is the Gorgon LNG facility, which has the capacity to export 15.6 million metric tons of LNG per year. On the upstream side, the development has the capacity to produce 2.6 billion cubic feet of natural gas and 20,000 barrels of condensate per day. In March 2016, the Gorgon LNG facility shipped off its first LNG cargo. Chevron owns 47% of this venture, and as of the third quarter of 2018, its net share of the Gorgon venture’s output was 228,000 BOE/d.

Pivoting to the Wheatstone LNG facility, this terminal has the capacity to export 8.9 million metric tons of LNG per year. Chevron owns 64% of the LNG terminal and like at the Gorgon venture, is the operator of the facility. On a side note, Chevron owns 80% of the offshore licenses containing the Wheatstone and Iago fields that are supplying gas to the LNG terminal. The facility’s first LNG train shipped out its first cargo on October 2017, and the second LNG train started operations in June 2018 (cargos from Train 2 commenced in July at the latest).

As of the third quarter of 2018, Chevron’s net share of the Wheatstone facility’s production was 151,000 BOE/d. We expect that figure to move higher in the coming quarters due to domestic gas sales slated to begin in 2019 and the completion of maintenance activity that impacted output during the third quarter of 2018. As previously stated, it was essential to bring both developments online. Not only are these LNG developments powerful upstream growth catalysts, but now that both projects are completed, capital that was previously allocated to long-cycle projects can flow to developing Chevron’s unconventional operations.

Image Source: Chevron Corporation – November 2018 Presentation

Conclusion

During the first three quarters of 2018, over three-quarters of Chevron’s earnings came from its upstream operations, and the company’s oil and gas production base is no longer moving lower, which had been cause for concern. By targeting short-cycle opportunities in North America following the completion of its two massive LNG projects in Australia, Chevron may have found the recipe it needs to revive its upstream production base. That won’t be enough to offset the recent tumble in global oil prices, but it does highlight how management appears to have fixed a structural flaw. If or when energy resource prices cooperate, Chevron’s free cash flow generation should follow suit, which directly enhances its dividend growth potential.

We’re staying on the sidelines with respect to Chevron as a candidate for the simulated Dividend Growth Newsletter portfolio. The company’s Dividend Cushion ratio currently sits at 1.2, highlighting the inherent risk of depending on volatile energy resource pricing and its large, albeit materially improved, net debt position of ~$26.4 billion at the end of the third quarter of 2018 (was ~$33.9 billion at the end of 2017).

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.