|

|

Recent Articles

-

Valuentum: Now Bearish, We’ve Been Here Every Step of the Way

Valuentum: Now Bearish, We’ve Been Here Every Step of the Way

Sep 5, 2022

-

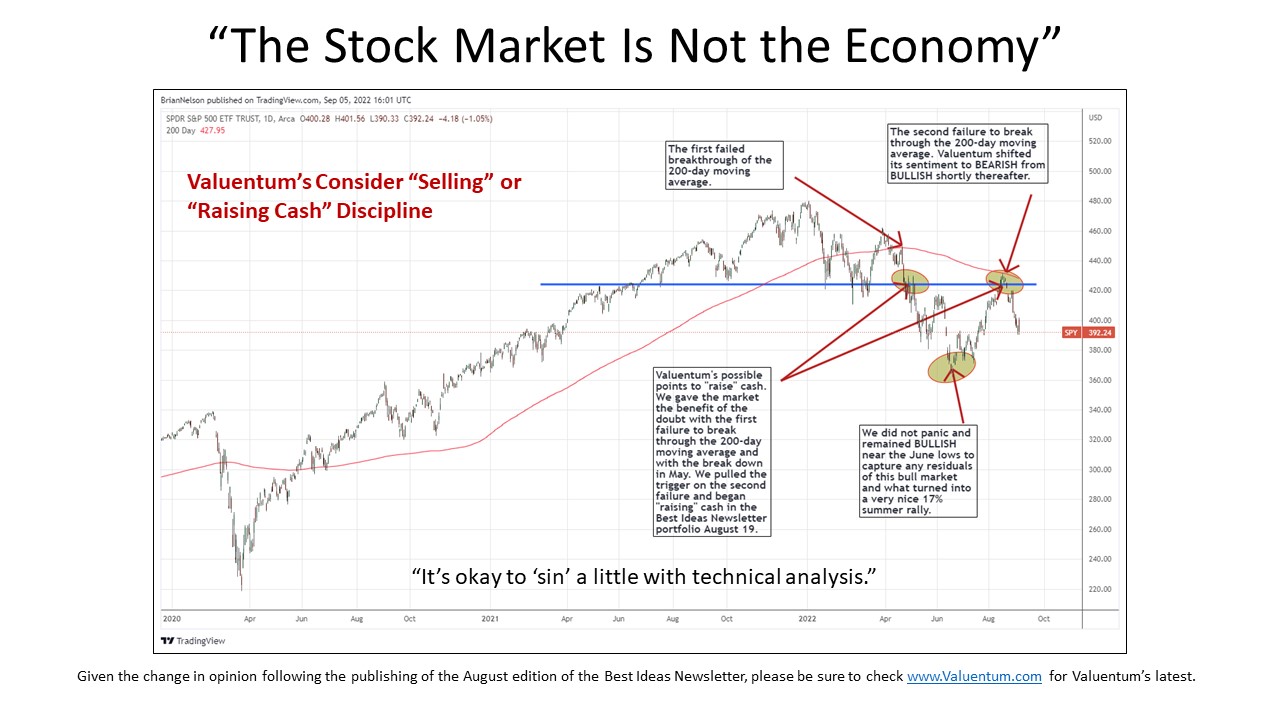

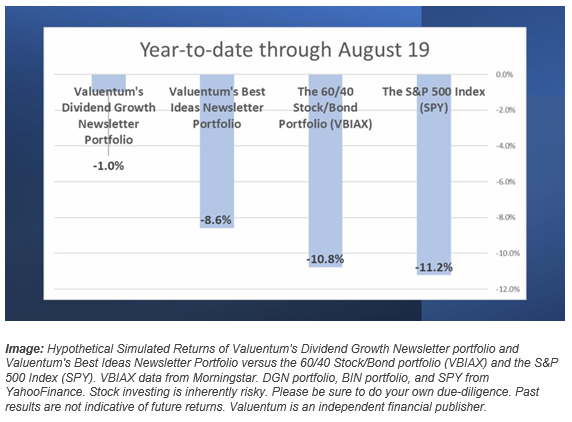

It’s easy to lose sight of the tremendous value that a Valuentum subscription provides during down markets, but we’ve been here for you every step of the way. 2019, 2020, and 2021 were fantastic years, and the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio have delivered in 2022. The High Yield Dividend Newsletter portfolio is holding up nicely, and ideas within the Exclusive publication continue to boast impressive success rates. Members continue to receive options ideas to bet directionally on the stock market, and the book Value Trap has been true to its efforts, showcasing the ongoing benefits of forward-looking analysis. [Given the change in opinion following the publishing of the August edition of the Best Ideas Newsletter, please be sure to check www.Valuentum.com for Valuentum’s latest.]

-

Video: How Many Stocks Should You Own?

Video: How Many Stocks Should You Own?

Sep 4, 2022

-

Valuentum's President of Investment Research, Brian Nelson, CFA, explains the importance of diversification, how to think about firm-specific and systematic risk, how many stocks one should own to achieve 90% of the diversification benefits, how to think about active asset allocation versus active equity management, and why diversification is a means to achieve goals, not the goal itself. A content-packed 14-minute video. Don't miss it!

-

Dividend Increases/Decreases for the Week of September 2

Dividend Increases/Decreases for the Week of September 2

Sep 2, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

-

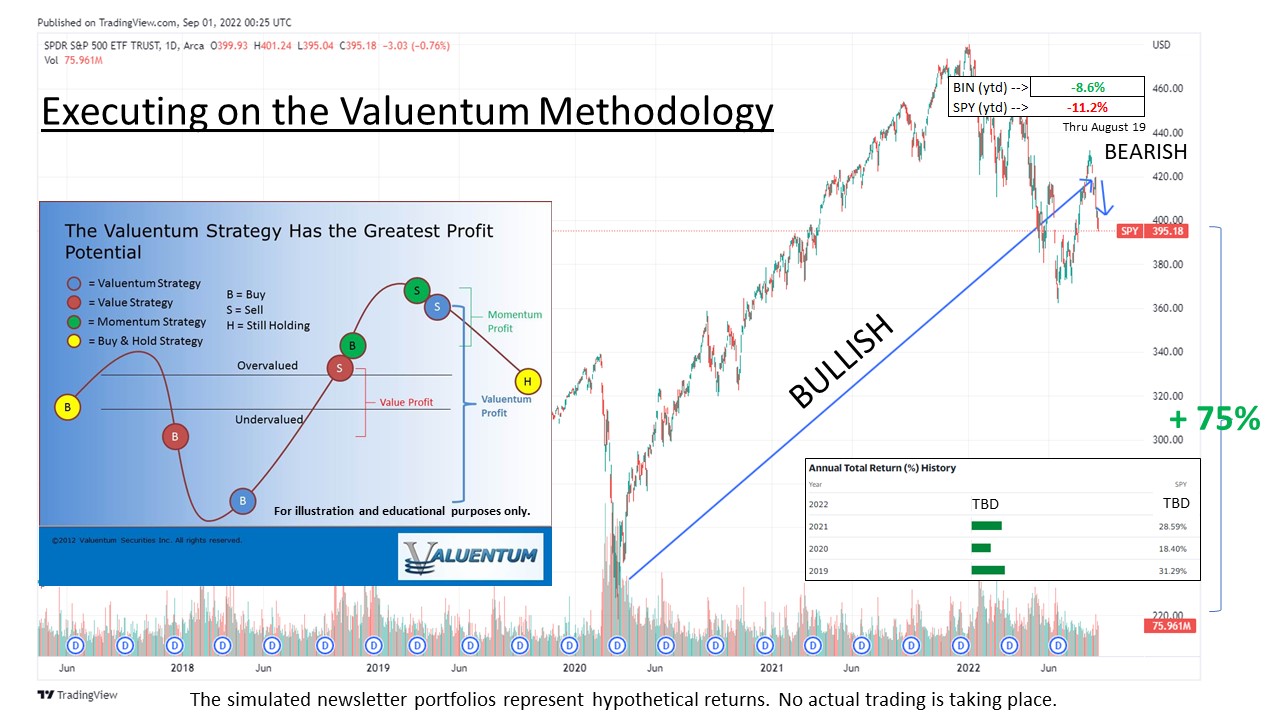

Nelson: Executing the Valuentum Strategy

Nelson: Executing the Valuentum Strategy

Sep 1, 2022

-

Video: Valuentum's President Brian Nelson, CFA, explains why he's turned bearish on the equity markets after a great bull run. In this 8-minute video, learn about the fantastic returns of the stock market the past three years, and how the Valuentum way has cushioned the market decline in 2022. Watch now to learn about the textbook execution of the Valuentum strategy and more!

|